Axial - Founder-led life sciences companies

Agency for great inventors

Founder-led life sciences companies

Historically founders have created some of the world’s most important businesses from Standard Oil to Amazon to Genentech. Simply if you’re the initial designer of a business or anything in general, you’ll know the limits of the company and its technology and act appropriately. This might seem obvious but founders who set the initial conditions of a business and understand the underlying thesis have a good shot at creating something great. It doesn’t mean a non-founder cannot do great work at a given company, but the bar for them is definitely higher.

Given that founders create important businesses, this should lead to investing in founder-led companies being pretty straightforward. That is not always that case. Founder-led investing is lucrative but often treacherous. An investor may not own enough of the company to generate necessary returns, a founder may go rogue and blow up the company, or the technology and business model may not be as exciting as initially thought. This is roughly represented by the variance between top and bottom quartiles in venture capital, which are multiples of other asset classes.

In software/information technology, venture capital was originally (1980s-beginning of Web 2.0 era) biased toward investors with a shift in favoring founders in the mid-2000s. It’s been pretty difficult to find the first round cap tables for companies across multiple eras in order to compare them. But after speaking to many venture capitalists who have invested over multiple decades, there was a major shift in the valuations offered for seed and Series A software companies after the dot-com bubble with the successes of Google and Facebook and their founders. Going through 20 S-1s from iconic companies from the 1980s to 2019, verifies this somewhat (doing a systematic analysis would be useful). Software investing began favoring founders once a few companies with founders leading from formation to scale worked out and the Internet matured enabling more scalable business models.

However, many investors in life sciences are still issuing term sheets at similar terms software VCs gave out in the 1980s and 1990s. This makes sense given what biotechnology went through in the 2000s. But with recent advancements in medicine particularly immunology, more acute financial outcomes, and a maturing industry that could sustain many different types of business models is creating the initial conditions for founder-led investing to creep into the field. Venture capital for most technology is now built on incentivizing great founders with significant ownership to build a large business. One major point is that this model really only works for scalable businesses. A SaaS company for milk delivery with a cap table where an investor owns 20% probably isn’t going to generate sufficient returns to invest again. In life sciences, investing in a single-asset company is the same thing. In general, an investor and founder must pick their spots wisely. In software, the model has already been validated where network effects and the incremental costs of software drive success. In life sciences, similar rules will emerge. This is where an edge can be created especially since software is not equivalent to biology especially in terms of business models.

Ultimately, companies led by an inspired founder and team have created some of the history’s greatest businesses. In life sciences, it’s no different - Genentech, Gilead. Financially it means having the clarity and courage to move forward independently and not sell too early and cap upside. Imagine if Foundation Medicine didn’t sell? How much would it be worth? Same for Beckman Instruments? As a life sciences investor, giving up ownership raises the bar for the uniqueness of the business model, the vision of the founders, and the overall magnitude of the opportunity. There will always be room for more traditional investing especially if firms play a large role in incubation and management.

Successful founder-led life sciences investing has to have narrow focus. Many of the software firms entering life sciences will probably invest in companies with incremental models and the firms will have less ownership - the returns won’t be there for many of these tourists. However, the firms that focus on unique business models led by great inventors and founders will probably make founder-led life sciences investing work out financially. This will create a positive-feedback loop where success begets more success - more founder-led in life sciences will be backed.

This was pursued for a bit in the 1990s but some bad models were financed and the returns weren’t there. Even in the early to mid-2000s, VC firms often had dual practices - biotechnology and software. When the returns diverged, the firms split - Atlas/Accomplice, KPCB/Westlake. In this era, we have another chance to be part of very large companies in life sciences. Founders and inventors need to focus on unique business models. Investors have the duty to underwrite unique businesses that have a shot of becoming very large so more founder-led investing can occur. Technology gives a company a shot to build a new company, but incentives create something special.

Recently, a set of articles have been published from technology and biotechnology VCs:

Atlas - https://lifescivc.com/2019/08/the-creation-of-biotech-startups-evolution-not-revolution/

Y Combinator - https://blog.ycombinator.com/how-biotech-startup-funding-will-change-in-the-next-10-years/

All of these articles are great at describing what’s either happened in the past or might happen in the future - all focused on technology. Bruce Booth’s article probably is the most rigorous and protends a future where some traditional life sciences investors transition toward more founder-led models and blow everyone else out of the water given their overall scientific excellence. But all of these articles miss out on a critical piece of what’s changing in life sciences. The dichotomy between say the traditional healthcare/biotechnology investors and the software investors is not actually artificial intelligence or automation, it is the cap table.

