Axial - Recursion Pharmaceuticals

Surveying great inventors and businesses

Axial partners with great founders and inventors. We invest in early-stage life sciences companies often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Recursion is one of the canonical AI drug discovery businesses. Founded in 2013 by Chris Gibson, Blake Borgeson, and Dean Li, the company spun out of the University of Utah to industrialize drug development. In conjunction with “The Business of AI in Life Sciences,” this case study is focused on understanding the key drivers for Recursion’s success and the long-term potential of their platform and business model.

An important theme for Recursion that shouldn’t be discounted is being in the right place at the right time. Gibson was an MD/PhD student at the University of Utah where we did his research on cerebral cavernous malformations (CCM). The only reason he moved out to Utah was due to his wife doing her medical residency in Salt Lake City. Chris then joined Dean Li’s lab who is well known for world-class medical research and had already spun off several companies in the past. Coincidentally, Chris’ college buddy Blake was already running a pretty successful Internet company while he was getting his PhD in bioinformatics. Chris and Blake met while at Rice University. The former was studying bioengineering and the latter, electrical engineering. Before starting Recursion, Blake actually founded and still runs a pretty successful online business: BuildASign.com. In no small part, this type of entrepreneurial experience was pivotal to help the company scale quickly; Blake was essential for implementing the core infrastructure that powers Recursion.

Moreover, the company was founded just in time to benefit from major breakthroughs in AI with ImageNet coming out in 2012 and TensorFlow and AlphaGo in 2015. I remember talking to Blake in early 2015. I was in Seattle interviewing for grad school at UoW, and what struck me the most was the company’s focus on perfecting image analysis. I ended up going to Berkeley for grad school. Recursion ended up scaling their platform pretty successfully. Their biological hypothesis was that unbiased models of diseases with hundreds to thousands of parameters can scalably discover new drug candidates. By relying on images, Recursion can then use the same assay for each disease and screen for drugs that make cells look more “normal.”

CCM was a perfect fit for this type of approach given that cellular models showed significant morphological changes. This motivated the initial project to screen compounds that can rescue this phenotype. With this premise, Recursion’s platform is focused on scaling the number of cellular parameters they can detect across as many models. Recursion’s disease purview is only limited by their ability to generate a screenable model. A key initial driver for the company’s success was in-licensing the compound from Chris’ CCM research while at Utah as its lead. While the drug candidate didn’t necessarily come from the platform, having an early pipeline helped with a wide-range of activities, mainly fundraising.

