Axial partners with great founders and inventors. We invest in early-stage life sciences companies such as Appia Bio, Seranova Bio, Delix Therapeutics, Simcha Therapeutics, among others often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Orchard Therapeutics was founded in 2015 by Bobby Gaspar and Donald Kohn (both pioneers in HSC gene therapies) with two GSK executives, Andrea Spezzi and Ben Auspitz to develop hematopoietic stem cell medicines for primary immune deficiencies, metabolic diseases, and hematological disorders. Orchard owns Strimvelis (bought from GSK), a gammaretroviral-based product for the treatment of adenosine deaminase-severe combined immunodeficiency (ADA-SCID). Orchard’s pipeline ranges from metachromatic leukodystrophy and ADA-SCID to Wiskott-Aldrich syndrome and X-linked chronic granulomatous disease.

The first slide of their latest corporate presentation explains Orchard’s mission to help patients with rare diseases.

The slide gives an overview of the milestones Orchard has achieved, mainly with over a hundred patients treated, and their value proposition to potentially provide cures to patients.

Then Orchard explains their recent pivot from immunological disorder to neurometabolic disorders; mainly the market in terms of patient population and potential sales is much higher for the latter. ADA-SCID is an ultra-rare disease with Strimvelis treating a little over 170 patients at a price tag of ~$700K.

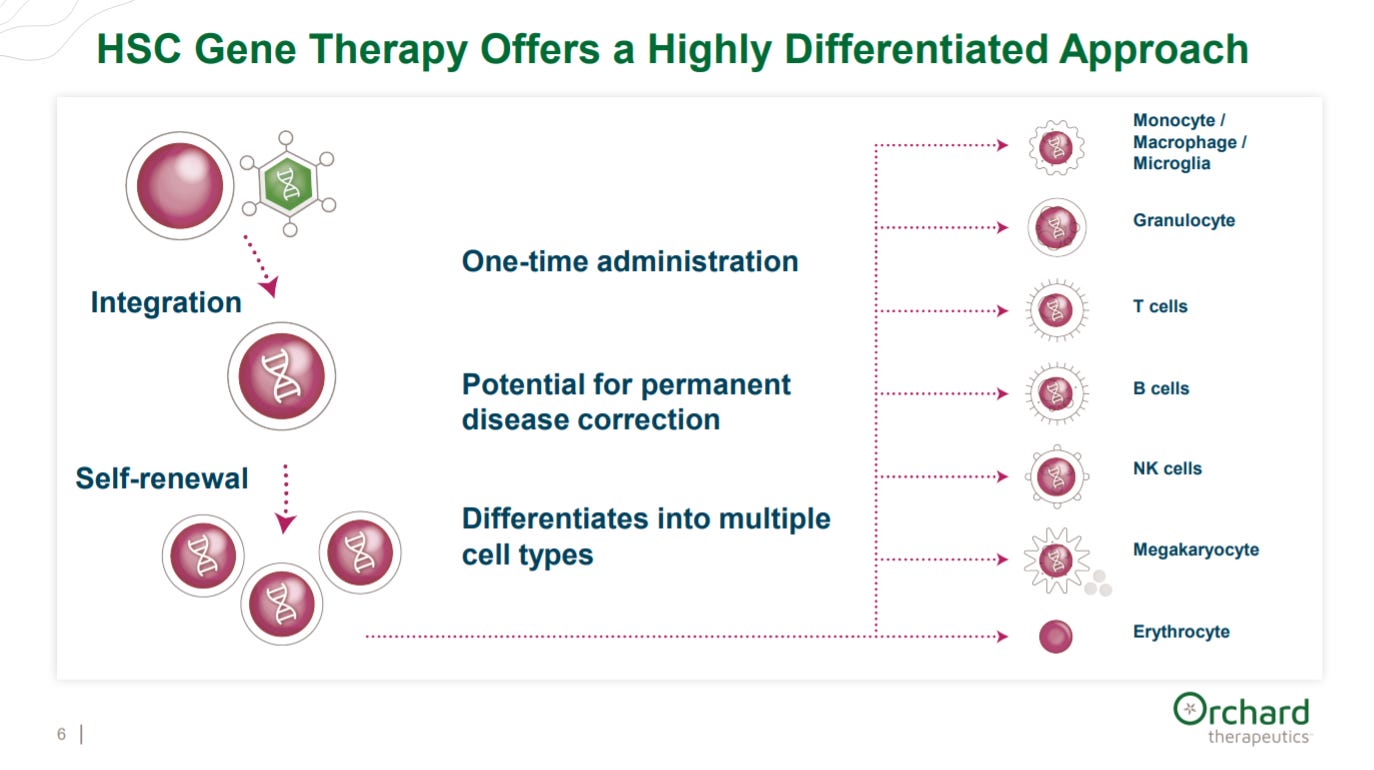

After explaining their achievements and pivot (probably to reset the narrative on their stock), the company gives an overview of the potential power of HSC medicines: long durability and ability to differentiate into multiple cell types.

This is a very powerful slide conveying the response durability to HSC medicines.