The life sciences industry as we know it now emerged in the 1970s/1980s led by a set of inventions around cloning technologies (the discovery of DNA’s structure and central dogma enabled all of this). The pioneering company of this era was Genentech. It went public in 1980, the same year Apple went public, and brought to market many important medicines notably cloning insulin (David Goeddel’s legendary work - “clone or die”) and bringing to market the first human insulin from recombinant technology. If you look at the first JP Morgan Healthcare (started as Hambrecht & Quist) conference, you have Genentech, Xoma, and a few others there. The upcoming conference the list of attendees show an industry reconfigured, matured significantly, and in some ways has become a banking industry where many participants are focused on financing decisions and not science. History would show, simply compare Genentech to Xoma, that science should always drive decision making and when financing leads the way, failure is near. Between the 1970s and somewhere around the 1980s/1990s, companies like Genentech, Amgen, and Biogen led by great inventors developed a new field we all benefit from. All of these companies were viewed as heretic from the established pharmaceutical industry who have now reshaped themselves in their image. However, this era didn’t last for a variety of reasons and slowly led to an era where investing shifted over mainly to investors.

Around the 1990s, life sciences’ returns compressed and relatively few enduring companies were built. It’s hard to pin down a reason(s), but a few events played a role:

Regulatory - around the beginning of the 2000s, the FDA became more conservative (or at the very least for new modalities)

Healthcare incentives - spending on healthcare was slowing down, albeit temporarily, lowering the imperative to invent new medicines

Productivity - the cost of getting a drug approved has been steadily increasing with the cost for one drug over $1B in R&D spend somewhere in the mid-1990s

Breakthroughs not working out - new inventions from genomics to gene therapies failed to improve productivity and as a result, were not valued

IPOs/M&A - overall liquidity in the life sciences market dried up

These five components interacted with one another along with a few other things giving rise to more conservative investing in the field. This has led to an environment where most capital in life sciences prefers experienced CEOs with high investor ownership. In the context of a recent era of low returns extending over a decade, this strategy makes sense. However, just as software investing was in a similar position with regards to returns (i.e. Dot-com crash) and preference (i.e. founders with MBAs) in the early-2000s, that field make a transition toward supporting engineers to become great founders. This has been a main driver for the growth of technology companies. Life sciences is in an eerily similar spot; as a result, there is a massive opportunity to support and partner with great inventors who may not have the business experience but can learn as the company grows. A useful analogy is that physicists often have successful careers in biology, whereas biologists have no chance in competing in world-class physics research. Just the same, scientists can learn business but the opposite might not be true.