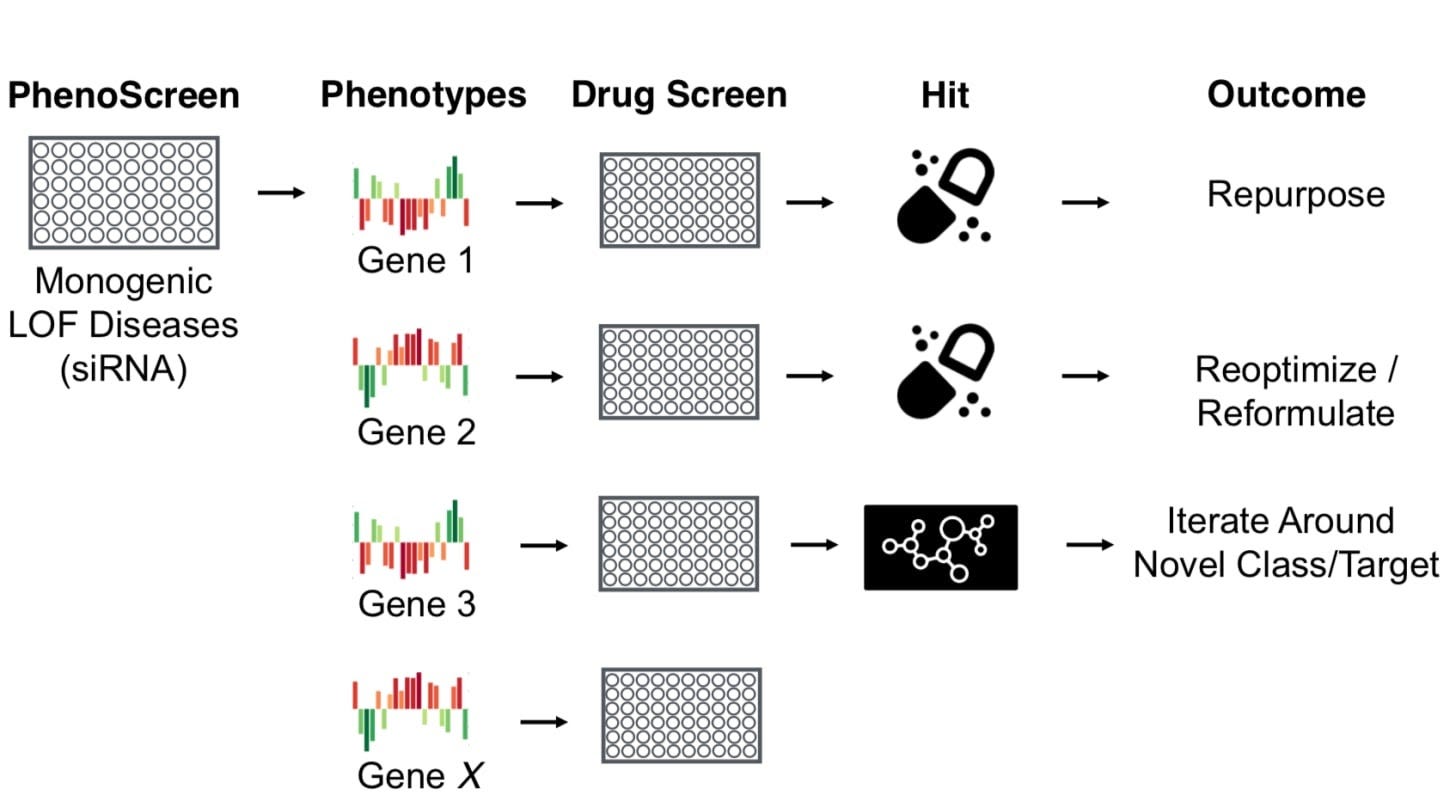

The company’s business model initially focused on rare, genetic diseases and drug repurposing. Recursion could more easily generate accurate cell models for rare diseases like NF2 and GM2 gangliosidosis. Over time, the company moved beyond repurposing into internal drug discovery and partnerships (i.e. repurposing often isn’t venture-scale). Now, Recursion is in the position to spinout companies and get more involved at the intersection of financial engineering and drug development.

Recursion recently went public. Congratulations to the founders and everyone on the team. This is the link to their S-1. Chris and Blake’s ability to build a founder-driven life sciences company has been inspiring. They also showed you can build a venture-backed biotech company outside a hub like San Francisco or Boston. By building their company in Salt Lake City, Utah, Chris and Blake had a near monopoly on talent. They also have a haven where they can craft a unique culture that merges biology with software: from the S-1, 40% of Recursion’s employees are biologists and chemists and 35% are software engineers and data scientists. This is pretty rare for any life sciences company.

Some key themes for Recursion have been:

An intense focus on building the infrastructure to generate large amounts of unbiased biological data. This requires substantial upfront investments without immediate payoff but has set up Recursion to generate a wide range of leads and garner more partnerships down-the-line.

Building truly interdisciplinary teams. This is highlighted by the company’s biology/software employee split. Blake as a founder and engineer with coding experience was always very instrumental to attract and train world-class engineering talent.

Focusing on diseases (i.e. rare) where their models were biologically relevant. Rather than pursue something like Alzheimer’s or Dry AMD from day one, Recursion built technical momentum by focusing on “lower hanging” fruit problems. This has set the company up to expand their purview to oncology and a lot of other diseases since their assay can be easily extended as long as they have an unbiased model.

The last 7-8 years, Recursion had to build out the technology platform and develop a pipeline of medicines. Their clinical results will be one of the first signals of artificial intelligence’s ability to make drug development more efficient/predictive. At the very least, AI allows a company to generate a large number of drug candidates. By working on industrializing drug discovery, the company is set up to become a market leader at the intersection of financial and technical infrastructure. By generating larger amounts of leads, Recursion has the platform to one day securitize pipelines. They might end up being the first company. It’s them or BridgeBio and maybe a few others. As a result, the next decade for Recursion will be driven by their clinical progress and march toward securitization.

~2014:

2018:

Key findings

An important technical moat for Recursion are their cellular models for as many diseases as possible. This is one of their major bottlenecks for the applicability of their platform. In 2014, Chris stated that “maybe 25 to 50 percent” of diseases will be amenable to Recursion’s platform. I am sure that purview has increased.

