Axial - AbCellera

Surveying great inventors and businesses

AbCellera is an emerging antibody discovery company led by Carl Hansen, a professor at the University of British Columbia. Formed around his core inventions on microfluidic valves, AbCellera combines microfluidics and next-generation sequencing to identify new antibodies. Similar to Adimab, AbCellera is of interest due to the unique economics it generates. Instead of developing a drug internally, the business model discovers unique molecular matter and licenses it out to companies whose core competency is clinical development. With the high clinical demand and vast target space for antibodies (graphic below represents the large pipeline of new antibodies coming to market), this type of business model is a great case study of how to create a reinvestment moat in the drug industry.

Key findings

Antibody companies have six important levers to build technical moats: target solubility, potency maturation, tolerance, immunogenicity, rare specificities, and diversity (i.e. CDRs).

The ability to create a drug discovery business model with unique economics requires 4 features: new indications to pursue, competition from generics, improved clinical success, and new technologies.

Find ways to validate technology before pursuing high-value deals in order to garner better terms.

Often the best way to successfully invest over multiple cycles is through the case study methodology. Trends are fleeting (i.e. I’ve never met a trend) and the best companies are the ones that are difficult to categorize initially. AbCellera is a really unique case study due to the company’s ability to use its set of inventions to execute brilliantly on the partnership side (i.e. accruing over 40 deals in ~3 years). Another business worth publicly profiling is Distributed Bio (another time). This survey on AbCellera is not exhaustive but is meant to serve as a rough framework for other life sciences businesses to follow.

Technology

AbCellera’s core technology alleviates bottlenecks found in traditional antibody discovery techniques such as hybridomas and immortalized cells particularly in variability, throughput, and immune tolerance. AbCellera uses a platform composed of thousands of nano-volume chambers integrated on a device. Each chamber houses a single antibody-secreting cell. Whereas hybridomas rely on engineering mice to produce “human” antibodies and immortalized cells require plate-based techniques to isolate B-cells from patient samples, AbCellera’s microfluidic platform removes the need for mice or plates and decreases the variability in the process of antibody expression and discovery.

When compared to multi-well techniques, AbCellera’s microfluidics platform increases the throughput from 10 cells per mL to over 10^6 cells per mL while lowering the required reactant volume from uL to nL. Given this, AbCellera has been able to achieve clinically relevant molarity in hours instead of days or weeks. This method provides a faster alternative for the generation of fully human antibodies.

However, AbCellera’s most important technical threat are display platforms. Display technologies allow libraries of antibodies and fragments to be screened against target antigens without the constraint of immune tolerance, which is often optimized for afterwards. This gets to the third point of AbCellera’s core technical advantage - the ability to benefit from natural antibody selection that happens in humans. The company’s technology takes advantage of the immune system to directly select for antibodies with certain binding properties and function.

Natural immune systems are great sources of antibodies and could have higher efficacy compared to antibodies generated using synthetic methods. More importantly than just pure efficacy, which can always be optimized for later, mining natural immune systems and doing precise screens can identify rare sub-populations of matter that others wouldn’t have discovered with other methods. This is where throughput is important as well because many targets do not produce a strong immunogenic response, and as a result, many cycles need to be conducted to discover promising leads.

AbCellera is not the only company pursuing human repertoires with microfluidics. Businesses like GigaGen, Augmenta Bioworks, AbVitro (acquired by Juno Therapeutics), Berkeley Lights, and others see the opportunity. By screening, for some millions of cells per run each company is working to generate high-quality antibodies that have strong odds of clinical success. As a result, each company has a few levers to differentiate itself:

Target solubility

Potency maturation

Tolerance

Immunogenicity

Rare specificities

Diversity (i.e. CDRs)

When compared to the set of microfluidic companies, AbCellera has an increasing powerful ability to control fluids in order to mimic natural selection processes. This allows the company to execute multi-step assays for precise monitoring and measuring of specificities, affinity, internalization, activation, and binding kinetics. For screens, many antibodies interact with a target and isolate the 1% or less of binding antibodies with the desired set of properties is tremendously difficult and cost prohibitive. This is where AbCellera has had success when compared to others; however, other companies have great technology as well. But AbCellera has been able to use its set of inventions to execute at a world-class level.

