Axial partners with great founders and inventors. We invest in early-stage life sciences companies often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Life sciences has some of the most diverse and interesting financing structures. This is mainly due to the high technology risk and lack of cash flow early on that necessitates a wide range of methods to raise capital. Out of all of the “deeptech” fields, life sciences particularly drug development has perfected the art of financing breakthrough inventions and discoveries into life saving products. This is a result of the field’s dense ecosystem from top to bottom creating several pathways for liquidity and raising capital.

This analysis gives brief overviews of important financing methods, with each one deserving a deeper dive, life science companies use to raise capital. Excitedly, these tools can be mixed and matched to help founders build an enduring business:

Venture capital - raising equity capital to finance a high-growth business

Debt - non-dilutive debt often to finance late-stage product development

Royalty-deals - derisking product development by giving up a future piece of revenue for capital now

Services - focusing on cash-flow

Co-development deals - working with a larger company in product development

R&D pact - doing a small-scale discovery deal with a larger company

Private equity - mixing and matching equity, debt, and royalties

SPACs / reverse merger - getting liquidity through financial engineering

Grants - getting non-dilutive money from the government, foundations, or other public sources

Bootstrap - raising no outside capital

IPO - raising capital from Wall Street

Licensing - selling access to technologies for a fee

Venture capital

Venture capital is probably the obvious way to get a life sciences company off the ground. The key stakeholders during a fundraising process is the founder, the investor, and the scientist. The founder might be technical and be able to answer specific questions about their company’s technology. Investors often bring in their own scientific consultants to assess the veracity of the company’s data, and companies often have inventors whose work formed its basis that might not be operational founders but sit on a SAB or advise.

Most large life sciences companies raise venture capital at some point. An easy example for raising venture capital is Impossible Foods. Out of Patrick Brown’s lab at Stanford, the company was once called Sand Hill Foods along with two other names and got its start in 2011 in the office of Khosla Ventures. That might have made it relatively easier for them to raise $9M to start off. On the opposite end of the spectrum is the founder who has to trek up and down Sand Hill Road, Kendall Square, or South Park for a few years to scrape together that first few million dollars. Ultimately, raising venture capital is really about selling futures. The whole industry is littered with unrealistic expectations from all the stakeholders. Companies often need more money than they projected leading to bridge rounds. Science and engineering almost always face unexpected challenges. Ultimately, the goal of venture capital is to hit specific scientific and business milestones to raise more capital onto the path of scale and profitability. Balancing futures with milestones is always the tricky part to get right for a given business.

Key levers

Dilution and pricing - in a capital intensive industry, dilution is the underappreciated aspect of the business

Choosing the right market - is this a land grab or a disruption?

Framing the technology from a shareholder perspective - why are the company’s inventions and discoveries useful in the market? Are these old inventions that are now useful? Or completely new breakthroughs that few people have access to right now?

Round competition - founders should create an auction and investors should avoid them

Tranching - bigger rounds often get doled out in pieces; what events trigger more capital?

Team building - has the company brought on the best people for specific jobs? Is the team big enough to warrant more capital?

Milestones for next round or profitability - what does the company need to do to convince investors downstream to provide more capital at a much higher price per share? Or what does the company need to do to gain scale and profitability? This is all about growing in a way to lower your cost of capital over time.

Examples

Insitro built a business that relies on a combination of partners and internal work to hopefully be less dilutive to its owners

Atlas Venture often tranches their capital in the companies they form

Moderna raised a lot of capital on the story of a land grab in the mRNA therapeutics field

Debt

Where venture capital investment is dilutive and focused on upside, debt is non-dilutive and focused on downside. People in equities in general are mostly focused on why a company will grow or its product will dominate the market. This is a major reason why equities outperform debt over a long period of time. People in debt focus on different features of a business and consequently have different personalities - compare Howard Marks to Warren Buffett. Getting debt is centered around convincing creditors that your company will be able to pay off the principal and interest. Also, a company might go bankrupt and debtors might actually make just as much money as they would if the company grows. So debt is about making sure the company can generate the cash to pay off the debt but also have a valuable set of assets for the worst-case scenario. Debt holders get paid before equity holders and in combination with a different outlook, debt providers have different incentives than equity investors. It actually might be easier to get debt than say venture capital for this reason.