This platform gives Recursion the unique ability to design securtizable pipelines. With an excess of capital right now, there is an opportunity to securitize drug portfolios. BridgeBio is in the lead and has the best shot at introducing “biobonds.” Others like Cullinan and Centessa are emerging as well. And a key part of securitization is building a pipeline of uncorrelated assets. Recursion has the technology to generate a lot of leads themselves; others often have to go out to license or acquire assets. The company has a strong shot at then pooling these leads together thoughtful about correlations and portfolio/risk management.

The morphological atlas Recursion has built out gives them a unique ability to get preclinical programs off the ground. Their disease purview is only limited by their cellular models. Long-term, the company ought to knock out every gene, using CRISPR, in the human genome and measure cellular changes across time. By making images as computable as the genome, Recursion has built a platform that can enable a unique business model.

There are thousands of rare, genetic diseases that affect over 20M patients in the US. Globally, rare diseases start looking a lot less rare. For example, there are ~360K CCM patients in the US and parts of Europe. China and India have at least 1M, maybe 2M, CCM patients. Around 93% of these diseases do not have an FDA-approved treatment. Given the regulatory and clinical advantages, the market pull helped Recursion more easily translate their platform into a pipeline.

The first couple years for Recursion were focused on getting the platform turned on. Five years after that the company implemented the platform to industrialize image analysis and lead discovery. This has set up Recursion to build a pretty unique business with a wide range of deal types and an ability to securitize entire drug portfolios. Just as much as Recursion is a pioneer in technically scaling drug development, the company can take the lead in financial scaling.

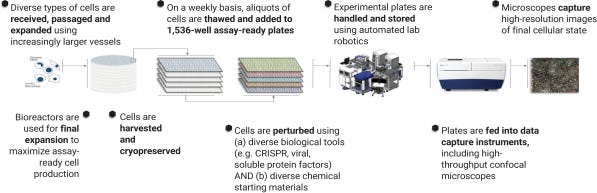

Recursion has built out their own drug development assembly line (image below). Hopefully the company will bring new medicines to patients faster and at scale. And for their business model, they have an opportunity to bring a lot of innovation to clinical trials - how they are both executed and financed. One thing that has struck me about Recursion is how Chris always acted like the CEO of a public (or soon-to-be) company. From how he ran his board meetings (i.e. presenting ~100 page overview documents) to always expanding Recursion’s ambitions every year, Chris and the team have built one of the iconic AI drug discovery companies. Others like Insitro, Enable Medicine, and Exscientia are in the mix. The next ten years for Recursion and similar companies will be an opportunity to measure the clinical impact of AI. Given Recursion’s history, it is guaranteed that they will evolve their platform and business model to match their vision.

Technology

Recursion’s technology is focused on industrialization. So for drug development, that means automation, unbiased data, and relevant biological models. The first iteration of Recursion’s platform was based on the Cell Painting and CellProfiler tools developed by the Carpenter Lab. The former relies on a series of fluorescent dyes to measure the morphology of cells and their internal structures like organelles. You can screen drugs against cells and measure how cell morphology changes - does it revert back to “normal?” A lot of biological information can be captured with an image, and if analysis is done correctly, new features, that humans often can’t see, can be detected to hone in on mechanism-of-action (MoA) and targets.

Images in biology are pretty powerful. Over a 1000 features can be measured from cell size, organelle shape, intensity, and a lot more to understand the effects of a drug. Done at scale, this type of work can generate a large database of cell images and their corresponding treatment. Recursion has open sourced some of this data with RxRx. Analysis of these cellular images can be helpful to cluster drugs and discover new compounds with a MoA of interest. This type of unbiased approach is particularly powerful for diseases and pathways not very well understood as long as there is some sort of genetic/morphological component.

