Build with Axial: https://axial22.axialvc.com/

Axial partners with great founders and inventors. We invest in early-stage life sciences companies such as Appia Bio, Seranova Bio, Delix Therapeutics, Simcha Therapeutics, among others often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Olink and Proteomics

Thank you to Hyde Patterson from Longitude Capital for putting Olink on my radar. The company was founded in 2004 out of Uppsala, Sweden. Spinning out of Ulf Landegren’s lab, the company got off-the-ground led by Björn Ekström along with 4 other PhD students. Olink was originally named Olink Bioscience and developed a suite of different tools & kits to analyze proteins from Duolink to visualize/quantify proteins in cells to Proseek, which was a kit to analyze proteins in 1 µl of serum. Using their product portfolio, the original Olink was very creative on the business model-side: out-licensing technology to Life Technologies and Affymetrix to generate non-dilutive capital as well as spinning off Q-Linea and Halo Genomics (acquired by Agilent). Ultimately, Olink, along with BioArctic, are the standard bearers for biotechnology in Sweden. Given that under Swedish law the inventor owns their IP, more founder-led companies are probably waiting to get sparked in the country.

In 2011, Simon Fredriksson became CEO. He was the inventor of proximity extension assay (PEA) that was published that same year. In 2016, the company split into two: Olink Proteomics and Navinci Diagnostics. During the corporate split, Jon Heimer became the CEO of Olink Proteomics. Olink was then acquired by Summa Equity in 2019 and IPO’ed in 2021.

Olink’s platform is centered around PEA, a method to measure thousands of circulating proteins in a single experiment. Right now the company is the market leader for protein measurement. With (unbiased) proteomics still a category up for grabs. PEA relies on a dual antibody system to measure proteins. Two antibodies recognizing different regions of a target are barcoded with matched pairs of DNA oligonucleotide tags. Once both bind the target protein, the oligos hybridize and are extended and detected by qPCR/NGS. This avoids cross-reactivity that is commonplace with ELISAs; in PEA, if an antibody binds a non-target protein, its tag won’t hybridize with the other antibody’s tag. This enables a >80% (sometimes high 90%) specificity rate, a sensitivity well over 60% for most panels, and a large dynamic range from fg to mg. Olink then develops various 48- to 96-protein panels for sample volume as low as 1 µL of blood, really building upon their legacy Proseek product. PEA allows multiplex protein measurement without sacrificing specificity.

These panels are distributed through 3 main channels:

Olink’s own instrument (co-developed with Fluidigm): the Olink Signature Q100, a benchtop system for biomarker analysis.

Olink Explore, a service to discover/measure biobanks using Illumina’s next-generation sequencing (NGS) machines. By using sequencing, Olink can offer a library for 3072 proteins across 8 diseases each with 384-plex panels. At this throughput, a company using Olink can measure ~1.3M proteins per week per NGS instrument.

Olink Focus to offer customized biomarker discovery for up to 21 proteins

Most of Olink’s revenue (~70%) and growth comes from services and their Explore product line. Over time, they are trying to move toward a razor-and-blade model with higher-margin kits and a moat to slow the growth of new entrants. Olink has established 29 Explore sites generating around $700K LTM each. For services, Olink sells their panels through their fee-for-service labs where they run the analysis on the behalf of customers. Right now, Olink works with 100s of customers, all top 20 biopharma companies, and is involved with over 900 research papers. But to scale and have the shot to become the market leader for the emerging proteomics market, Olink will need to ensure their product revenues (i.e. selling a kit customers run & analyze on their own) significantly outpace services.

On the other end of the pond is SomaLogic. Founded in 2000 by Larry Gold, a biotech legend & professor at Colorado whose lab did pioneering research on SELEX, the company was based on the discovery that aptamers (i.e. nucleic acids) can be used to detect proteins. Two key parts of their business model are biopharma partnerships and distribution: their deal with Novartis started in 2011 and was key to fund the company with the collaboration extended in 2014 and expanded again in 2019. SomaLogic has very strong distribution, much better than Olink, through partnerships with Illumina and Agilent, a similar strategy 10X Genomics executed early-on and one Element Genomics is using as well with their bench-top sequencer.

The company mainly distributes their SomaScan panels, that can measure up to 7K proteins with a 55-μL sample, through certified sites. In terms of pricing, Olink charges around $100 per sample for their 48- and 96-protein panels while SomaLogic costs ~$800 per sample for panels an order of magnitude larger. And a key part of SomaLogic’s moat is their database of human protein/aptamer pairs with over 450K samples. Olink’s comparable moat is their antibody pair library. As their dataset grows, SomaLogic has worked toward developing proteomic-based diagnostics with their SomaSignal tests currently for cardiovascular risks, glucose tolerance, body fat percentage, resting energy rate, among others.

