Axial partners with great founders and inventors. We invest in early-stage life sciences companies such as Appia Bio, Seranova Bio, Delix Therapeutics, Simcha Therapeutics, among others often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Who leads Dyno?

Dyno Therapeutics was founded by Eric Kelsic, Adrian Veres, Sam Sinai, George Church, and Alan Crane in 2018 to bring machine learning to AAV gene therapies. Eric, Sam, and George had done pioneering work multiplex screening AAV capsids that formed the basis of the company.

What does Dyno do?

Dyno combines machine learning with high-throughput in vivo screening to develop new AAV gene therapies. The company’s platform, CapsidMap, comprehensively maps across the AAV capsid to have different tropism, better packaging, among other features. With this platform, Dyno licenses out the AAV vectors they invent to co-develop with partners.

What makes Dyno unique?

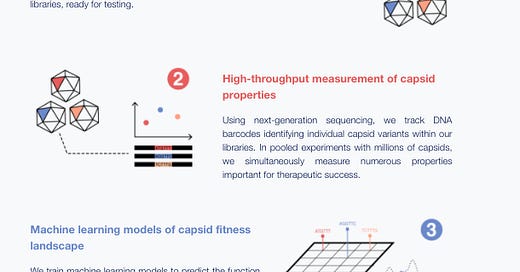

Dyno combined DNA synthesis and sequencing to comprehensively screen AAV capsid sequence space and select capsids more easily. The company’s method is composed of 3 main parts:

Relying on DNA synthesis for library creation

This enables the use of sequencing to select capsids versus successive rounds of enrichment done by incumbents

Machine learning enables optimization for multiple AAV properties like immunogenicity, packaging, and tropism

Dyno was formed around a proof-of-concept engineering AAV2 (a vector useful for liver diseases). The paper mutated every capsid gene for AAV2 and screened for properties like:

Virus production

Immunogenicity

Thermostability

Biodistribution

By screening across the entire capsid sequence space through “single-codon substitutions, insertions, and deletions”, the technology can screen for more useful AAV variants versus random mutagenesis. The key part is linking mutants and barcodes that relies on a synthesis-and-split method. The paper generated 1271 variants of AAV2 with a little over 25% functional (i.e. liver tropism) versus the standard of under 1% of variants showing function from a random mutagenesis screening method. For example, they were able to discover new residues important for biodistribution. Amazingly, they actually discovered a new AAV2 gene in the VP1 region that encodes for a “membrane-associated accessory protein that limits AAV production through competitive exclusion.” This is only really possible through systematic mutagenesis across the capsid. This comprehensive approach is only possible with a method that relies on DNA synthesis and sequencing.

Dyno uses systematic mutagenesis to search across the capsid landscape to significantly improve the odds of finding a new and functional AAV variant. Combined with machine learning, the company can generate large numbers of AAVs optimized over several features. Dyno is building up substantial advantages to invent synthetic variants of AAVs that might have improvements across several properties versus natural AAVs.

Why I like what Dyno is doing?

Dyno is building a scalable platform to screen a large number of AAV variants focused on 4 areas:

Tissue specificity

Lower immunogenicity

Higher package sizes

Easier manufacturing

This technology enables a new business model for the company. Dyno can develop AAVs that might deliver new modalities like CRISPR. Their AAVs have the potential to pursue more diseases that other vectors cannot and might help Dyno get to market more quickly. Gene therapy companies have a flipped value proposition where the vehicle is a first-class citizen and the main value and the gene delivered is a commodity. As Dyno develops clinically successful AAVs, they will have an increasing power to deliver a wide set of genes for more indications.

Ultimately, Dyno has the potential to be the successor to Regenxbio. Dyno’s recent business development success is a very positive indicator:

Novartis - combined with Sarepta deal worth potentially $2B, to develop new AAV vectors for ocular diseases

Sarepta Therapeutics - developing AAVs for muscular diseases

Roche / Spark Therapeutics - deal worth up to $1.8B to develop new AAV vectors for CNS and liver diseases

Overtime, Dyno’s platform will have the ability to build an internal pipeline for the company. Dyno’s ability to select for AAVs across multiple features is particularly useful to develop gene therapies in neuroscience. Moreover, the potential to combine software-enabled drug discovery platforms, like Dyno, with capital markets can help a company get to scale faster. Software is good at generating IP, and as long as the work has the potential to generate over ~$1B, securitization can bundle this IP and bring the capital to develop a large set.

You can find Dyno here.