Recursion has done a great job at building up a world-class image analysis team. Maybe only Calico can rival their current capabilities. With the premise of using images to develop drugs, Recursion has a platform with a wide range of applications limited only by what one can image and measure. This is at least one lifetime’s worth of work. An image of a cell contains thousands, if not more, different features that can be fed into a machine learning model. This work can generate phenotypic fingerprints that can be used to infer the state of the cell. Other pieces of data in drug development and life sciences aren’t nearly as extensible. For example in chemistry, solubility and permeability data don’t generate nearly as many features. This is a core issue in AI: dimensionality of the dataset can limit the predictive power of a machine learning model. Moreover, data needs to be generated in a standardized way so it can be successfully interpreted by a model. Too much variation in public datasets or merged ones often leads teams down the wrong path. Recursion spent the capital to build up their own platform and bypass this problem. Overall, the company’s platform can be segmented into 6 major parts:

ReChem - selection and design of chemical compounds

ReScreen - workflow for complex screening experiments

ReScreenRun - automate the screening of millions of compounds across many cellular disease models

ReRun - phenotypic signatures (Recursion calls them phenoprints)

ReAnalyze - measure a compound’s efficacy and toxicity

RePredict - models compounds based on phenoprints, structure, and other features

The first step for Recursion’s platform is to generate a library of cellular models and drug candidates. A figure (below) from Recursion a few years ago does a good job at showing the dimensions at which their platform can grow: chemical matter, perturbations, and human cell types. From the S-1, Recursion has at least 36 different cell lines ranging from iPSC-derived and primary cells to hepatic progenitor cells, human colon adenocarcinoma, cardiomyocytes, and macrophages. Recursion started off with repurposed chemical matter because it’s a bit cheaper to acquire but now has their own internal library compounds and a larger in silico database. Perturbations can be a lot of things from genetic knockouts to cytokine treatments.

An important technical moat for Recursion are their cellular models for as many diseases as possible. This is one of their major bottlenecks for the applicability of their platform. In 2014, Chris stated that “maybe 25 to 50 percent” of diseases will be amenable to Recursion’s platform. I am sure that purview has increased. All-in-all, Recursion is scaling an old technology to a new problem. Drug discovery first started by finding chemical matter that generates a useful effect like a biochemical change or a change in physical appearance. This work focuses on screening for phenotypes (and rescues) of interest. The power of genomics and structure-based drug design has revolutionized many parts of drug discovery by flipping this process to start at a particular target or pathway; however, phenotypic screening is still useful in some contexts where the underlying biology hasn’t been fully characterized. Recursion’s unbiased approach can be useful in places where target-centric hypotheses have not worked - rescuing a disease profile is a lot more scalable than screening against many targets. On a side point, phenotypic screening could bring transformative products in consumer products among other markets.

In 2015, a team at Pfizer published a paper defining the key rules for a phenotypic screen:

Selecting physiologically-relevant cell types and models. Examples are iPSCs, organoids, and even animal models. In vitro models offer higher throughput versus in vivo models that might have more accuracy. So far Recursion has focused on simpler, more scalable models, but I am sure that will change in the future.

Designing assays that are relevant to a disease. This is where a substantial moat is built.

Defining assay endpoints that are similar to clinical endpoints. This is focused on using biomarkers or disease signatures that are matched to clinical samples.

These types of screens can be divided into 2 major steps: (1) simple primary assay to cover as much chemical matter as possible and (2) complex, physiologically-relevant models to hone in on interesting hits. After the model is established, a large library of molecules are screened to measure something like expression changes in a panel of proteins or cellular characteristics like proliferation. Secondary assays are used mainly to counter screen and filter out molecules that have general effects. This is the part where phenotypic screening has higher upfront costs versus target-based programs. Recursion’s focus on automation gives them an important ability to reduce these costs. On top of this work, Recursion and other companies can filter hits more accurately with transcriptomics, proteomics, unsupervised machine learning, high-content imaging, and other tools within the assays themselves. Hits are then grouped into mechanism classes to prioritize them with a focus on target deconvolution. Even though many approved drugs have been approved without a known target, this knowledge is incredibly important to de-risk a program and much more accessible with the wide-array of tools: panels of known target classes are screened against, activity-based protein profiling is very useful along with compound-immobilized beads, photoaffinity labeling, and cellular thermal shift assays. Overtime, Recursion’s success will be partly driven by their ability to perfect assays that can work for a large class of human diseases.

After the experimental infrastructure is set up, Recursion can screen across many phenotypes. With a toolkit to screen a large number of compounds across many cell types and perturbations, where do you start? In 2017, Recursion ran 2.2M experiments generating 0.5 PB of data across 7 cell types using a library with 3000 compounds; the cost per experiment (CPE) was $0.63. A key metric for Recursion’s technology is this cost. In 2018, the CPE was $0.45. In 2019, it was $0.36. In 2020, it has gone down to $0.33. Over 4 years, the company drove down their platform costs by well over 40%. At a certain point, other companies might have a hard time catching up for the cell and assay types Recursion focuses on. In 2020, the company did 55.6M experiments (a ~25x increase) that generated 6.8 PB of data across 36 cell types using a library with 706K compounds (with a larger in silico library numbered in the billions).

