Build with Axial: https://axial22.axialvc.com/

Axial partners with great founders and inventors. We invest in early-stage life sciences companies such as Appia Bio, Seranova Bio, Delix Therapeutics, Simcha Therapeutics, among others often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

A great way to find compelling startup ideas is to ask: What do other companies enable? Technology both solves and creates problems. Case studies are powerful tools to uncover these opportunities.

F-Star Therapeutics

F-Star Therapeutics arguably has the best bispecific design platform in the world. Founded in 2006, F-Star’s platform is based on Florian Rüker’s work out of Austria. The platform is focused on combinatorially engineering Fc regions to develop antibodies with new binding capabilities and invent bispecifics with manufacturability similar to monoclonal antibodies. This technology helped F-Star raise around $200M in non-dilutive capital building one of the best bispecific engineering platforms in the world.

The company went public in November 2020 through a reverse merger without much fanfare from bankers and other promoters. In the past, the company had executed deals with companies like Denali, AbbVie, Bristol Myers Squibb, and Merck KGaA. More recently, F-Star closed out a deal with Janssen. F-Star’s legacy business model focused on partnerships. Their alpha, beta, gamma, delta NewCos were used to house certain assets and options to acquire them for specific partners. Around 2019, F-Star decided to focus more on its internal pipeline, which is logical given owning a majority of a drug is a lot better than having a ~5% royalty. F-Star is a case study, and an opportunity, of a platform with a lot more value than its pipeline.

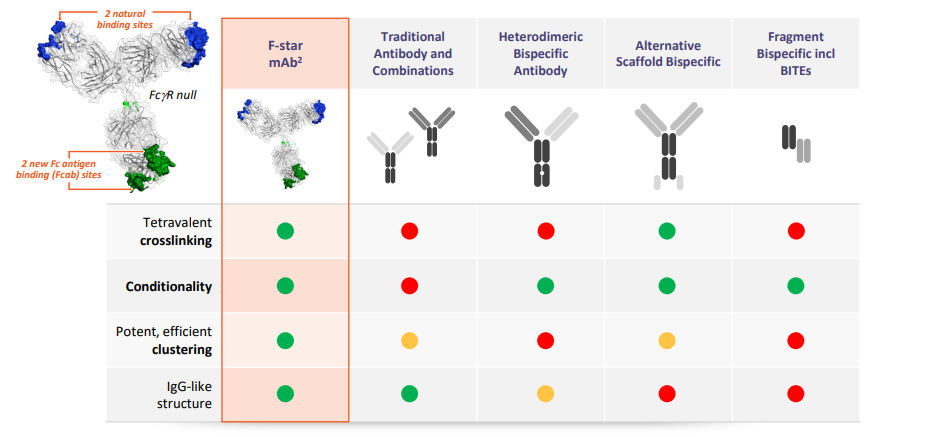

F-Star calls its platform, mAb², which introduces new antigen binding sites to the constant regions of an antibody. The company calls these new binding sites Fcab, or Fc domains with antigen binding ability and with the original antibody binding domain, this allows an antibody to bind 2 different antigens. The technical premise is that this tetravalent format enables bivalent binding for each target, versus monovalent found in other bispecifics, which leads to stronger target engagement and possibly better responses. This approach allows F-Star’s biologics to maintain the “3Cs” while retaining the structure of a monoclonal antibody. The latter is done by keeping ~95% of the Fc antibody format helping with biomanufacturing, scaling, and minimizing immunogenicity risk:

Crosslinking - a bispecific engages two targets to bring them closer together either on one cell or bringing two cells in closer proximity. An example is using a bispecific to engage a T-cell and a cancer cell to recruit more T-cells to the tumor site.

Clustering - certain receptors are activated when in closer proximity to other cell-surface proteins. A bispecific is a useful tool to do this.

Conditionality - immune responses are often only activated when two targets are turned on. A bispecific can simultaneously engage both to conditionally activate an anti-cancer immune pathway.

Due to the modular nature of F-Star’s biologics, and antibodies in general, the company has generated a valuable library of Fcabs. These building blocks can be mixed-and-matched with other antibody scaffolds during the drug development process to find which target pairings are effective for a given disease. This is only possible due to F-Star’s focus on minimizing the modifications made to an Fc domain.

For bispecific technologies in general, there are 3 main platforms: CrossMab (Roche/Genentech), DART (MacroGenics), BiTE (Amgen). Numab has really interesting technology as well - they’ve invented a tool called lambda-cap to generate highly stable Fv fragments. This enables the company to easily graft complementarity determining regions (CDRs) into any model.