In life sciences, debt is often used around the time of a product offering. For a company with a recent drug approval they will have line-of-sight for some profits and will take out a loan, often from a bank but more-and-more from private equity firms, to finance commercialization of that product versus taking more dilutive capital. Debt can also be used for early-stage product development as long as a diverse enough portfolio is created - this side of the market is a little trickier and requires the company to have a forecasting advantage. The best example is BridgeBio. The company’s intellectual basis is from Andrew Lo at MIT - https://mitsloan.mit.edu/faculty/directory/andrew-w-lo

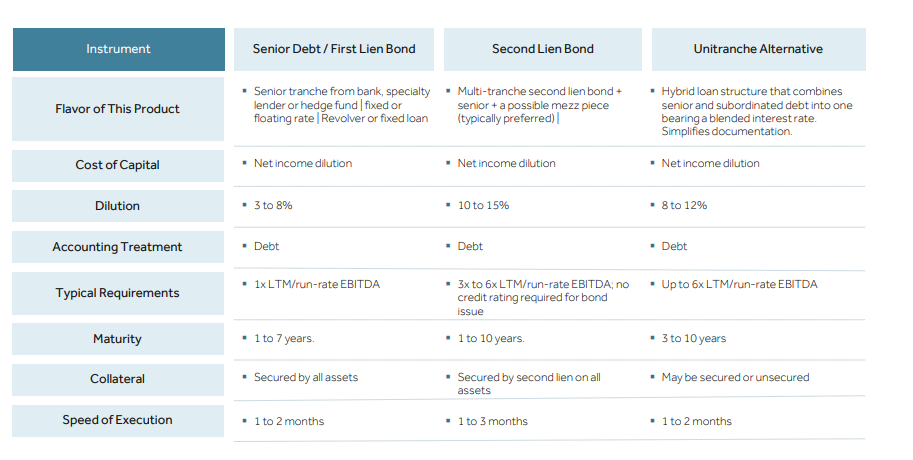

Source: Oxford Finance, SVB, Hercules

Key levers

Showing that your company won’t fail or be worth 0 - in life sciences, having valuable IP, a series of products, or some initial revenue with a line-of-sight to profitability

For late-stage product development - having a clear understanding of the ramp up rates for sales, an effective targeting/marketing strategy, and good operational control on your margins

For early-stage product development - building a diverse portfolio in a specific field; for BridgeBio, the initial focus was in rare diseases. Also, having venture capital actually helps earlier stage businesses get venture debt. Government-sponsored debt is a pretty viable path for non-venture backed companies too.

Examples

BridgeBio for building a broad pipeline in rare diseases

In 2017, Tesaro took out a $500M loan to finance to commercialize their PARP inhibitor in ovarian cancer

There’s a pretty significant cohort of Series A/B companies that take out venture debt, or at least have the facilities, to take on less dilution and have money to grow faster

Royalty-deals

Royalties in life sciences is a place where the terms become a lot more creative. Venture capital, equity in general, and debt are pretty vanilla most of the time. Royalty-deals are a space where the market is not as efficient in pricing.

In short, a company can trade a percentage of future product sales for money upfront. During negotiations, a royalty rate is agreed upon - this is often on the use of the IP. Another part is figuring out if the royalty rate is fixed or tiered. The latter is used to adjust rates for a market or sales milestones. Royalty Pharma is the largest purveyor of drug royalties.

Key levers

The royalty rate and type - fixed versus tiered

Duration - how long the royalty agreement lasts?

Type of IP - is the royalty on a patent, trademark, or something else?

Product stage - preclinical, clinical, approved, on the market

Potential profitability - is your product pursuing a large and underserved market? You might be able to negotiate a lower royalty rate.

Exclusivity - is the royalty agreement exclusive for the use of IP? Just in case a similar product is developed; this is more downside protection.

Examples

Royalty Pharma for late-stage and approved products

Ligand Pharmaceuticals for mid-stage products

XOMA for early-stage products

If you are aggregating preclinical product royalties or want to, please email me. Thank you.

Services

Getting capital through services is a grind. You can easily become commoditized and a services business often hits a local maxima. However, using service-based contracts to generate cash allows an operator to control their own destiny. The tricky part is scaling to more and more customers without sacrificing quality, turnaround time, and being outcompeted.

