Axial - Synthego

Surveying great inventors and businesses

Synthego is a company automating and scaling genome engineering. Founded in 2012 by the Dabrowski brothers who were heavily influenced by SpaceX’s model of automation and rapid iteration, the company sought to increase access to reproducible CRISPR gene editing technology. In life sciences, many tasks are arduous and hard to scale. Ideally, every experiment could be automated enabling cloud biology and the ability to produce biological products from the screen of a computer. However, given that many biological experiments are bespoke, Synthego chose to focus on automating one particular task: CRISPR gene editing. Instead of focusing on automating every task, the lesson of Synthego’s success is to identify the most valuable experiments and automate just one:

Editing - Synthego

Fermentation - Culture

Single-cell preparation - 10X

Transfection - Indee

DNA synthesis - Twist

mRNA manufacturing - Nutcracker

Organ-on-chip - Emulate

Synthego has been able to get scale for a particular experiment. The most valuable business model would be to point this automation engine toward drug development. However, the talent in software design and automation engineering right now doesn’t overlap with biology and drug talent. So Synthego and similar companies use their scale to compel companies with experience in drug development and other fields to partner to get access to better economics. Over time, Synthego can automate other experiments as they become tractable. The company can create a model similar to an assembly line, and they might be able to make products internally, but this is a question of culture and focus like most platform businesses. If Synthego can continue to scale up and automate gene editing and other experiments, they can move toward black box drug development where a hypothesis is sent to an automation platform and valuable hits are received.

Key findings

Synthego’s timing was impeccable to focus on automating CRISPR gene editing; the market was just getting started allowing the company to gain a significant share early and use the company’s integration to rapidly improve it kits surpassing competitors.

CRISPR and PCR each enabled new business models - Synthego from the former and companies like Bioline from the latter. PCR-driven models ended up becoming commodities with little pricing power. What’s potentially changed for Synthego is the use of software to version its kits maintaining pricing power and giving the company the potential to get economics on drug development programs.