Then Orchard provides a generic pipeline slide.

With the set up, the company focuses on their lead indication, MLD, a horrible disease affecting children with a life expectancy of a few years. The disease is an autosomal recessive lysosomal storage disorder (LSD) characterized by severe and progressive demyelination affecting the central and peripheral nervous system.

Then the clinical PoC data for OTL-200, a HSC medicine acquired from GSK that contains autologous CD34+ cell-enriched haematopoietic stem and progenitor cells (HSPC) transduced ex vivo using a lentiviral vector encoding the human arylsulfatase A (ARSA) gene. The results for late infantile and early juvenile, n=10 for both treatment arms, was pretty transformational for patients by their primary endpoints.

Orchard then presents an overview for their second indication: MPS-I.

Early clinical data on efficacy in two patients is still hard to call positive or negative.

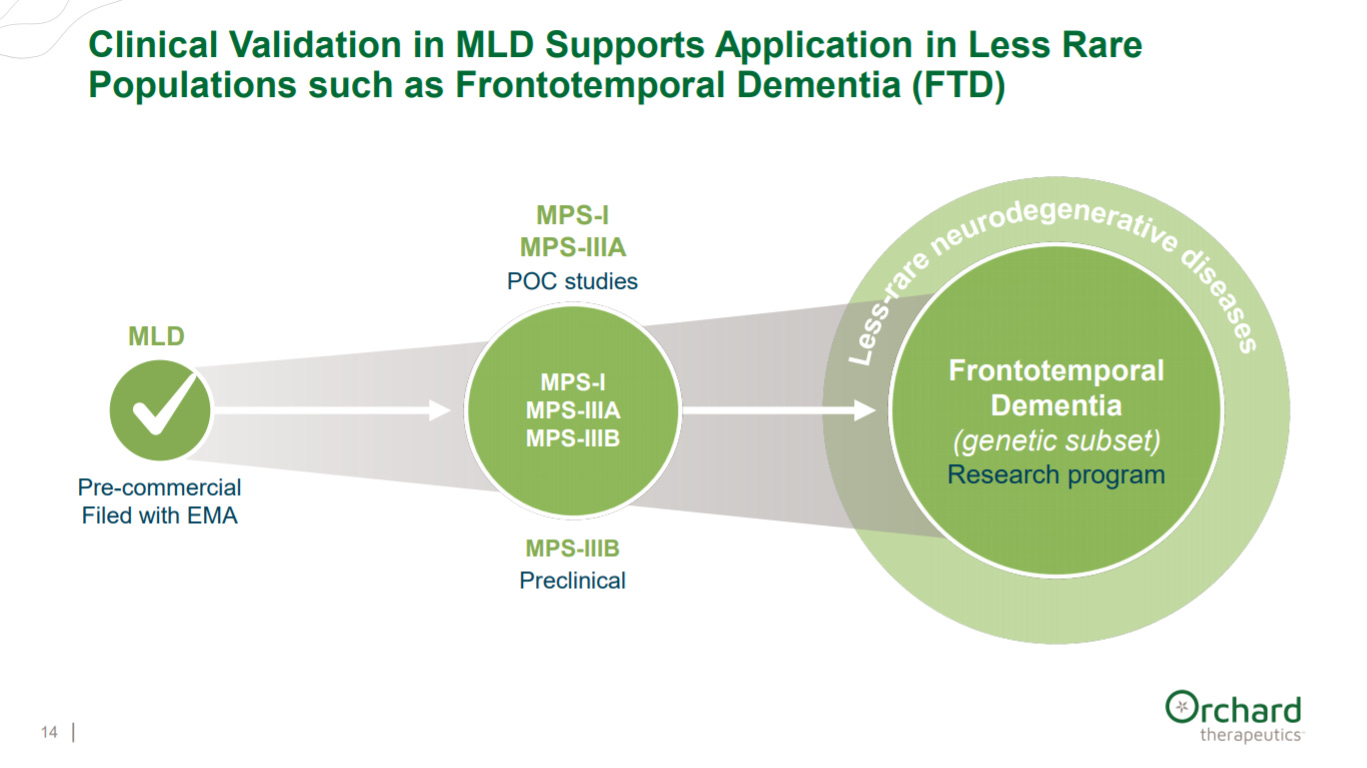

After giving an overview of their two lead clinical assets, Orchard provides their clinical plan to treat rare diseases (i.e. MLD) then to indications with slightly larger patient populations (i.e. MPS-I) and finally large neurodegenerative diseases like dementia.

Then Orchard plans to move beyond neurological conditions to other disease types and organs. The last two slides are pretty important for the company to reset the narrative that they are not only an ultra-rare disease company.

After neurometabolic disorders, Orchard’s second focus is in primary immune deficiencies. They show some early data in WAS and X-CGD.

For primary immune deficiencies, the company’s clinical plan is to also expand from rare diseases to larger indications like Crohn’s disease.

