Axial partners with great founders and inventors. We invest in early-stage life sciences companies such as Appia Bio, Seranova Bio, Delix Therapeutics, Simcha Therapeutics, among others often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Agios was founded in 2008 by Craig Thompson (UPenn at the time), Lewis Cantley (HMS), and Tak Mak (University of Toronto) based on their work in cancer metabolism. The company was formed around work from Lewis Cantley’s lab that found that cancer cells enzymes involved in increases in metabolism - https://pubmed.ncbi.nlm.nih.gov/18337823/

The scientific premise of Agios was that cancer cells increase their metabolism and consume more nutrients to ramp up their growth rates so the companies sought to develop new medicines targeting autophagy, fatty acid metabolism, and glycolysis. With this approach, Agios made a breakthrough discovery of the role of isocitrate dehydrogenase (IDH) 1 and 2 (metabolic enzymes) in cancer:

https://www.cell.com/cancer-cell/fulltext/S1535-6108(10)00036-X#%20 (both published in 2010)

This work gave Agios an incredible opportunity to develop new medicines targeting mutated versions of IDH1/2. With a unique MoA, Agios set off to develop first-in-class medicines - this enabled the company to execute an iconic deal with Celgene in 2010 and get two medicines approved: Idhifa (with Celgene) targeting IDH2 for AML and Tibsovo targeting IDH1 for AML.

The first slide of their latest corporate presentation simply conveys Agios is focused on getting to 2025.

The next slide sets the tone for Agios’ patient focus. They use an example from pyruvate kinase (PK) deficiency, a disease for which Agios has a phase 3 asset in.

With this forward looking and patient-focused tone, Agios lays out their strategy: to focus on targeting metabolism in (1) hematology (2) solid tumors and (3) rare disease.

Agios goes into their track record. Two approved drugs in 10 years is pretty good.

Within 5 years, Agios is focused on getting two more drug approvals and becoming cash-flow positive.

With their goals, the company gives an overview of their catalysts over the next 5 years.

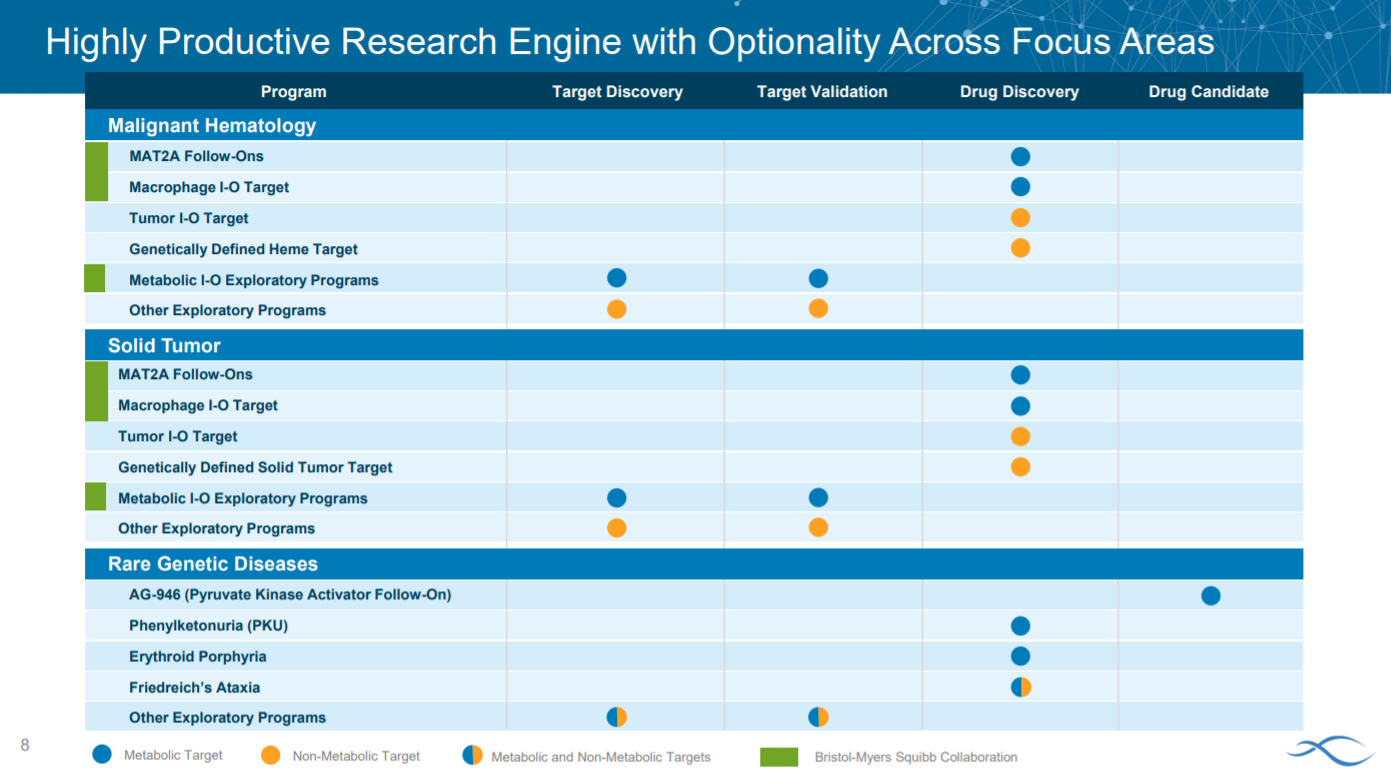

An important driver for Agio’s success will come from its preclinical pipeline.