Regulatory

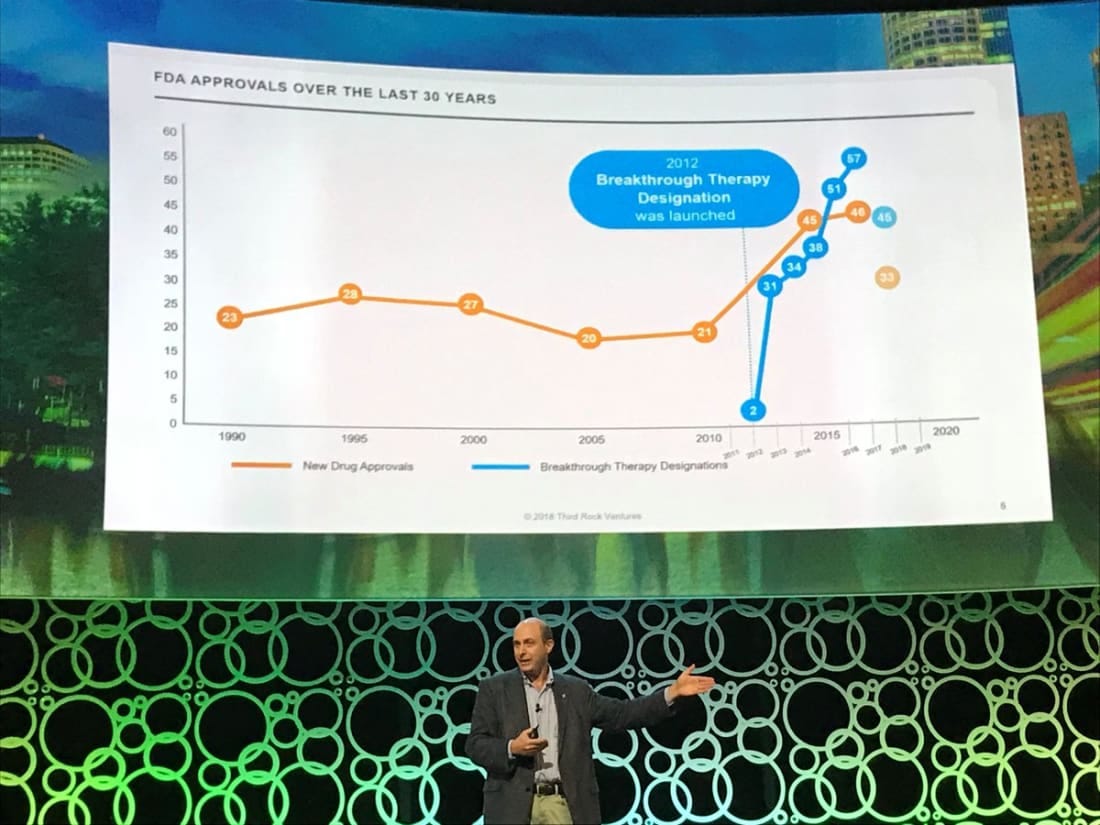

During this time, the FDA was approving less drugs. Maybe due to scientific complexity and partly due to the FDA becoming a little more risk averse. During the 2000s, the FDA was approving any where between half or two/thirds less drugs when compared to the current era. This drove up costs, increased the barriers of entry for new companies, and contributed to lower overall returns in the field:

Source: S&P Global

Healthcare incentives

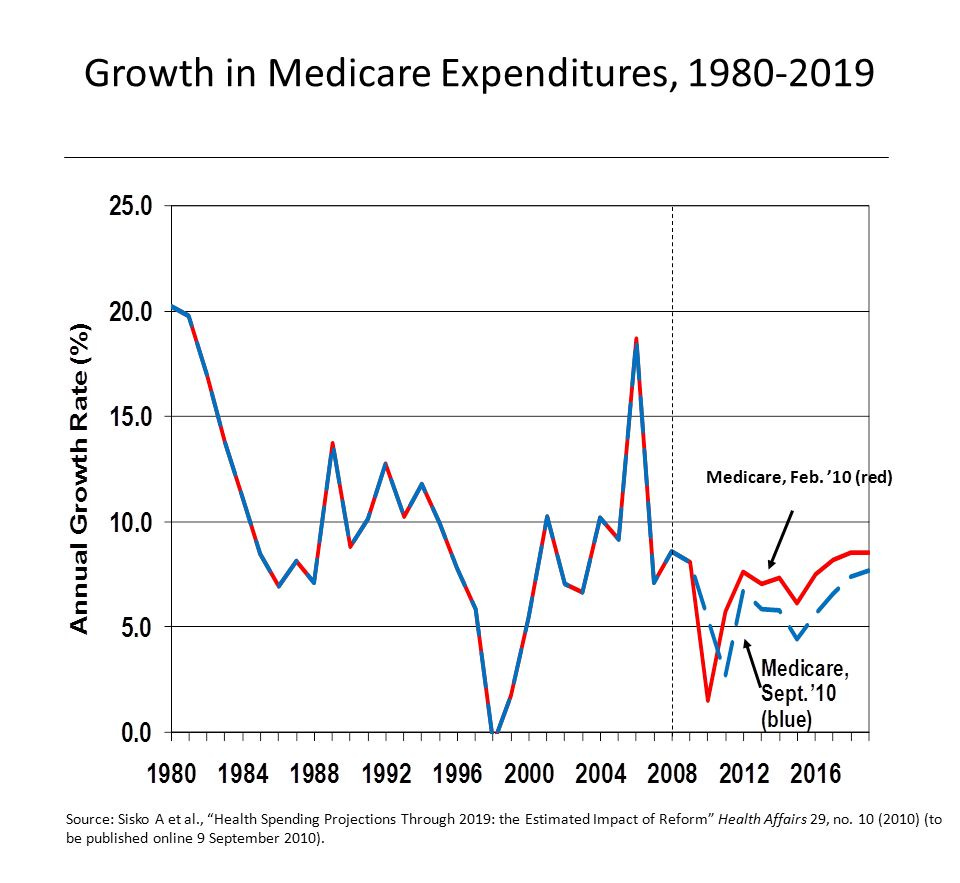

For many reasons healthcare spending in the US decelerated a bit in the 1990s. With a relatively young population that had yet to enter their AARP years, the US was in a sweet-spot where the inefficiencies of the healthcare system was tolerated because it was only ~10% of overall GDP. This led to a lower incentive to invent curative medicines - often a therapeutic or management tool is a more efficient way to deliver care than a hospital.