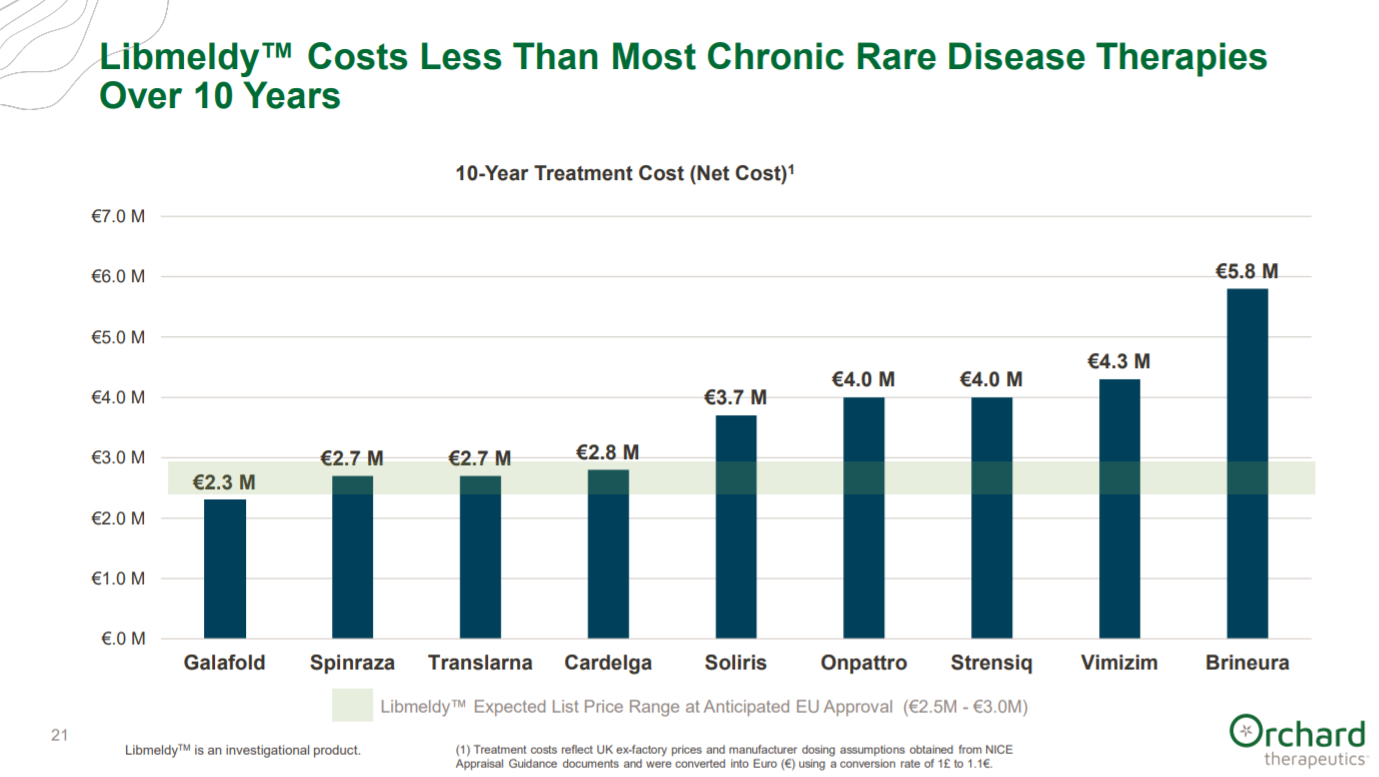

Orchard touches upon their drug pricing plan of OTL-200 in MLD: this is a pretty vague figure to argue that a price of a few million dollars per treatment is manageable given the overall societal benefit. Given the age of the patients, a potential cure is probably worth this. However, longer-term studies probably will be needed to charge this price; the durability of HSCs in general may negate this. BioMarin is facing this issue for their Hemophilia A gene therapy.

This is a useful figure to compare the cost of OTL-200 to 10-years worth of treatment of rare diseases.

Orchard touches on their launch strategy for their lead asset in MLD given regulatory approval. Importantly, success with this launch will make successive commercialization runs for other medicines in their pipeline a lot easier. Orchard is aiming to become a fully-integrated drug company.

For all cell therapies, the process is the product. Orchard splits their manufacturing strategy into 3 parts: (1) Investing in new technology (2) Partnering for infrastructure (3) Building their own facilities over time.

Orchard has a market sizing slide that might be better off coming after slide 18 where they frame their strategy to pursue larger and larger indications over time.

Orchard ends with milestones across their pipeline over the next 1-1.5 years. This is always a good place to end.

The deck does a good job to convey their pivot and new strategy to go after diseases with larger patient populations. Orchard needs to add a team slide; the CEO is truly one of the scientific leaders in the HSC field.

Follow up questions for the team:

Will the FDA and other regulatory bodies need longer-term follow up studies for Orchard’s HSC programs?

Versus a traditional BMT, what is the value proposition of Orchard’s products for clinicians and patients? Safety? Access?

What is Orchard’s current manufacturing capacity for Strimvelis? Will the growth rate in throughput match Orchard’s strategy to go after larger indications?