Technology

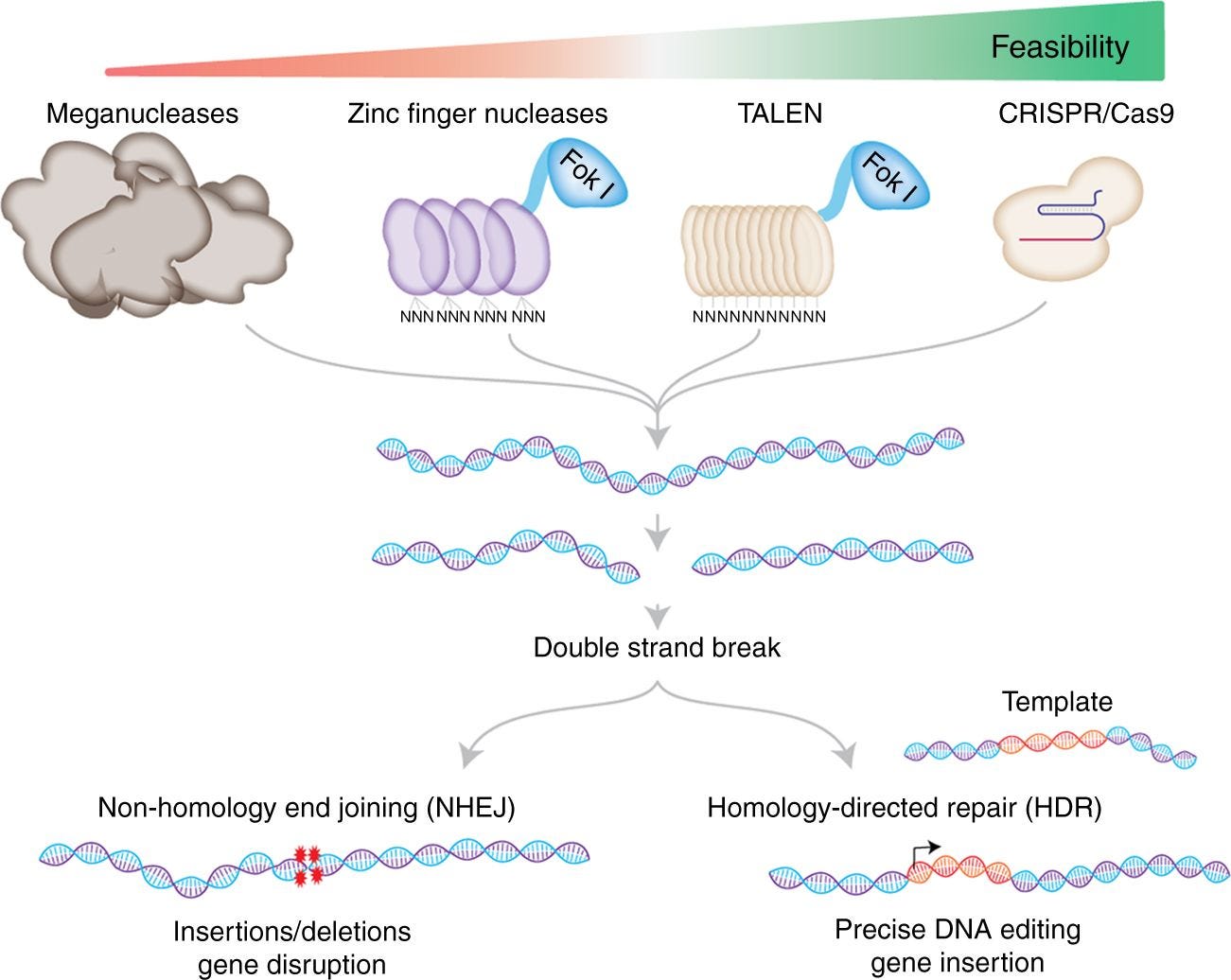

CRISPR(clustered regularly interspaced short palindromic repeats) is a major breakthrough in gene editing improving the usability and decreasing the costs by at least an order of magnitude (image below). Past technologies had bottlenecks around delivery, cost, accuracy, and general complexity. From personal experience of cloning a TALENs for over a year probably costing thousands of dollars in reagents, a CRISPR construct can now be built in weeks for a few bucks.

CRISPR is a bacterial defense system against viruses. A guide RNA (gRNA) docks with the Cas protein. The gRNA can effectively bind almost any site of the genome and can programmatically bring the Cas protein to a particular gene for a cut and repair to occur so a genetic change (i.e. base change, insertion) is achieved. Jill Banfield generated the data set for Jennifer Doudna and Emmanuelle Charpentier to do the initial work to develop CRISPR as a programmatic tool with Feng Zhang leading the way along with so many others to expand the gene editing toolkit. Now with CRISPR variants beyond Cas9, the system is used to modulate epigenetics and the 3D genome, monitor live cells, and regulate gene expression.

Source: Nature

The ability for almostanyoneto editany genehas transformed scientific research and is changing human health, agriculture, and industrial biotechnology. Synthego was founded the same year the seminal CRISPR papershowing gene editing use was published. So it was only natural that the founders would identify CRISPR gene editing as an experiment to automate and scale up. Whereas similar business models are formed around an internal invention, Synthego was in the right place at the right time to start the company when one of history’s most important scientific breakthroughs was made. As the CRISPR field grew at an extraordinary pace, Synthego massively benefited from the growing sophistication of the gene editing toolkit and increasing demand for it.

For CRISPR gene editing, there are 4 main parts (image below):

Software design of the gRNA

Manufacturing of the gRNA

Delivery of the gRNA and Cas protein into cells

Verification of the edit

In 2012 and 2013, success rates for CRISPR were fairly low probably around 10% (anecdotally). This was mainly due to these 4 parts not being optimized properly like many early inventions. As more work was done, success rates have gone up modestly 2x-4x. However, Synthego has been able to get success rates of 80%-90% albeit charging a substantially higher price to customers. In addition to higher success rates, Synthego integrates the various components of gene editing into one kit. Most of the time, a biologist would have to source the various reagents themselves and do the validation internally. This might work for a rotation project but as the success of the experiment becomes more important for a lab or a company, having a ready-to-go kit is incredibly valuable.