Productivity

The declining productivity of drug development has been a worrisome trend; however, one major caveat is that medicine now is generating cures. However, in the 1990s and 2000s that really wasn’t the case. Other measures of productivity in life sciences are available; however, most business models are tied to the FDA or Medicare somehow (drugs, diagnostics, medical devices, healthcare software). Industrial biotechnology was in a major bubble due to cleantech and could be in one with climate-chance investors, and it was pretty obvious to the intelligent investor that the economics for many of these businesses just didn’t make sense (the demand for a higher priced microbe-derived commodity chemical isn’t there, a microbe-derived lotion the same).

The key point for this overall phenomena in drug development, often called Eroom’s Law, is that it has put the cost of bringing a drug from invention to approval out of reach for many early-stage companies (not many companies can raise $1B):

Source: Nature

As this occurred, large drug companies cut their R&D departments, maybe further exacerbating the problem (i.e. financing leading the science), that affected an generation(s) of founders and inventors - they didn’t get exposed to world-class biotech research and company formation. This along with the patent cliff of the 2000s/2010s and increasing competition among indications, led to decline in industry sales in 2012. This accelerated the shift toward virtualization where early-stage companies use CROs and partners to keep overhead costs low during the discovery phase. Bruce Booth brings up a lot of great points with regards to new platforms like lower cost sequencing and bioinformatics also playing a role in large biopharma companies reducing their R&D footprint - they simply needed less employees. Consequentially, this also led to layoffs at an unprecedented scale, with 100Ks of employees let go from large drug developers.

Drug companies along the way began taking less scientific risk and started rewarding managers (i.e. penny pinchers) instead of productive, creative individuals. In response, many VCs (Atlas, Venbio) shifted their models toward externalizing R&D departments for large companies and pioneering a build-to-buy approach. This approach has been extremely lucrative with the funds multiplying capital many times over; in particular, The Column Group had a vintage in 2014 that has generated an IRR near 400%. However, large companies, say worth over $5B/$10B, have been scarce with only Kite and Juno reaching the $10B mark for companies founded since 2000. To be fair, Actelion probably should be counted given that is was acquired for over $30B with a spinoff allowed (worth ~$2B), but it was founded in 1997. The last $100B life sciences companies to be founded was Gilead, which was formed by an inspired founder who set the company on course for its scientific excellence in viral disease. Companies like Bluebird, Alnylam, Sage, and Agios will likely surpass this valuation over time so I don’t want to be overly critical. But when compared to the 1980s, a golden era for life sciences, the 1990s/2000s have been challenging for founders and investors. These incentives led to decisions that further compounded declining productivity in our field. This probably led to a depleted stock of great life sciences founders who could take a company from formation to scale (over $10B and hopefully over $100B).

Ultimately, early-stage companies no longer had the capability to bring a drug to patients themselves. This incentivized companies to be formed around drug repurposing, orphan drugs, reformulations, picking up late-stage programs and flipping them back to biopharma, overall taking on less technology and business model risk. These types of companies could generate high returns but likely would not lead to large companies. Investors and founders during this era realized the easy work had been done by Genentech, Biogen, and others so they decided collectively to not pursue higher-risk projects, for all five reasons and the fact that gene therapies failed in the late 1990s and other modalities just were not working, and instead conservatively financed companies still going after iterative problems. This is a completely rational approach to take if new drug platforms (i.e. cell therapies, RNAi) were not working.