The first bispecific technology, Quadroma, came out during the 1980s. It relies on fusing 2 hybridoma cell lines to merge distinct heavy/light chain pairs. This process was really messing because 16 different combinations of a bispecific can be generated from the 2 heavy and light chains. Over the last few decades, protein engineering has become more and more sophisticated. Enabling the specific pairing of certain chains and for F-Star, pretty seamless mixing and matching with minimal modifications.

F-Star still needs a lot more time and has a lot of work left to do for clinical validation. BiTE has an approval and CrossMab and DART have several candidates in the clinic. In short, F-Star’s technology generates building blocks for technologies like BiTE and CrossMab:

CrossMab, one could argue this is the best bispecific technology in the world given its history and advantages around stability. The technology is centered around a knob-into-hole premise to engineer the chains of different antibodies to bind each other (i.e. simply changing amino acids to create a hole and another one to bind it). The key part is to avoid chemical linkers which could lead to aggregation and poor stability. The tradeoff here is to reduce potential complexity of a CrossMab.

BiTE has a clinical approval with Blincyto. The format relies on a single polypeptide chain to bring different fragments together - this increases antigen recognition but could lead to higher rates of aggregation.

DART = dual-affinity re-targeting antibody. A DART biologic is created from switching VH domains from 2 Fv fragments. The premise is that this process creates an interaction that is found within the larger IgC molecule and leads to lower rates of aggregation.

VelocImmune from Regeneron. Although not completely focused on bispecifics, it is a world-class technology to produce fully human antibodies in vivo.

On one side, minimal engineering is the value prop to avoid potential toxicity issues later in the clinic. On the other side, complex engineering creates a zoo of biologics to choose from. F-Star has a technology a layer above all 3 of these platforms: Fcabs can be interchanged with existing biologics or used to create new ones, they can be used as monospecific antibodies themselves, and even be used in ADCs. Bispecifics are also being found to help re-engage CAR-T cell therapies and increase the efficacy of past treatment regimens. There are a ton of opportunities to map out platform technologies in biotech and build on top of them rather than compete directly.

F-Star got started in an era of capital scarcity in biotech. On a side note, 2022 is a massive slowdown that probably persists for at least a year, but overall, the fundamentals point to substantial growth over the next decade. So F-Star’s original business model emerged from an era of scarcity and consequently was focused on capital efficiency: housing assets into different vehicles to enable different types of liquidity. Despite the slowdown in biotech, there is an emerging opportunity to use platforms to create ecosystems. F-Star, and new companies as well, to do something similar for bispecifics. There are also similar opportunities in mRNA, AAV promoters, and non-traditional hosts right now.

This initial analysis on F-Star uncovers an interesting problem of linkers for biologics. Ideally, you would avoid using one. That’s the value prop of CrossMab and somewhat for F-Star.