In drug development programs, the key focus is formulating and testing a hypothesis. In target-based discovery, the process tests a hypothesis by generating a hit for a given target then going to lead selection and optimization and finally into pre-clinical/clinical testing. Whereas, phenotypic screening generates a hit for a given phenotype then the next step is to find the target. The latter process can get tricky sometimes and can make lead selection a bit more difficult, and as a result, Recursion’s platform is a better framework to make phenotypic screening as structured as target-based programs:

In vitro models that are relevant for more diseases. Patient-derived cell lines are a step forward here, but could lead to unexpected variance in assay conditions. Co-culturing is also another useful approach but could impact throughput.

With more complex assay designs, identifying important variables that influence reproducibility and disease relevance. Recursion’s automation reduces variance here.

“Chain of translatability,” an idea from biopharma, to connect assay endpoints to a clinical outcome

On the screening side, Recursion has many opportunities. Can they move to more complex models like an organ-on-a-chip or organoid and increase screening throughput there. Recursion can integrate their platform with proteomic tools, particularly activity-based profiling, during the target deconvolution step. This would speed up the process and lower the barrier to entry to use phenotypic screening because this step is the last and sometimes hardest. Long-term, Recursion has the potential to create a database to enable the matching of a “phenoprint” to target from a virtual screen one day. Hopefully, they will open source most of the data.

Then image analysis is done to capture various cellular features during the screen. Across thousands of structural (morphological) and functional (activity) parameters, the company’s technology measures disease-specific changes in cells and finds drugs that rescue them. From the data, Recursion asks (relatively) simple questions to hone in on drug candidates. What is the size and shape of the cells? Did the nucleus or other organelles move after the perturbation? By how much? What changes are specific to a disease? Recursion might not be able to establish cause-effect relationships for these correlations, but they can measure them at scale to screen chemical compounds.

In morphological profiling, quantitative data are extracted from microscopy images of cells to identify biologically relevant similarities and differences among samples based on these profiles. Image-based tools in drug development and life sciences in general offer a new angle to hone in one things like mechanism-of-action, biomarkers, and a lot more. With the increasing power of computer vision tools over the last 5 years or so, morphological profiling of cells, led by Recursion, has made a larger impact on drug discovery. This work casts a wide net to discover new biomarkers, MoAs, and leads:

MoA - perturbation and rescue experiments are used to to match images of treated cells with cells perturbed for a given gene. A database of images for cells knocked-out for a given gene or treated with an annotated compound enables quick search and comparison.

Lead generation - 100s to 1000s of hits can be narrowed down pretty easily to a few leads based on filtering for a given MoA or target. As long as the image of the perturbed gene exists then it can be used to sort on.

Biomarkers - another important part of morphological profiling is discovering and developing new biomarkers from images. This is useful in drug discovery to potentially stratify samples or patients and diagnostics. The actual image and morphological features can be used in addition to genetic expression profiles as a biomarker.

Hundreds to thousands of features can be extracted (i.e. shape, size, intensity) from a cell to measure phenotypes that may have not been detected before. These features can help validate new drug targets, group compounds together, and find new disease signatures. Excitedly this work can be done in parallel versus serial across many different targets and disease models. A key problem to solve is scaling cell culture and reducing the time for feature analysis. The actual cell culture and imaging can take a few days to weeks. Moreover, the data analysis for a lot of this work takes a few weeks as well. Can the analysis part be automated and completed in a ~day? In combination with genomics, especially spatial transcriptomics, morphological profiling can easily generate large amounts of IP in sync. This analysis component is the essential part of Recursion’s ability to generate a lot of leads - this will enable them to one day securitize their pipeline (we’ll go more into this in the business model section below).