A legendary example is WuXi founded by Ge Li. WuXi is one of the most formidable services companies in life sciences. Evotec is a great example too. WuXi is the world’s largest CRO and has been a big driver for the decreasing costs to start up a life sciences company. Ge Li was trained as an organic chemist at Columbia and started WuXi in 2000 by providing synthetic chemistry services to large pharma companies in the US, Europe, and Japan. Each year, WuXi rolled out a new suite of services from manufacturing, formulation, toxicology to mouse models until Charles River Laboratories (CRL) offered to buy WuXi for $1.6B in 2010. CRL’s board ultimately nixed the deal and the rest is history: WuXi is now the biggest CRO in the world. WuXi now has all the pieces to make their own drugs and be a truly global life sciences company. Who wants to build the American-version of WuXi?

Key levers

Customer discovery - just make sure LTV/CAV > 0

Operational margins - does the company’s margin go down with scale? If that happens, start again and only pursue services where the margin stays stable and ideally get better with scale.

Cross-selling potential - would your customers be comfortable with buying other services from you? If you’re selling medchem services, customers would be comfortable purchasing toxicology services from you but maybe not gene editing services.

Examples

Aldevron for reagents

Catalent for biologics and gene therapy manufacturing

Twist Bioscience for DNA synthesis

Co-development deals

In life sciences and business in general, drug development is one of the few industries where large incumbents are willing to provide non-dilutive capital to their future competitors. Co-development deals also exist in other life sciences fields but are most predominant in drug development. Co-developing a product(s) with a larger company often leads to faster development times and less equity dilution, but an upstart company might leave a lot of future money on the table with a royalty and might get distracted from their internal programs.

Developmental partnerships are core to the life sciences industry - biopharma and incumbents have large R&D budgets and use partnerships to externalize part of it to gain access to technologies and products they don’t have the know-how to build. The common motif is that of a nimble biotech company with a focused research program and a large biopharma company that has the balance sheet to take on developmental risk and how the clinical/sales infrastructure to bring products to a pivotal study and market. Regeneron is a true pioneer in the use of partnerships to grow their business relying on 50/50 deals to keep the company alive despite some big failures in the beginning.

Key levers

It’s all about the long game - business development for a good partnership is a long dance. It also depends on who you are - if you’re Rick Klausner, you can pick up a phone and get a deal lined up with GSK before lunch. For everyone else, consultants and depending on your size, full time business development people are required. Deals take some time to set up and are quick to get done. Going to conferences, presenting data, building relationships are the prerequisites for successful business development.

Technology or market overlap - once a conversation(s) is initiated, some technical or market synergies need to be identified. For a startup working on a next-generation immunotherapy, they should probably talk to BMS or Merck. A company going after RA should engage with AbbVie.

Due diligence - diligence for partnerships is pretty rigorous and actually might be more intense than venture capital diligence. Larger companies have more scientific resources to bring to bear.

Terms - what is the upfront payment? Are there milestone-based payments? Royalty rate? Is there an equity investment in conjunction with the partnership?

Shared resources - larger companies often share resources like reagents, distribution, marketing, bench space, and other things to make sure their partner can successfully run their experiments or trials

Roll ups - can the partner help you get preferred pricing for CROs/CMOs?

Examples

Merck just struck up a large partnership with Seattle Genetics to gain access to the latter’s ADC products

Gilead completed a 10-year partnership with Arcus Biosciences with an upfront payment of $175M and a $200M equity investment mainly to get access to the latter’s anti-TIGIT antibody

R&D pact

Next to co-development deals are R&D deals where a larger company pays for scientific work that might lead to a product. Often R&D pacts are done because one company has access to a technology that the other company wants to use. The upfront payments are often an order of magnitude or two lower - in the millions and sometimes hundreds of thousands of dollars. Correspondingly, the terms are less onerous with lower royalty rates. Zymeworks is a great example of pursuing this model successfully. The company actually started off making industrial enzymes but pivoted towards biologics. In 2011, they struck up a pact with Merck to provide access to their protein engineering platform. Zymeworks focused on bispecifics and improving control over them. The company used this pact to validate their technology especially in the backdrop of their pivot. This set Zymeworks to get deals done with Johnson & Johnson and GSK and actually expand their deal with Merck.