Initially, AbCellera validated their technology for infectious disease targets (with a little help from Canada and a few other partners). As the company’s turnaround time was measured in weeks not years to generate functional antibodies, they moved toward higher-value indications. Once the technology became validated, AbCellera scaled up their experimental capacity by investing in robotic automation and bioinformatics to increase their throughput (millions of cells) per run.

Ultimately, the company creates moats not only around the set of experiments it conducts but by the increasing ability to predict an antibody’s and its corresponding class ability to bind a given target. A weak spot AbCellera initially had, like many discovery companies, and still has some what, is the total size of the antibody library. However, over time AbCellera should shore up this moat. This is where Distributed and its SuperHuman library has a very strong advantage right now.

Market

Antibodies are the most rapidly growing drug class - over the last 3 decades the modality has had a major impact on human health, particularly in oncology, autoimmunity, and chronic inflammatory diseases. Many of the best understood and most tractable cell surface and secreted targets with known roles in human diseases have been extensively interrogated with antibodies. Since the mid‐1990s, antibodies have grown steadily into a clinically and commercially successful drug class and overall becoming commoditized. Over 60 antibody‐based drugs have been approved for therapeutic use and are currently marketed, with worldwide revenues over $100B. Historically, the success rate of humanized and human antibodies from first‐in‐human studies to regulatory approval has been at least 15%. Thus, many new antibody drugs are expected from the extensive pipeline of over 600 antibodies in clinical development. Due to this commoditization, new types of business models centered around discovery and services are possible. This gives companies like AbCellera high levels of leverage to use its core technology to create unique economics for the antibodies it discovers.

With such a strong pipeline of antibodies, the competitive landscape for relevant targets (i.e. CD20, EGFR, PD1/L1, TNF) is fierce. This market dynamic along with expiration of a several important patents (i.e. Humira) has incentivized the development of next-generation antibodies with higher efficacy and other differentiating features. However, unlike the previous generation of antibody discovery companies, the new generation are often pursuing harder-to-drug targets.

The monoclonal antibody (mAb) market size is estimated to be worth over $100B (Source for market data: BioCentury, Nature). An aside, market sizes ideally should be the total addressable sales for an industry in a given year. Too often, market sizes are false signals because they are distorted and made much larger than they are. The monoclonal antibody market has changed rapidly over the last decade. The market size has nearly doubled and become increasingly dominated by fully human molecules. Although there is no strong scientific evidence yet of their advantages over chimeric or humanized mAbs, but the clinical activity is significant for any business. This growth is continuing with sales potentially going to $200B in 5-10 years driven by new demand (i.e. China) and the increasing importance of antibodies in higher-value indications (i.e. Alzheimer’s). Antibodies for research uses and diagnostics also generate over $20B in revenue with mid-single digit growth.

All-in-all, the market opportunity is large and diverse - best kindling for unique business models to emerge:

A market incentive to expand use cases across more indications

Competition from biosimilars (i.e. generic biologics) to generate new antibodies against existing targets in order to maintain pricing power

Increased clinical predictivity of antibodies

New technologies to increase throughput and automate screening and manufacturing

This is not all unique to antibodies; however, for companies developing other modalities (i.e. cell/gene therapies, natural products), they need opportunities with these 4 features:

New indications to pursue

Competition from generics

Improved clinical success

New technologies

A market incentive to expand use cases across more indications

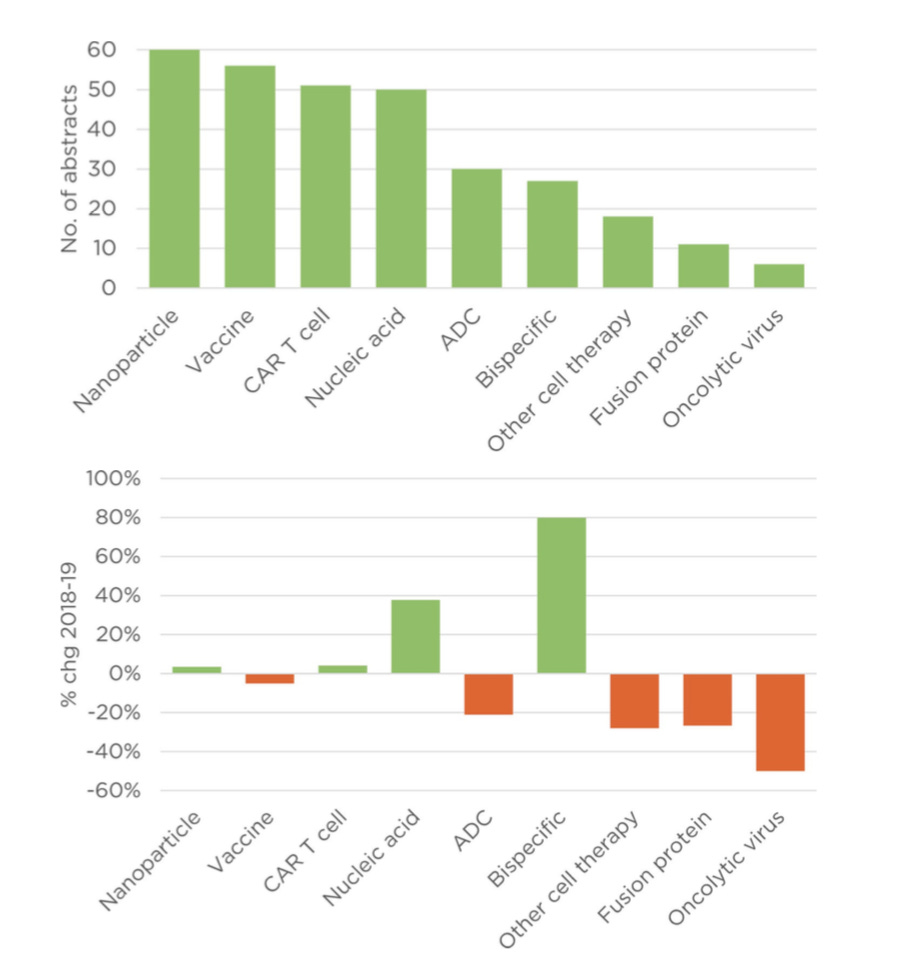

Biotechnology is becoming increasingly large as revenues surpass tens of billions of dollars annual for some companies. Over 90% of the antibody market is dominated by 8 companies with Genentech (Roche) taking almost a third themselves. As a result, new lands must be conquered. Diabetes, immuno-oncology, and so much more is now being pursued. New biologics beyond monoclonal antibodies are being developed (this is a massive opportunity for a new company beyond AbCellera to emerge). At the most recent ASCO, the use of bispecifics (i.e. a molecule that engages two targets) grew significantly:

Source: BioCentury

Antibodies become a $200B, $300B, and beyond industry going beyond oncology and autoimmunity and into diabetes, Alzheimer’s disease, and more.

Competition from biosimilars to generate new antibodies against existing targets in order to maintain pricing power

Biosimilars represent the potential to eliminate a lot of revenue from very large drug development companies. Their effects have been more pronounced in Europe than the United States, but the threat is real. As a result, companies like Roche are exploring new ways to maintain pricing power of their drugs. For Roche, acquisitions of companies like Foundation definitely help to allow prices to not drop as precipitously. A more lucrative pathway is to new develop better drugs that they can charge full prices on.

Increased clinical predictivity of antibodies

This is probably the easiest feature to obverse and validate. In general, antibodies have at least an order of magnitude increased success rate in the clinic. No other modality has as strong as an advantage here. Once observed for another modality maybe in a given indication, then the time is right to pile in the money. The two best candidates are cell therapies and some classes of natural products.