Recursion then uses software and machine learning to analyze this dataset. With petabytes of biological images, the company has standardized data to feed into their models. There is some non-trivial backend software engineering here. Doing this at scale with an increasing amount of data is an important moat. Storing the images, handling data streaming and processing, and having a system for ad-hoc analysis, gives Recursion an ability to quickly go from a screen to a lead. Also, I am sure most of the technical problems faced by Recursion probably don’t require sophisticated machine learning work. The software infrastructure allows machine learning to make a major impact on the long-tail of biological problems. A section from the The Business of AI in Life Sciences does a good job explaining this part:

“[AI] creates an entirely new way to do biology where experiments aren’t necessarily going to provide meaningful results but are done to more accurately train models. Biology is a large search space and can easily multiply the number of edge cases thereby increasing costs of development. AI models that take advantage of parallelization to test models, manage data inputs, and work to eliminate steps in the product development process have a shot to reduce this search space. These edge cases may never disappear given the complexity of biology and will need to be validated at the bench or the clinic.”

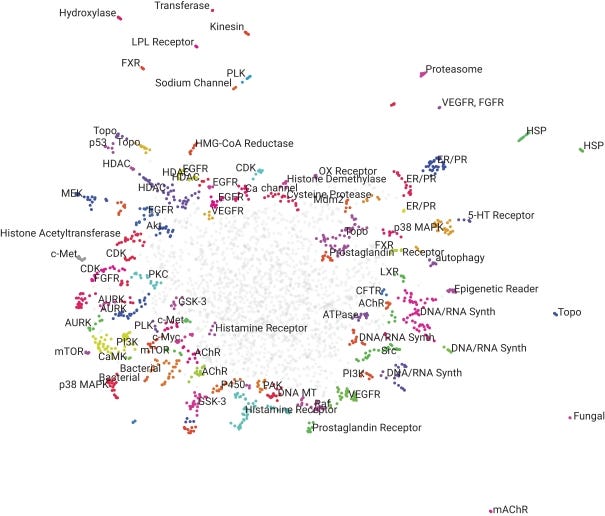

Over time, this platform can begin to make more accurate predictions during their drug development process. Recursion has done a great job at matching the right dataset to the problem. Most machine learning models are very sensitive to variations in data and if they are applied to non-standardized or static datasets, overfitting is likely to occur. Another key consideration, especially in biology, for using models for predictions is batch effects. Small parts of an experimental design like temperature and treatment duration can be picked up by an autoencoder and lead to incorrect conclusions. Once this hard work is complete, Recursion has the ability to transform this screening data into useful results and predictions like drug clustered by MoAs, targets, and other features (image below).

With a large enough N, Recursion can establish the definitive atlas of cell biology. This type of roadmap can help the company move from a hypothesis to a lead a lot more quickly than others. The true test of this technology is clinical success. This is still to be determined for the entire AI field, but Recursion is currently in the lead.

Recursion has made incredible progress from a small company starting off in a conference room in Salt Lake City to a sprawling labspace with some of the best robotics in life sciences. Their success has been driven by their focus, along with being in the right places at the right now, but Recursion still hasn’t scratched the surface on AI’s potential impact on drug discovery. The company ought to make more progress and begin to establish AI’s ability to bring new medicines to patients.

This platform gives Recursion the unique ability to design securtizable pipelines. With an excess of capital right now, there is an opportunity to securitize drug portfolios. BridgeBio is in the lead and has the best shot at introducing “biobonds.” Others like Cullinan and Centessa are emerging as well. And a key part of securitization is building a pipeline of uncorrelated assets. Recursion has the technology to generate a lot of leads themselves; others often have to go out to license or acquire assets. The company has a strong shot at then pooling these leads together thoughtful about correlations and portfolio/risk management.

The morphological atlas Recursion has built out gives them a unique ability to get preclinical programs off the ground. Their disease purview is only limited by their cellular models. Long-term, the company ought to knock out every gene, using CRISPR, in the human genome and measure cellular changes across time. By making images as computable as the genome, Recursion has built a platform that can enable a unique business model.

Market

The market for Recursion, like all drug companies, is pretty self-evident: cure disease and help patients. Recursion’s initial focus on rare diseases played a pivotal role in its success. An important theme in biotechnology is focusing a platform on lower-hanging fruit problems then expanding. The company’s first program was for CCM from Chris’ PhD project. Having an in-licensed pipeline helped Recurison get to the clinic sooner rather than later. A key risk for a bit was whether Recursion’s platform could generate clinical assets. Now the company has to show it can get one of their programs to approval over the next ~decade.