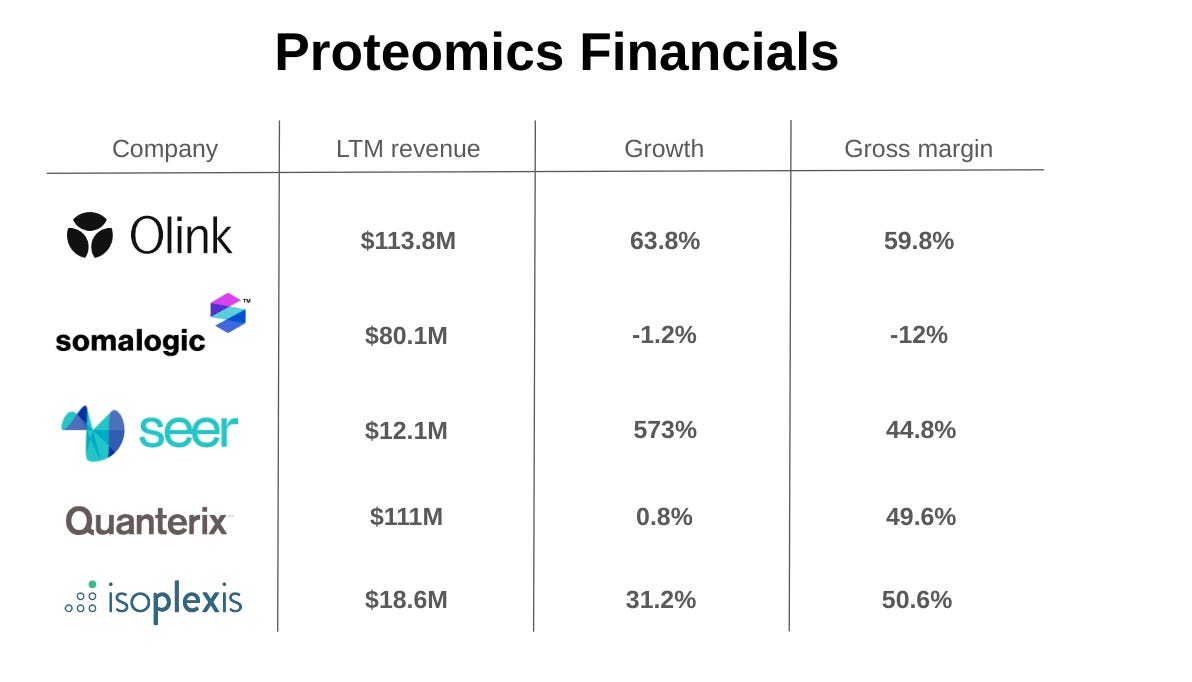

The key opportunity is to build the defining proteomics tools company. Olink is working toward transitioning from services to product growth. SomaLogic is working on the same and is also making a beachhead in diagnostics. Other comparables are Seer, Nautilus, Glyphic, Quanterix, Nomic, and Isoplexis. Seer and Nautilus are working to develop tools to capture the entire proteome, in an unbiased way. Glyphic is the upstart in this group and is bringing a new approach to proteomics to leapfrog Seer/Nautilus and capture the proteomics market. Quanterix is the legacy company while Nomic is more similar to Olink/SomaLogic in terms of product value prop and Isoplexis is focused on single-cell applications. For their business model transition, Olink wants to improve their margin. Amongst this group, Olink has the best gross margin but still has a lot of work to do to reach parity with Illumina (~70% gross margin) and 10X (80%). SomaLogic wants to own protein measurement and the applications and are likely to invest more in diagnostics and do more M&A expanding the number of apps for their database. Ultimately, the goal is to set the standard for proteomics and increase access to this toolkit for drug development, diagnostics, and research.

After the Human Genome Project, the number of genes came out to be ~5x lower than expected at a little over 20K. A lot of the complexity of biology actually comes from proteins and an even larger set of variants. From these 20K genes, there are over 60K protein isoforms that come from splicing, which are modified with post-translational modifications (PTM). And the combination of isoforms and PTMs create millions of proteoforms. This is the opportunity for existing and new proteomics companies: to capture the full diversity of various proteoforms that exist.

We need reliable tools to go beyond measuring proteins in the blood and more sensitive methods to detect/quantify intact proteoforms. The detecting part is hard but quantifying is a lot more difficult given that a cell can have one copy to millions of copies of a given protein. The dynamic range is pretty daunting. Detecting DNA faced similar issues in the 1970s/1980s and that's why PCR was such a breakthrough. A unified proteomics platform needs to have the power of being unbiased like a microscope and the capability of PCR to detect low-copy proteoforms.

Seer with their Proteograph technology and Nautilus Biotechnology with their own approach are currently in the lead to build this proteomics platform. Mass spectrometry (fragmenting/ionizing proteins to generate spectral peaks) has been the workhorse of proteomics. However, unknown proteoforms are invisible to mass spec given that they must have a unique molecular peak known a priori to be detected. Then the dynamic range of mass spec is still an issue to detect certain PTMs and protein variants. Seer came out of Omid Farokhzad’s lab at HMS to use nanoparticles (NP) to bind specific proteins based on features such as surface charge, protein modifications, and more. Proteins bound to a given NP are then fragmented and measured by mass spec. The premise is that NPs can be designed to capture a subclass of proteins (and proteoforms) that would be lost by traditional LC/MS. Then Nautilus uses an imaging approach invented by Parag Mallick to capture single-molecules of proteins in a microarray and then run a large number of cycles (in the hundreds) of antibodies measuring specific epitopes. Whereas Olink and SomaLogic are focused on minimizing cross-reactivity, Nautilus is actually trying to maximize it. Each cycle provides a snapshot of what proteoforms could be in a sample generating at least an order of magnitude more data than NGS for whole-genomes until the complete proteoform picture is captured. This approach is comprehensive but requires a large library of antibodies and a high number of cycles that could make the product price inaccessible to most. Given Olink’s antibody library, it would actually seem natural for them to acquire Nautilus if their platform can become cost competitive in terms of price per sample. Olink has a market cap of a little over $2B and Nautilus is currently at ~$250M. But in short, proteomics still needs a market leader.

The ability to sequence genomes has lowered the barrier to develop new medicines for genetic diseases and has transformed healthcare, ubiquitous proteomics will do the same specifically for chronic and inflammatory diseases:

“The vast majority of diseases that we’re struggling with today are not necessarily genetic in origin. They come from environmental factors, or aging or inflammatory conditions – [and] proteins have had an outsized impact on those conditions.”

- Parag Mallick, Co-Founder and Chief Scientist at Nautilus Biotechnology