Praxis Precision Medicines

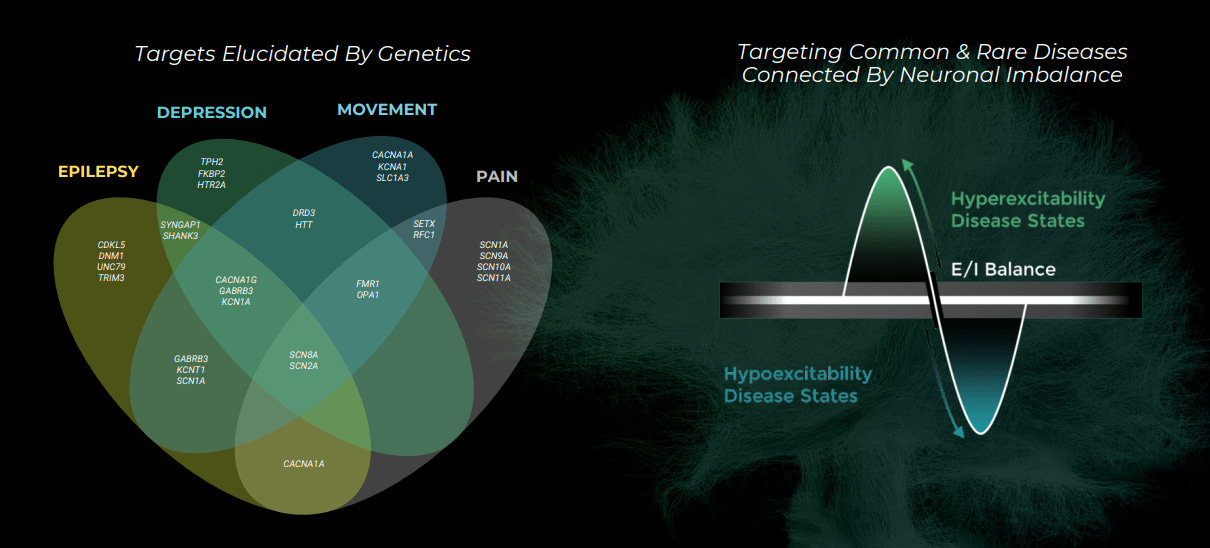

Praxis Precision Medicines is working to bring precision medicine to central nervous system (CNS) disorders. The company was founded and funded by Blackstone in 2016, originally as EpiPM Therapeutics, after the epilepsy research consortium with the same name and based on the work of David Goldstein and Steve Petrou. The biological hypothesis early on was using large-scale genomics to identify genes that control the excitation and inhibition of neuronal brain circuits across a wide range of CNS disorders. From this work, the company discovered new druggable, binding sites on the GABA (technically it’s the GABAa receptor) neurotransmitter. This work led them to identify and license a drug candidate, a positive allosteric modulator of GABA, from Purdue Pharma focusing on major depressive disorder (MDD) and perimenopausal depression (PMD).

The company’s main theme for its pipeline is drugging neuronal imbalance. Normal brain function requires the balance between excitatory and inhibitory neurons. CNS disorders often emerge when this balance is disrupted. Praxis uses its genomics platform, centered round sequencing, transgenic animal models, and electrophysiology tools, to find genetic mutations that influence the excitation-inhibition imbalance in depression and other neurological diseases. The company has a diverse pipeline, by stages, and it’ll be exciting to see how their clinical readouts come out. Their approach also has the potential to merge neurodegeneration with neuropsychiatry and start bringing precision medicine to diseases like Parkinson’s and Alzheimer’s

However, Praxis is an interesting business to study mainly for its platform and its approach to drug development. Anchoring drug development programs around human genetics may lower costs, not by increasing predictive power but efficiently getting to a go/no decision earlier in clinical studies. Powering this premise is an incredibly powerful concept of genetic dose-response curves = finding common and rare variants associated with the same disease where they just have a different magnitude of effect on phenotype. So a set of genetic variants can have different magnitudes of effects on a phenotype: one variant leading to a 2x increase in expression while another one leads to a complete knockout and everything in between. If the genetic architecture of a disease can be mapped out, perturbing the function of a target and assessing phenotype, genetic dose-response curves can be generated and act as useful and cheaper surrogates for potential drug efficacy. They can also be used to identify biomarkers for early preclinical and maybe clinical work.

The key experiment here is mapping out the allelic series of a given gene. Doing some sort of systematic knockout screen in cell lines can first uncover where a gene has variants with substantially different functional effects. If so, a dose-response curve can be generated. This work is likely more productive for complex diseases with genetic types not strongly selected against. Cardiovascular, IBD, metabolic disease, neuro, among others. With these curves, sequencing data can be translated into function-phenotype atlases. For example, when the link between heart disease and cholesterol was discovered from large-scale epidemiological studies around the 50s/60s, rare populations uncovered the connection between certain variants in the LDL receptor gene and coronary health risk. The higher the number of LDLR alleles a patient had all the way to a full knockout, the higher risk of heart disease. This genetic dose-response relationship set up the development of statins. Excitedly, there are many more clinical trials of nature like this laying around in biology. Large-scale genetic studies need to be combined with high-throughput validation to measure the phenotypic effects of genetic variants.

This unveils the need for a federation of biobanks. There are millions of patient samples across biobanks around the world. With the dramatic reduction in the cost of genome and exome sequencing and the increased access to patient registries and longitudinal databases, Praxis and other companies could take in this data and generate dose-response curves identifying high quality, disease-causal genes. There is a need to focus on diverse ancestries - Omica is in the lead here for LATAM. The second opportunity is harmonizing data (genetic, clinical) across the global network of biobanks. Standardizing diagnostic codes, medical histories, physician notes, and even self-reported patient data need to be structured all together. Once this is done, genetic and phenotypic relationships can be more efficiently mapped out. This sets up a need for new tools to enable scale and patient privacy. Federated learning with companies like Owkin in the mix could make a large impact on tying together various biobanks and enabling others to generate more genetic dose-response curves.

Once patient data can be structured and processed, dose-response curves can allow a rare-to-common drug development strategy and possibly make the entire process a bit faster. The challenge will be that most genetic variants are in non-protein coding regions and an allelic series probably can’t be generated most of the time. Dose-response curves also might be dependent on the cell type used for screening. Even then translation into animal models and humans might be challenging. But the value of having a set of curves will massively unlock the value of biobanks and all large-scale genomic studies. Going from patient genetic data into atlases that can quickly determine if a candidate is likely to have a pharmacological effect in humans. But these models are more valuable to determine which programs to end, or deprioritize, earlier on in a development program.