There are thousands of rare, genetic diseases that affect over 20M patients in the US. Globally, rare diseases start looking a lot less rare. For example, there are ~360K CCM patients in the US and parts of Europe. China and India have at least 1M, maybe 2M, CCM patients. Around 93% of these diseases do not have an FDA-approved treatment. Given the regulatory and clinical advantages, the market pull helped Recursion more easily translate their platform into a pipeline. Around the time (2015ish) when AI was making a lot of progress, Recursion made a slight pivot from focusing on rare diseases to industrialization. Their platform enables the company to move into the clinic faster (image below). By industrializing a certain set of experiments, Recursion’s market strategy has been to leapfrog and expand into larger markets.

Recursion’s pipeline reflects this market dynamic. REC-994 (CCM) is from previous work and three out of four of Recursion’s clinical assets are for rare, genetic diseases. They have expanded their pipeline to oncology and neuroscience along with moving from known chemical entities to new ones. An important consideration is developing this pipeline as efficiently as possible; this is where the business model becomes important. Beyond the technology, the company is transitioning to a late-stage clinical company and will need to update its talent base to reflect their goals of being a fully-integrated drug company.

Business model

It seems like Recursion expands its business purview every year. On this point, it also seems like Chris slightly reinvents himself every year by learning/adopting a new skill set from AI-driven drug discovery to clinical development and BD. Versus a technology company that has two main phases - before and after product-market fit, biotech companies are multi-phasic and this requires a CEO that can reinvent themselves. Chris has done an incredible job at growing his skillset to match Recursion’s growing ambitions.