Breakthroughs not working out

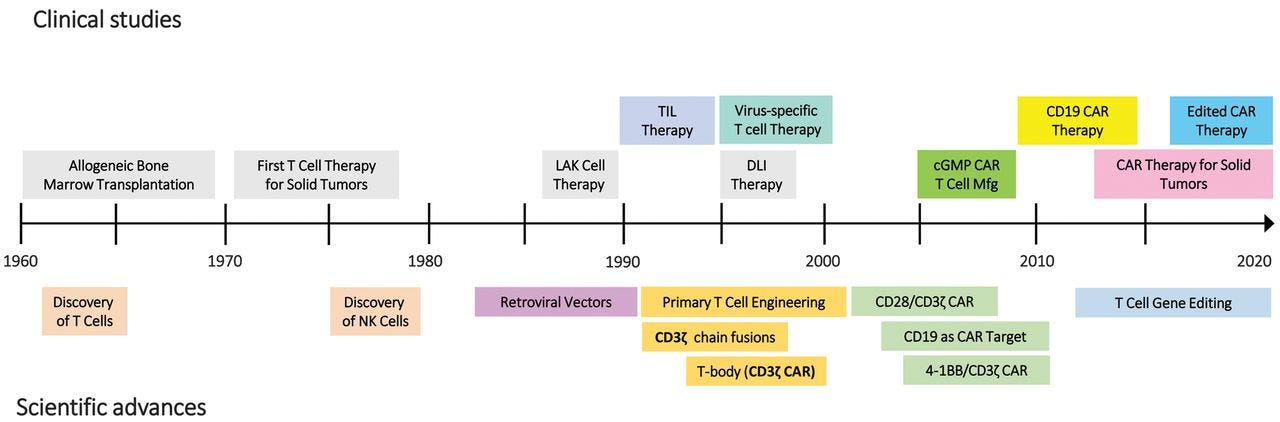

On top of the regulatory and productivity problems, new technologies just were not working. T-cell therapies did not show efficacy, gene therapies more-or-less failed in the 1990s, modalities beyond small molecules and antibodies were facing delivery problems. Overall the power of recombinant technology and its rapid growth in the 1970s/1990s didn’t necessarily translate into success for new technologies:

Source: Science

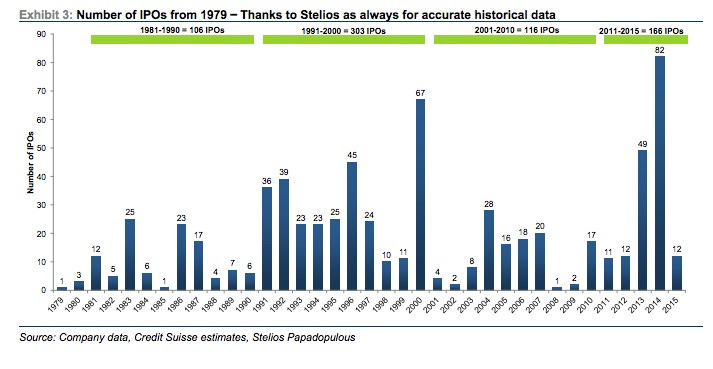

IPOs/M&A

The last component was a closed IPO and sometimes M&A windows for life sciences investors. If new companies can’t get liquidity, investors can’t generate returns and invest in more companies. For the 2000s, going public was rare for many biotechnology companies. Getting acquired was a more likely outcome:

Source: Credit Suisse

Source: MTS Partners

Now life sciences is out of this period driven by new medicines and technologies mainly centered around immunology (checkpoint inhibitors, cell therapies/CAR-T, bispecifics, mAbs). The exciting part is that new companies now are more and more resembling businesses from the 1970s/1980s era.

Whereas companies were designed to be built-to-buy during the 2000s, new startups are increasingly trying to pursue drug development programs on their own. One way to represent this is the number of $1B companies formed - between 2013-2018, 78 biopharma companies reached a valuation of at least $1B. The five components that drove the slowdown, are now driving this renaissance:

The FDA especially when it was under Gottlieb has become more supportive of getting new drugs through the clinic faster and promoting post-market approvals. This is enabling new modalities from gene/cell therapies, RNAi, peptides, microbial therapeutics, oncology drugs pursuing genomic signatures, and beyond get the patients faster. Excitedly, patient-advocacy groups are rising in power and will lead the way for more approvals (this is a place where software can help support especially for patient recruitment). This is actually leading to a new problem of pricing that is still being sorted out - gene therapies are leading the way and will set precedent on how payors reimburse for high-priced cures.

Healthcare spend began to accelerate in the 2000s as a large cohort of the US population began to approach 60 years old with overall spending on healthcare approaching 20% of GDP. This led to an increasing need for new medicines to prevent patients from entering a costly hospital along with an overhaul of the US healthcare system to induce a shift from fee-for-service to fee-for-value.