Key levers

It’s still about the long game - the barriers to entry to get an R&D pact done versus a developmental deal is much lower. But it still requires some level of business development sophistication. Often these R&D deals can set up a startup for a larger deal down the line.

Technology overlap - most R&D pacts are done to get a cheap call option on an emerging technology

Diligence, terms, shared resources, roll ups - same types of drivers as a co-development deal

Examples

A lot of CRISPR companies get early infusions of capital using these types of deals

Early-stage biologics companies strike R&D pacts to get the capital and guidance for their pre-clinical work. And if the data looks attractive, the partner will likely expand the scope of the collaboration.

Private equity

Only recently have private equity firms really made their presence felt in life sciences. That probably is a function of decreasing returns in other industries and the increasing predictability of product launches and development in life sciences. Private equity firms are a major user of debt and are obsessed with cash flow, repayments, and covenants. Private equity people are a lot different than venture capital people.

A recent example of private equity getting deeply involved in life sciences is the Blackstone $2B deal with Alnylam Pharmaceuticals. Blackstone provided $150M for the development of two products: vutrisiran (phase 3) and ALN-AGT (phase 2/3). Blackstone also provided $100M in equity, $750M in loans, and $1B for royalties on inclisiran. This is an incredible deal and a signal for what is yet to come to drug development. Quite simply, financing structures will have a massive impact on drug development and healthcare. If the industry can be connected to the other half of capital markets, more trials can be initiated probably leading to more approved products. Where technology works to make product development more efficient and predictable, better financing enables more products to be developed. More sophisticated financing structures are a sign that life sciences is maturing as an industry.

Key levers

Debt - private equity (PE) is the convergence of debt, royalties, and equity. PE firms want to make sure the company won’t fail and if it does, it has assets that are valuable enough to pay off the debt.

Royalties - similar to negotiating terms, duration, and other parts of a royalty deal

Equity - similar levers as venture capital in terms of market, technology, and price. But private equity has a lot more flexibility in terms of what deals they can execute. PE firms can do combination deals, roll ups, carve outs, and more. They just might not be able to take early-stage risk because they need to returns billions of dollars to their LPs

Examples

The Blackstone / Alnylam deal is one of the canonical deals

KKR was deeply involved with BridgeBio

The best is yet to come for private equity in life sciences

SPACs / reverse merger

Sooner or later a life sciences company needs to get liquidity to get a broader shareholder base, allow investors and employees to take cash off the table, and raise larger sums of capital. Versus an IPO, discussed below, a quicker way to get public is to do a reverse merger with a shell company or a company whose stock has been battered; Rocket Pharmaceuticals and Forte Biosciences are recent examples. Another pathway that has been used in the past and has become very popular recently, is a special purpose acquisition company (SPAC). The advantages are speed to market, a large infusion of capital, and a company only has to convince one person instead of many (i.e. an IPO). SPACs have a lot of issues mainly around governance. A rising use of SPACs is historically indicative of a stock market bubble. That’s probably true - the IPO window in biotech seems bigger than ever. A recent example of using a SPAC is with Immatics Biotechnologies going public through a SPAC sponsored by Perceptive Advisors.

Key levers

Duration - SPACs often have 2 years to acquire another company. If they don’t successfully complete an acquisition, the capital is returned. SPACs are just blank check companies that raise capital in public markets with the sole purpose of buying an existing business.

Sponsor - SPACs are often led by well-known investors with expertise in a particular industry. Having experienced sponsors helps with sourcing the acquisition target but also with attracting institutional investors to provide a lot of the capital.

Examples

BiomX going public with the Chardan Healthcare SPAC

RA Capital, EcoR1 Capital, and several other funds have spun up SPACs recently. If you’re a well known public fund, you should probably start a SPAC. History would suggest the use of SPACs won’t end up well for the general public, but a fund can use the vehicles to gain access to companies at prices that would otherwise be the realm of private investors.

Grants

A good way to get a company capitalized is through grants from governments, foundations, and other public entities. Grants are non-dilutive and often allow a company to focus on scientific risk and not have to be put on a venture capital clock. There are a lot of great examples of companies that use grants to build a business that become venture-backable. The issue with grants is that sometimes their scope doesn't allow a company to use the money for experiments and projects that have commercial potential. Moreover, foundations are increasingly important sources of funding for drug development. The collaboration between Vertex and the Cystic Fibrosis Foundation is one of the best examples of patient-driven drug development.