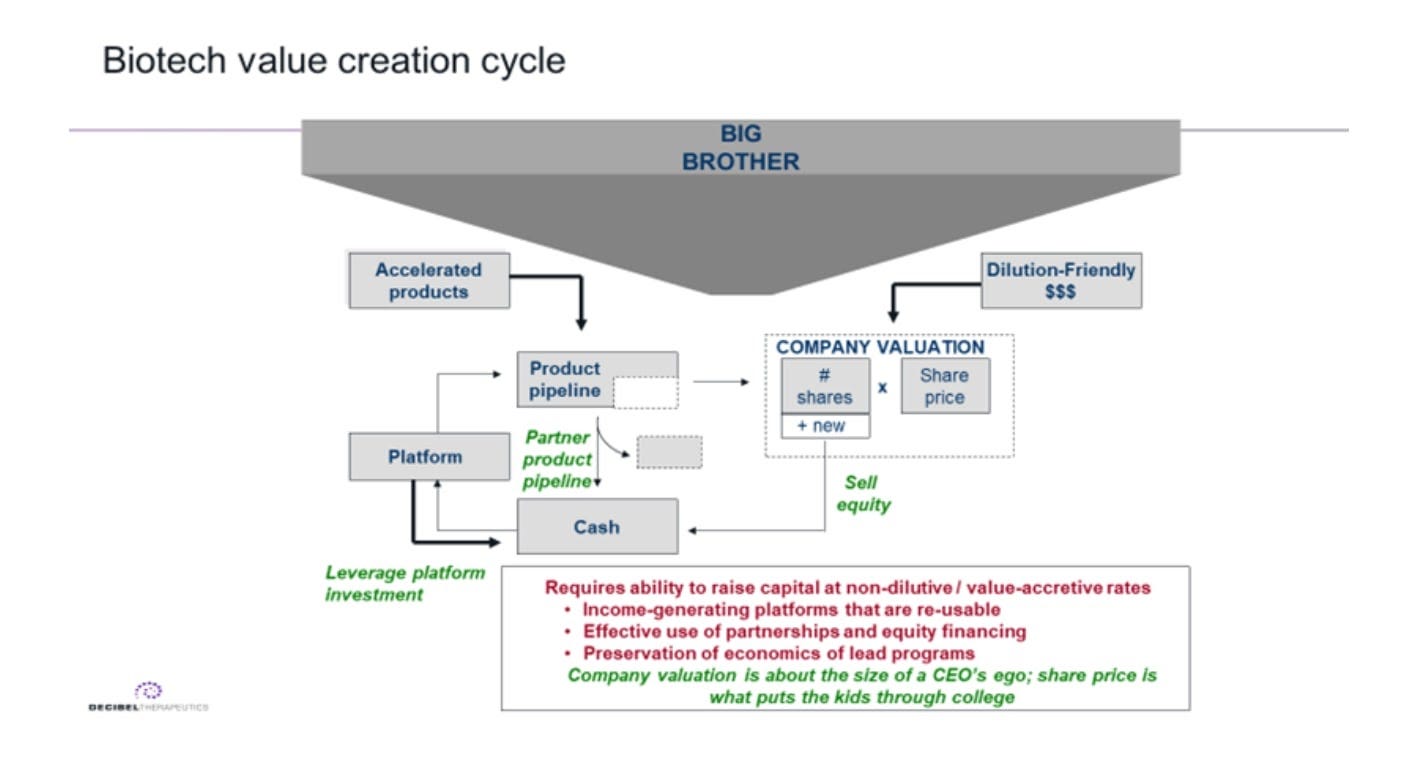

The core part of Recursion’s business model is its platform and internal pipeline. With this base, the company has increasing power to engage in creative business deals from partnerships with companies like Bayer and Sanofi Genzyme to a spinout with CereXis (to house their NF2 program). What has always surprised me was that Recursion never really scaled up their partnership side of the business. A natural comparable for the company is Millennium Pharmaceuticals. Millennium was the category leader in genomics and used that positioning to scale up partnering. Recursion is the category leader in AI and drug discovery; given that, the company could still scale up on partnerships. But capital is a lot more accessible for biotech companies versus the early 1990s so focusing too much on partnerships and maximizing non-dilutive dollars (image below) might be more of a distraction now. Given the progress Recursion has made with its platform, it might have the bargaining power now to execute 50/50 deals pioneered by companies like Regeneron. The first couple years for Recursion were focused on getting the platform turned on. Five years after that the company implemented the platform to industrialize image analysis and lead discovery. This has set up Recursion to build a pretty unique business with a wide range of deal types and an ability to securitize entire drug portfolios. Just as much as Recursion is a pioneer in technically scaling drug development, the company can take the lead in financial scaling.

Pipeline design and execution have been a key driver for Recursion’s business model. The platform can generate a lot of leads then it's on the company to filter and manage them efficiently. For example, after a few years developing their program for Ataxia Telangiectasia, Recursion ultimately had to move on from it. Overall, AI provides an advantage at the top of the drug development funnel. Then financial engineering and clinical expertise (i.e. KOLs) is the advantage at the bottom. On the financial engineering side, Recursion has current capabilities to spinout new companies and acquire external assets. On the former, Recursion spun out CereXis to drive the NF2 drug program forward. This type of deal structure is very useful to reset the cap table and realign incentives on a particular asset(s). What Recursion is doing here is very similar to BridgeBio’s work as well. Recursion can also move into joint ventures if they wanted to - focusing their platform on something like aging or infectious disease with a corporate partner.

To get to 100, if not hundreds, of drug candidates, Recursion will need financial engineering and greater access to capital markets. Their platform is validated to generate a lot of leads not only in rare diseases but in oncology, neuroscience, fibrosis, and more. The next few years, Recursion will likely be operating at the intersection of technical and financial engineering. I am sure they are going to use a lot of the great ideas from Andrew Lo at MIT. Versus other companies with similar ambitions of securitizing portfolios of drugs one day, Recursion has the technology to develop a pipeline in sync and generate their own IP. The playbook here is being written but some important considerations are:

How to measure correlation between drugs? - https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3704655 One idea is to build a portfolio where say if one asset(s) works, then the other one will not.

Matching a portfolio to specific risk/return mandates with a focus to limit drawdowns

Figuring when a drug candidate becomes a “real asset” that can back a bond?

Avoid the asymmetry of maturity problem - https://lifescivc.com/2011/12/solving-biotechs-asymmetry-of-maturity-challenge/

Recursion has built out their own drug development assembly line (image below). Hopefully the company will bring new medicines to patients faster and at scale. And for their business model, they have an opportunity to bring a lot of innovation to clinical trials - how they are both executed and financed. One thing that has struck me about Recursion is how Chris always acted like the CEO of a public (or soon-to-be) company. From how he ran his board meetings (i.e. presenting ~100 page overview documents) to always expanding Recursion’s ambitions every year, Chris and the team have built one of the iconic AI drug discovery companies. Others like Insitro, Enable Medicine, and Exscientia are in the mix. The next ten years for Recursion and similar companies will be an opportunity to measure the clinical impact of AI. Given Recursion’s history, it is guaranteed that they will evolve their platform and business model to match their vision.