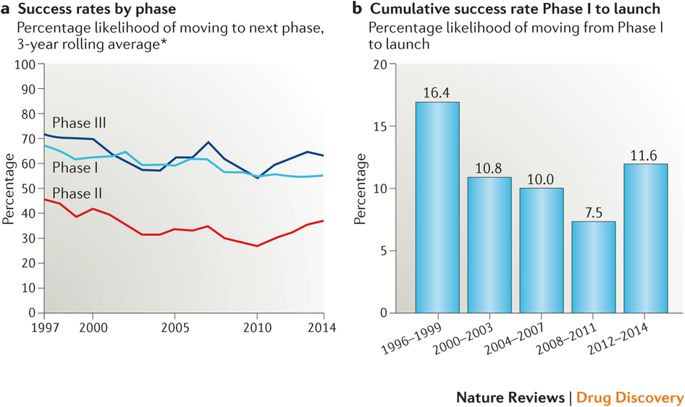

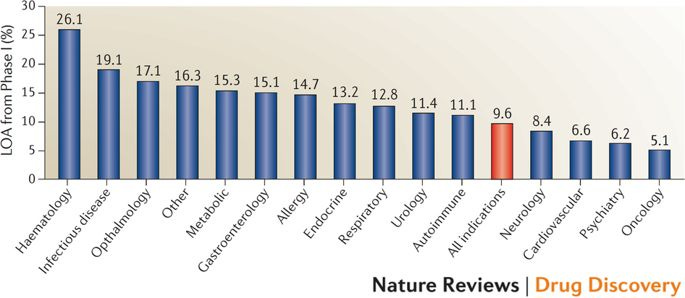

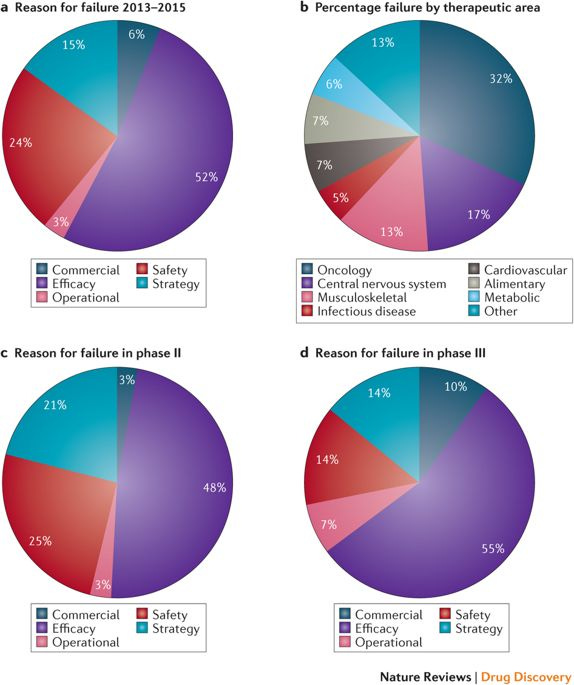

Clinical success rates have been on the rebound since 2012. However, there is a lot of room for improvement especially around Phase II studies.

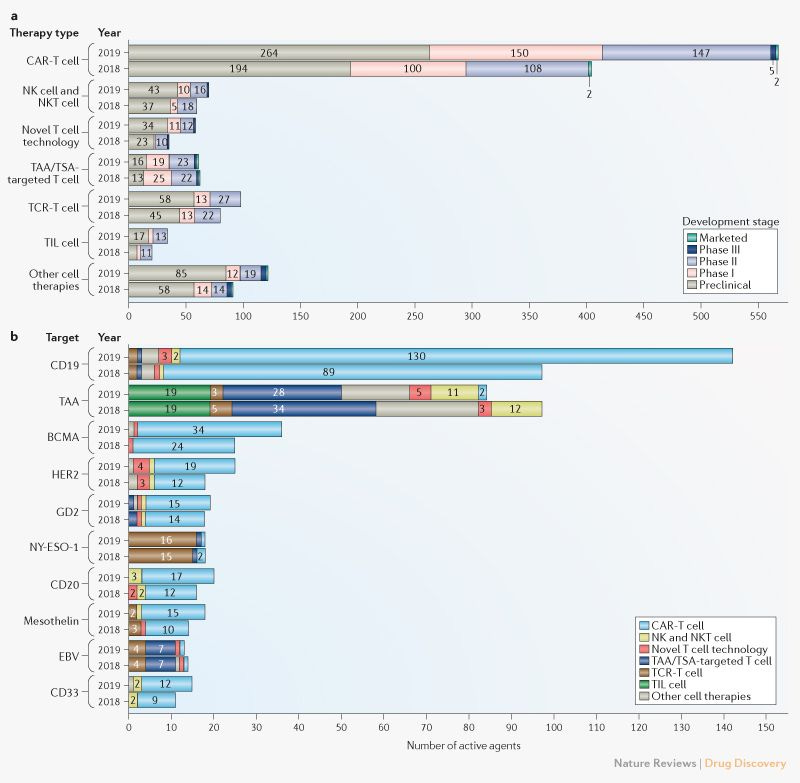

New scientific discoveries have found success during translation. In particular, CAR-T therapies along with a few others.