Then Agios goes into the first part of their strategy: hematology. The slide sizes the patient population for their 3 main indications in the category: IDH1-positive AML and MDS along with MCL and DLBCL.

Their wholly-owned AML drug, Tibsovo, has been a successful commercial launch.

Agios uses a pie chart to size their opportunity in AML and how they address each segment: for untreated patients and those ineligible for intensive chemotherapy, Tibsovo is approved as a monotherapy. For the other half of the IDH1-positive AML patient population, the company has a phase 3 trial ongoing.

For the other half Agios is pursuing, the company presents the phase 1 data from the study.

Along with phase 1 data from a combination trial of IDH1-positive AML patients who are ineligible for intensive chemotherapy.

After explaining the opportunity in hematology, Agios goes into solid tumors.

The company presents early phase 2 data of Tibsovo in 2nd-line cholangiocarcinoma.

Agios also lays out their phase 3 trial design of vorasidenib (inhibits both IDH1 and 2) in low-grade glioma.

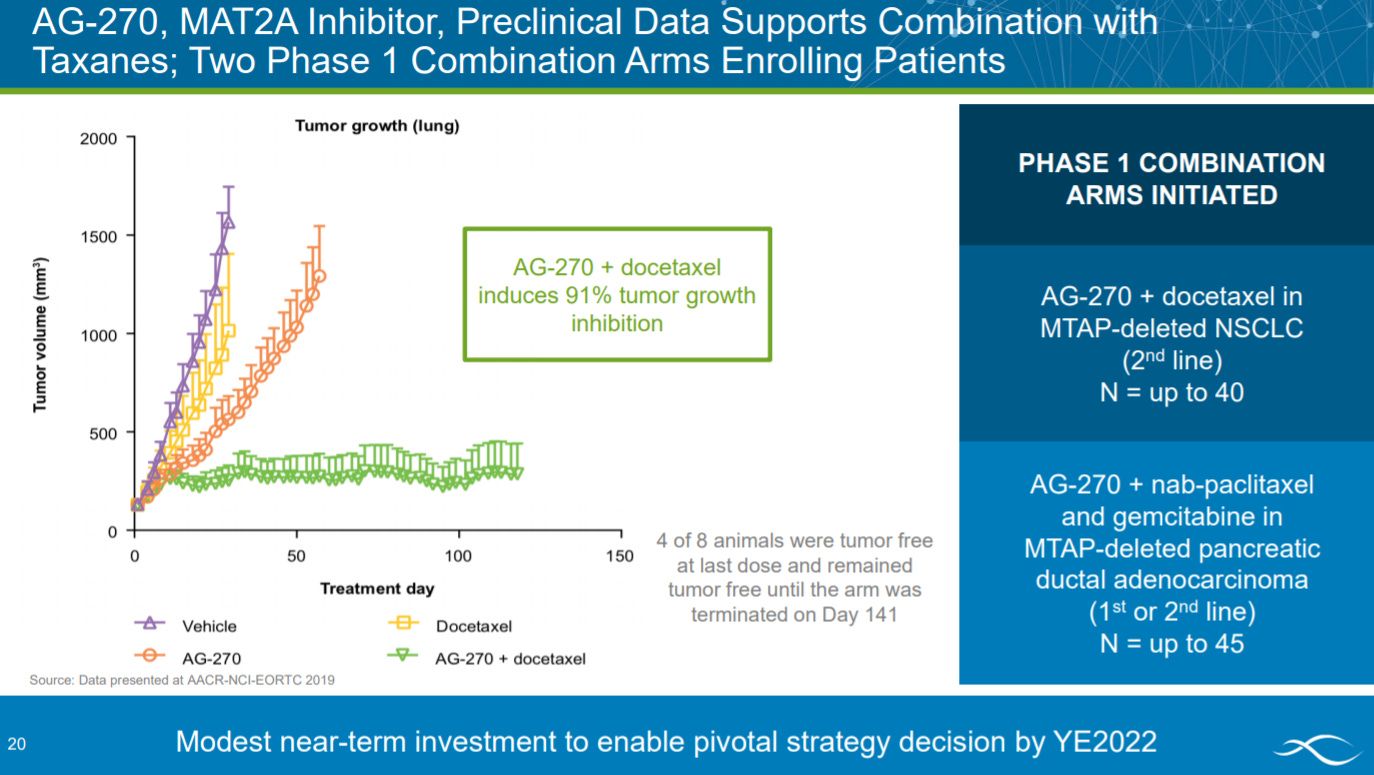

To conclude the solid tumor section, the company presents preclinical data on a MAT2A (methionine adenosyltransferase) inhibitor with two phase 1 trials ongoing for NSCLC and pancreatic ductal adenocarcinoma.