AbCellera is an inspiring example of a business that used grants in infectious disease to validate their antibody platform. The company moved into fibrosis, neuroscience, and beyond and ended up raising venture capital.

Key levers

Which institution are you dealing with? - in the US, there’s NIH (largest source of capital), DoD, NSF, SBIR/STTR (most amenable to startups with NIH and DoD providing most of the money here), and a lot of other grant sources. Each application process is a little different along with the terms. In the US, federal agencies with R&D budgets over $100M are required to set aside 2.5% of their extramural research budget to fund emerging businesses.

Payout terms - is the money paid in one sum? Or paid out overtime?

Audits and accounting - each grant have different reporting requirements

Conditions - for SBIR grants, a company is required to demonstrate technical progress and commercial potential to receive money for multiple phases - discovery awards are up to $150K, standard ones are $1M with higher amounts with more progress. DoD focuses on supporting projects so it can meet its 80% commercialization rate goal.

Competition - what’s the application success rate for each program?

Access to patients - for drug development, grants from foundations can also provide advantages in patient recruitment

Examples

Once again, AbCellera is a really great example

Most platform companies have to use grants to de-risk their technology before raising venture capital. The hard part is that these companies can get stuck doing work that has little venture capital potential.

Vertex and the Cystic Fibrosis Foundation along with United Therapeutics/Martine Rothblatt and Amicus Therapeutics/John Crowley

Bootstrap

Bootstrapping a life sciences company is pretty hard. Equipment, talent, reagents, and lab space get pretty expensive. I can’t think of a completely bootstrapped biotech company that is large.

Epic is an example of a bootstrapped company but in healthcare software. Epic was founded by Judith Faulkner in 1979 in Wisconsin. The company is a leader in electronic medical records with billions of dollars in revenue. Epic was able to bootstrap (a caveat is that they received $70K from friends and family) mainly because their customers were willing to pay upfront for their software. So pure-play software companies in drug development and synthetic biology might end up creating some successful examples of bootstrapping. Veeva only raised $7M in venture capital and is now worth $40B.

Key levers

Customers pay upfront - customers have to be willing to pay for a product that will be made

Keep it lean - bootstrapping a company is pretty simple and pretty hard; you have very little money to spend so you have to be cheap by default

Examples

In life sciences, as virtualization becomes more predominant than it already is and new markets are pursued, bootstrapped software companies might become viable

IPO

The traditional way to go public is through an initial-public offering (IPO). Going public is a function of supply-and-demand - do bankers have the conviction that enough investors will show up to buy stock so they can make the market? Preclinical companies can go public all the way to companies with substantial revenue. Once a company decides to do an IPO, lawyers are paid to help compose an S-1, the executives do a roadshow to drum up interest, and bankers have to promote the new listing. It takes months for a company to conduct an IPO. You can see why things like SPACS, direct listings (these might be a derivative of an IPO), and reverse mergers have become popular. Moderna owns the record for the largest IPO in biotechnology raising $600M.

Key levers

Market demand - can bankers promote the listing? Are there enough buyers to make the market?

Roadshow - pitching the company to institutional investors

Lockups - when can existing shareholders sell their stock? It’s often between 3-6 months.

Regulatory - beyond the S-1 there are other regulatory requirements to comply with Sarbanes-Oxley

Examples

Royalty Pharma is the largest IPO in life sciences raising $2.2B

Gossamer Bio is up their as well

Licensing

Licensing deals are theoretically really attractive but hard to execute. Most companies don’t have technologies that are unique enough for enough people to want to license. Adimab is one of the most successful examples of building a large business centered around licensing. Adimab clearly solved IP issues other biopharma companies were facing with antibody humanization. Building a large, pure-play licensing business might be too hard. However, licensing deals can be a relatively easy way to get money in the door without having to do that much work. Simply, licensing allows one company to trade a technology or product candidate for capital without having to provide any labor.

Key levers

Scarce technology - the most important driver here is that a company has access to a method or IP that larger companies cannot access

Examples

AbCellera is another example in antibodies along with Distributed Bio

Regenxbio in AAV gene therapies is another great example