The IPO window has been open for much longer than anyone expected with high levels of M&A. Low-interest rates help drive a shift toward very high risk companies (i.e. drug development). Large companies, who gutted their R&D departments and were facing a patent cliff, were caught back-footed when CAR-T started working and a few other things. As a result, large companies like Novartis, Gilead, and Celgene responded with generous buying sprees. This helped funds like The Column Group’s 2014 fund generate gaudy returns. Lastly, around 2012/2013, the returns of biotechnology index (XBI) began surpassing the technology index (QTEC).

Supportive FDA

Relative to the 2000s, the FDA is approving more and more drugs with 2018 setting a new record. For 2018, well over half of companies used a priority pathway during clinical trials from orphan designations, priority review, breakthrough therapy, and a few other mechanisms. Importantly, the FDA has made progress to become more collaborative with companies as they go through their process accepting retrospective studies, surrogate endpoints, basket trials, and master protocols. The Parker Institute is doing pioneering work in this area. This is enabling smaller companies to have a shot at getting a drug approved at a much lower cost:

Source: Alexis Borisy

Shift from fee-for-service to fee-for-value

Healthcare spending expectedly picked up again combined with an aging population, the US economy was becoming very overweight. By the mid-2000s, it became obvious that healthcare was going to take up 20% of the US’ GDP and had the potential to debilitate the economy if something wasn’t done. This led to an overall shifting of incentives toward for fee-for-value - this transition has been incredibly slow but has the potential to enable new classes of business models in life sciences. From a regulatory perspective, healthcare was completely revamped (i.e. insurance mandate). Medicines were in the perfect spot to support this shift. With Medicare payments having somewhere around half of payments fee-for-value and private insurance falling beyond by a wide margin (~10%), the opportunity for life sciences companies is only growing.

Clinical success

Success in the clinic has been increasing:

Source: Nature

Source: Oxford Biostatistics

Source: Nature

Around 2012, success rates began to increase possibly signifying the end of one era and the beginning of a new one. The most important driver for clinical success is phase II (Tony Wood from GSK has a great perspective on where software can help this stage). A drug’s efficacy is tested during a phase II study sometimes costing over $100M with the chance of failure higher than success:

Source: Nature

Source: Nature

Source: Nature

Phase II success rates have been steadily increasing since 2012. This is driven by a combination of breakthrough science working out, a more lenient FDA, and the use of biomarkers to stratify patient populations at a higher resolution. This has made companies bolder in their ambitions to raise capital to bring drugs to market themselves.

Breakthroughs

Recently, mainly around immunology, new medicines and technologies have transformed many diseases - creating cures for some. This is exciting for founders, investors, and patients. This has led more capital to enter along with getting more support from regulators and possibly increasing clinical success. Immunology has transformed life sciences and other fields and platforms have the potential to keep this trending persisting. However, this situation is eerily similar to the 1990s - an industry coming off the high of cloning and the power of molecular biology and failing to deliver on making cell/gene therapies work. The same thing can happen again so its up to great inventors and founders to drive new discoveries and successful translation:

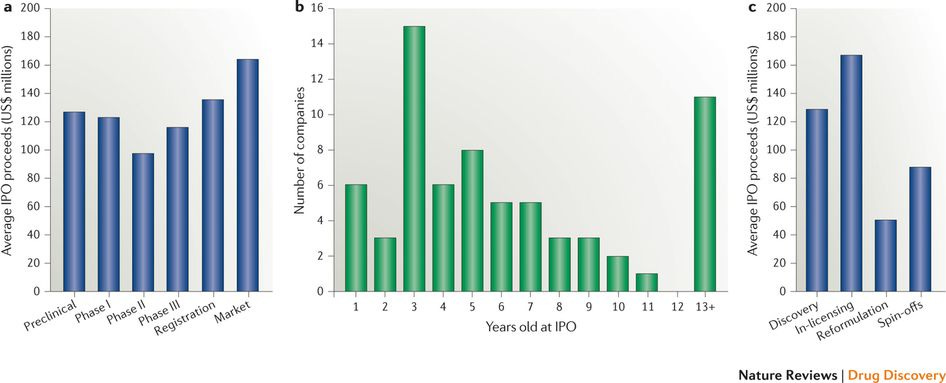

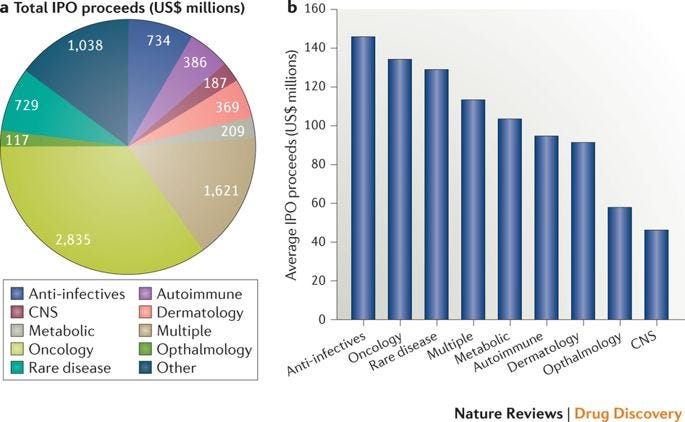

High-levels of liquidity

Returns in the field have come back - many new life sciences companies are being valued not only for their late-stage assets but the underlying technology platforms. Biotechnology IPOs have been increasing along with M&A with valuations across the board increasing any where between 2x-5x when comparing this era to the mid-1990s/2000s:

Source: SVB

Source: Nature

Source: Nature

These five components are making it possible for large life sciences companies to be created. This is making founder-led investing possible in the field. But even in this environment most capital is being directed toward cap tables that resemble traditional approaches. This has shifted a bit with founders from the Kites and Junos of the world financing some parts of their new companies independently and software investors entering the fray. Overall, new tools are giving smaller groups of people more leverage and ability to create unique business models on top of a mature industry. In the 1970s/1980s, small groups of people could solve relatively less complex problems and be successful on their own. This changed dramatically toward large (albeit smaller for them due to layoffs), inefficient teams, but recent growth (4 parts) and new platforms are swinging the pendulum back. Advances in computation, biostatistics, and immunology are making life sciences more scalable. A lot of caution needs to be taken here on where software can change the field. Biology is not the same thing as software. A prototype in software looks a lot different than one in biology. If something breaks in the backend for the former, there is almost always a cause-and-effect relationship to discover. The same is not really true for the latter. As a result seed investing is a lot different between software and life sciences. In software, a proof-of-concept can be created and scale relatively quickly where in life sciences, PoCs are easier to come by but their is still a lot of technical risk to understand (this is a place to gain an edge) and a march toward phase II studies, which is somewhat equivalent to a startup reaching scale. In industrial biotechnology, the equivalent is a lot closer to software just with a lot of more technology risk. The exciting part is as biology becomes more well understood and new tools emerge, the opportunity to develop new medicines and products is very large. But for intelligent investing, picking spots where software can significantly create value in life sciences (i.e. models, design, screening, manufacturing) will sort out the winners and losers.

Since ~2010, technological change in life sciences has been accelerating with inventions like gene therapies, CAR-T, liquid biopsies beginning to work out. Roughly, when a field’s technology is changing rapidly, technical founders have advantages. For software and information technology this has been true. For software design, the toolkit and possible products given tremendous advantages to founders who have the engineering capability and understanding on what will become possible. Whereas, when change is slow, supporting management, say over new technologies, is logical (as observed during the 2000s). Sometimes fields rapidly change for a bit then calm down going back and forth. However, recent founder-led companies and their success will determine the amount of capital that shifts overtime to this approach and how new capital invests. Companies like Emulate, Recursion, Atomwise, and Synthego need to become very large (over $10B and one reaching $100B) to validate this model. We’re not out of the woods yet - returns on R&D are still abysmal and breakthroughs in other fields like neuroscience might not happen. It still takes at least ~$25M to discover something, do hit-to-lead and optimization studies, and mice work to enter the clinic. There are still many inefficiencies/opportunities for new companies to solve here.

Just as firms like a16z began to prefer young engineers as founders and provide them with the agency infrastructure to support their development as CEOs, life sciences needs to begin to provide this agency to inventors. This makes sense - engineers leading software companies know what product decisions to make and do so quickly. Given that the investment community in software began providing massive levels of support to these engineers, these founders were able to grow and mature over time. Software investors have more to provide on investing structures and incentives rather than artificial intelligence to the life sciences field. Most people tend to focus on technology, but leave out the most important feature of building an enduring company: founders and incentives.