For Agios’ rare disease strategy, the company is focusing on pyruvate kinase R (PKR) because the mechanism is straightforward and has a role in PK deficiency and several anemias.

Agios presents phase 2 data for their PKR activator in PK deficiency showing safety based on hemolytic biomarkers and iron overload.

For the PKR activator, Agios explains the establishment of safety to pursue a phase 2 study in thalassemia.

Agios explains a possible mechanism by which PKR activation can treat sickle cell anemia. Part of the theme of pursuing multiple indications through drugging PKR.

The final slide of the rare disease section explains the market opportunity for PKR activation.

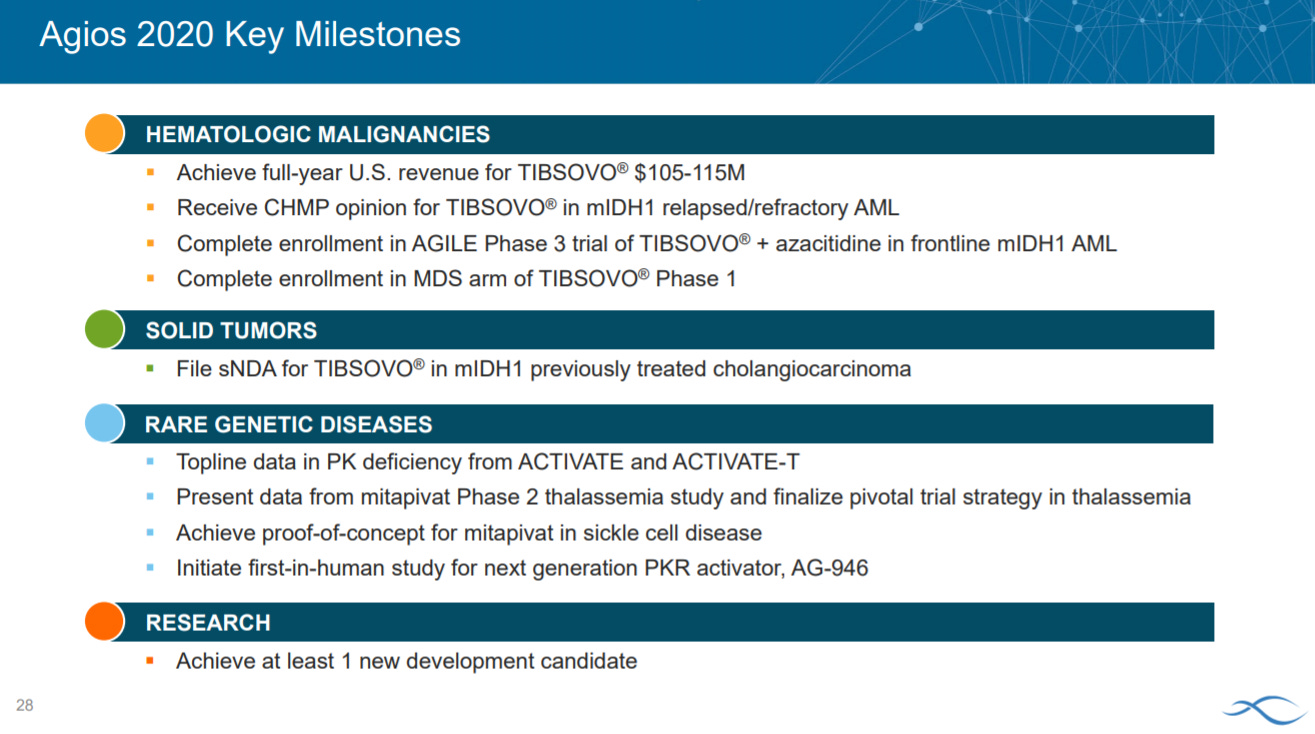

Then the company explains their milestones across their 3 key strategic areas and R&D.

Agios ends the presentation with their goals slide for the next 5 years.

Agios’ presentation does a good job to make their focus clear. The last 10 years of the company’s history has been driven by getting new drugs approved around IDH1/2. The next 5 years will be focused on expanding the value of their IDH1 franchise in Tibsovo and pursuing new indications.

Follow up questions for the team:

What advantages does Agios have in rare diseases and IDH1/2-negative cancers?

Is Agios looking at acquiring smaller companies for their assets within the company’s three areas of strategic importance?

What’s the upper limit of revenue potential for label expansion of Tibsovo?