New technologies to increase throughput and automate screening and manufacturing

Finally, new technologies to improve drug development, decrease the time to the clinic, and optimize biomanufacturing allow new businesses to emerge to fulfill the demand from patients and larger companies. Opportunities within this segment are to develop fully human molecules, new subclasses, and scalable manufacturing. In the clinic right now, mAbs with purely human genetic sequences make up over 60% of the market with a third humanized and the rest chimeric. In the long-run, almost every antibody will come directly from a human source. Secondly, most antibodies approved are in the IgG subclass mainly because they are the majority of antibodies found in plasma. Companies like AbCellera can use their inventions to make development of other antibody subclasses easier. Lastly, manufacturing is a large opportunity to enable new types of development. Right now mammalian expression platforms are used predominately for antibodies mainly to get the desired post-translational modification (PTM) patterns. Over half of manufacturing is from Chinese hamster ovary cells (CHO) with variants of myeloma cells taking the rest. The ability to create new expression platforms and corresponding bioreactors can improve development and the ability to bring antibodies to market.

Business model

AbCellera has publicly stated closing over 40 deals with around half disclosed in detail. I mapped out the company’s business activity and economics (happy to send over parts of the data).

Licensing

AbCellera set off to create a business centered around licensing antibodies instead of bringing their molecules to the clinic themselves. This is an economically scalable model that has generated sales of well over $30M disclosed publicly. With the royalties in these deals and sales milestones, AbCellera is on the trajectory to become a very large business. To validate the model, AbCellera chose to pursue infectious diseases initially due to the non-dilutive capital available and validate its technology before closing deals in higher-value indications. This is a powerful lesson from AbCellera - deal terms become more lucrative once partners know a technology platform works. Going through AbCellera’s deals, the company’s terms have increasingly improved over time - the hallmark of a great business: the ability to raise prices. Now in infectious disease, oncology, CNS, and autoimmunity, AbCellera is in a strong position to create unique transactions beyond licensing into discovery deals, co-development, and joint ventures. Examples of deals are:

Sanofi

AbCellera is collaborating with Sanofi to develop a vaccine using AbCellera's single-cell screening platform for the treatment of influenza.

June 2017 - https://www.abcellera.com/news/2017-06-antibody-discovery-program-in-influenza-vaccine-research

GSK

AbCellera is developing monoclonal antibodies against an integral membrane protein target using it's high-throughput single cell antibody platform in collaboration with GlaxoSmithKline for the treatment of undisclosed diseases.

September 2017 - https://www.abcellera.com/news/2017-09-antibody-discovery-collaboration-with-gsk

Denali Therapeutics

AbCellera and Denali Therapeutics are developing novel monoclonal antibodies with specific binding properties against a genetically-validated target using single-cell screening technology for the treatment of neurodegenerative disease.

June 2018 - https://www.abcellera.com/news/2018-06-abcellera-announces-collaboration-with-denali-therapeutics

Bill & Melinda Gates Foundation

AbCellera is developing fully-human antibodies for the prevention and treatment of high-priority infectious diseases including HIV, malaria, and tuberculosis.

March 2019 - https://www.abcellera.com/news/2019-03-abcellera-signs-agreement-with-global-health-foundation

Gilead

AbCellera is developing fully-human antibodies for a set of infectious diseases important to Gilead.

June 2019 - https://www.fiercebiotech.com/biotech/gilead-abcellera-ink-infectious-disease-antibody-discovery-pact

Over time, AbCellera’s terms have gotten better - the terms for the partnerships with Gilead and Denali are substantially better than the ones with Sanofi and GSK. With strong business activity, new business models can emerge in the field:

Internal development

Overtime, as AbCellera builds moats around antibody and target libraries, the company will have the ability and capital to bring a drug of their own to market. With the scale of experiments AbCellera is achieving, in the long-run, this will enable internal drug development at a greater scale than any individual partner.