Initially, the prices of Synthego’s kits along with the relatively small CRISPR market made the company appear commodity-like. What types of economics could Synthego achieve in a margin-thin lab reagent market? Where would CRISPR gene editing be valuable? How far could it surpass other techniques? Synthego took an important position that CRISPR gene editing would be the predominant method for research and drug development. In 2012, by targeting a small market with a lot of potential where the use cases were not completely mapped out, Synthego set off to build a design and production platform for one experiment: CRISPR gene editing. Now ~7 years from then, the company’s expertise in automation has been the competitive advantage that is setting Synthego’s kits from other lab reagent companies. By fully integrating design, manufacturing, delivery, and verification, the company has been able to rapidly version guide RNAs and its kit in general. Even though companies like Thermo may be able to undercut on price, Synthego has the ability to offer a continuously improving product to earn the right to charge higher prices; the hallmark of any great business - pricing power.

Now being in the enviable position of having the capability to do a CRISPR gene editing experiment better than anyone, Synthego has massively benefited from the refinement of the toolkit from academic labs and other companies. The therapeutic potential of this tool is the most exciting for human health and Synthego’s business model ranging from delivering CRISPRto cure disease to engineering cellular therapies.

Source: Synthego

Market

For lab reagents, gene editing, inclusive of CRISPR, zinc finger nucleases (ZFN), transcription activator-like effector nuclease (TALENS), and meganucleases, probably generates around $2B-$3B today. This is based on going through the various financial statements of the large companies (i.e. Thermo Fisher, Genscript) offering various kits or services. The growth rate of the market is much harder to pin down. Various reports claim the market size will be anywhere between $10B-$20B in about 5 years. It is just too hard to tell how large gene editing can become from here. This works in Synthego’s advantage because there is new market share to capture. Traditionally, when a new use case emerges or becomes accessible in a market, the size of it becomes much larger than expected. CRISPR is enabling entire new capabilities to edit genes that are allowing new therapies to emerge and new discoveries to occur.

The most promising market for CRISPR and Synthego is therapeutic development. Since the discovery of CRISPR gene editing, companies (i.e. Editas, Intellia, Scribe) focused on commercializing the technology have raised many billions of dollars. This activity is premised on the potential to cure genetic disease worth something in the $10Bs maybe $100Bs, develop new cell therapies, and beyond. Where Editas and Scribe focus on internal development, Synthego is using its automation engine to potentially power these drug programs. So instead of taking the risk of internal development, although it would be exciting and much more lucrative for the company to hire their own drug development team, Synthego automates the most important experiment for these companies to accrue value in these very large drug markets.

Business model

Synthego is using automation to create a unique life sciences business model. Older models to study are Invitrogen, Life Technologies, Bioline, and in general the proliferation in use of polymerases and invention of polymerase chain reactions (PCR) during the 1980s/1990s. Compared to then, what’s changed is the increasing power of software and automation. Synthego can make new mistakes where its expertise in automation helps its kits maintain its pricing power. Past models premised on one or a few experiments over time veered toward commodity-like prices.

Synthego has been able to build a fast-growing kit business that is hitting a major inflection point. The company has been able to engage in two main partnerships to distribute its product to more customers. Going direct-to-consumer (DTC) is ideal for Synthego is minimize SG&A costs; however, the reality of scientific research and drug development requires the company to work through pre-existing channels such as lab reagents providers and contract research organizations (CRO). The next major step would be to close development deals with therapeutic companies. Moreover, similar to Atomwise and Distributed Bio, Synthego could generate a lot of value by working with Charles River or an equivalent CRO.

Synthego & Eurofins (11/2018)

Distribution deal for Synthego’s synthetic guide RNA products for CRISPR genome engineering.

Synthego & Thermo Fisher (10/2017)

Distribution and supply deal for Synthego’s products.

On the premise that most value accrues to a therapeutic in at least the American healthcare system, Synthego is pointing its platform toward drug development from target identification to approval (image below).

Source: FDA