Guardant Health is one of the canonical case studies on how to design a diagnostics business that can potentially generate drug-like economics. With the basis of monitoring cancer development across every stage, Guardant is transitioning over time to developing new medicines likely with a partner. Whereas most diagnostics companies suffer from mediocre economics over time as competition increases mainly because the moats of diagnostics businesses are not strong other than scale (i.e. Quest, Danaher), Guardant is using the model to garner economic deals similar to a drug company. With the underlying platform mapping out patients’ entire experience with cancer, Guardant could potentially version new medicines.

Founded in 2012 by Helmy Eltoukhy, Guardant has been driven by scientific integrity. Eltoukhy was originally an electrical engineer who started doing work on sequencing at the Stanford Genome Technology Center ultimately co-founding Avantome, which was acquired by Illumina about a year after founding. With this exit and some experience at Illumina, Eltoukhy founded Guardant with an even larger vision.

Key findings

Success in preventative diagnostics and therapies is driven by validating technology for late-stage disease then transitioning to early-stage to gain clinical credibility and build out a robust biobank.

By focusing on a new analyte and diagnostic workflow, Guardant has used its beachhead in liquid biopsies to get in the position to get drug-like economics.

Technology

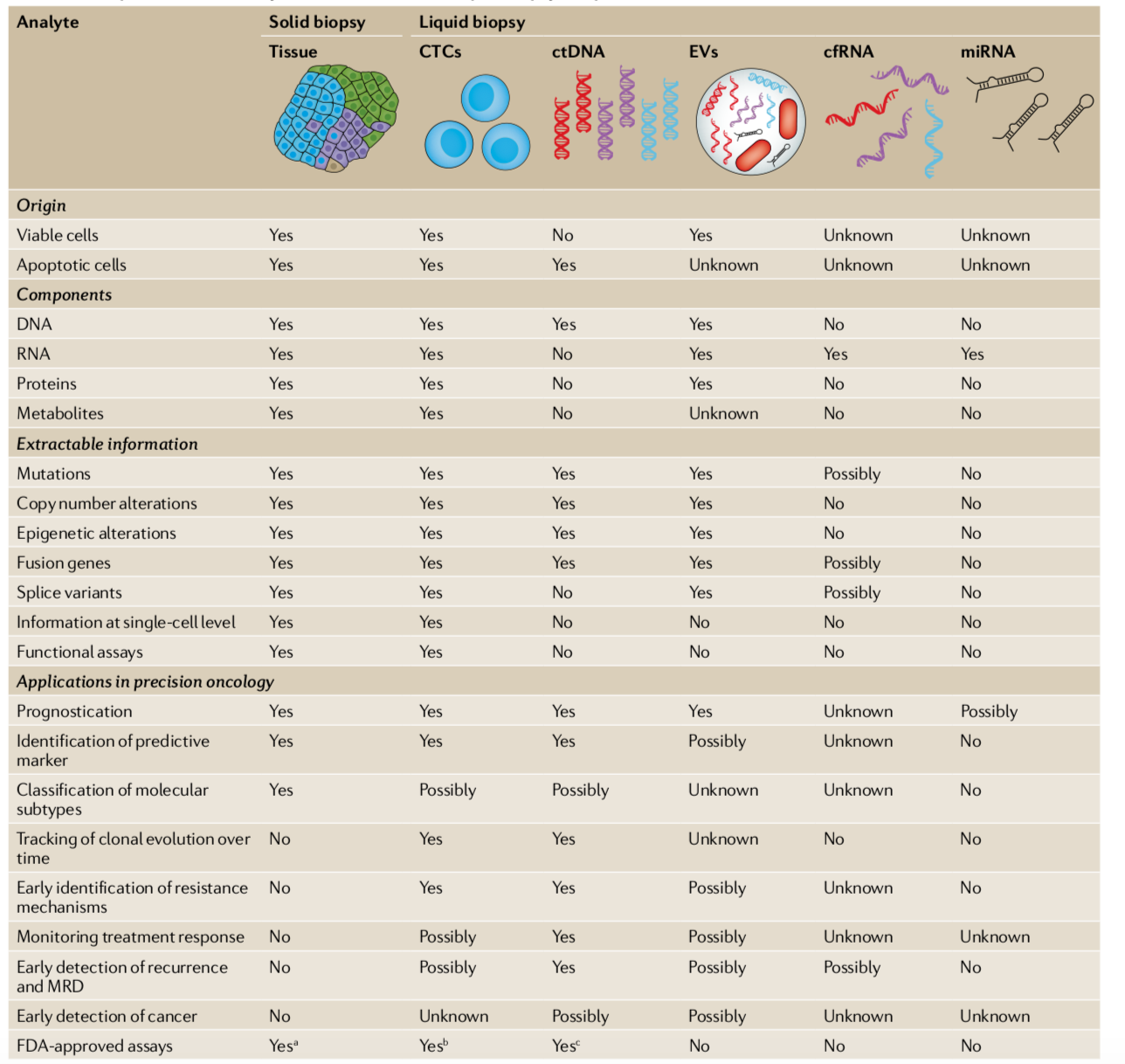

Liquid biopsies are diagnostic tests that monitor a disease from a blood draw instead of a tissue sample (image below). Guardant chose to point the power of sequencing to measure circulating cell-free DNA (cfDNA) at a time where isolating circulating-tumor cells (CTC) was seen by some as a more promising route. cfDNA is highly fragmented DNA in the blood emitted by dead cells where somewhere around, depending on stage, 0.01% of it is from a tumor. The ultimate vision is to use a liquid biopsy to prevent cancer before it develops; however, the technical challenges to create such a test was almost impossible when Guardant was founded. Instead, the company chose to focus on late-stage cancer when cancer-derived cfDNA is in higher concentrations in the blood then transition into early-stage cancer and hopefully prevention. The key measurement of test improvement was specificity to enable earlier and earlier detection (on average, sensitivity in diagnostics is a little overrated). For liquid biopsies and any test relying on next-generation sequencing (NGS), maintaining clinically-useful specificity at detection levels below a 1% is incredibly difficult.

Source: Nature

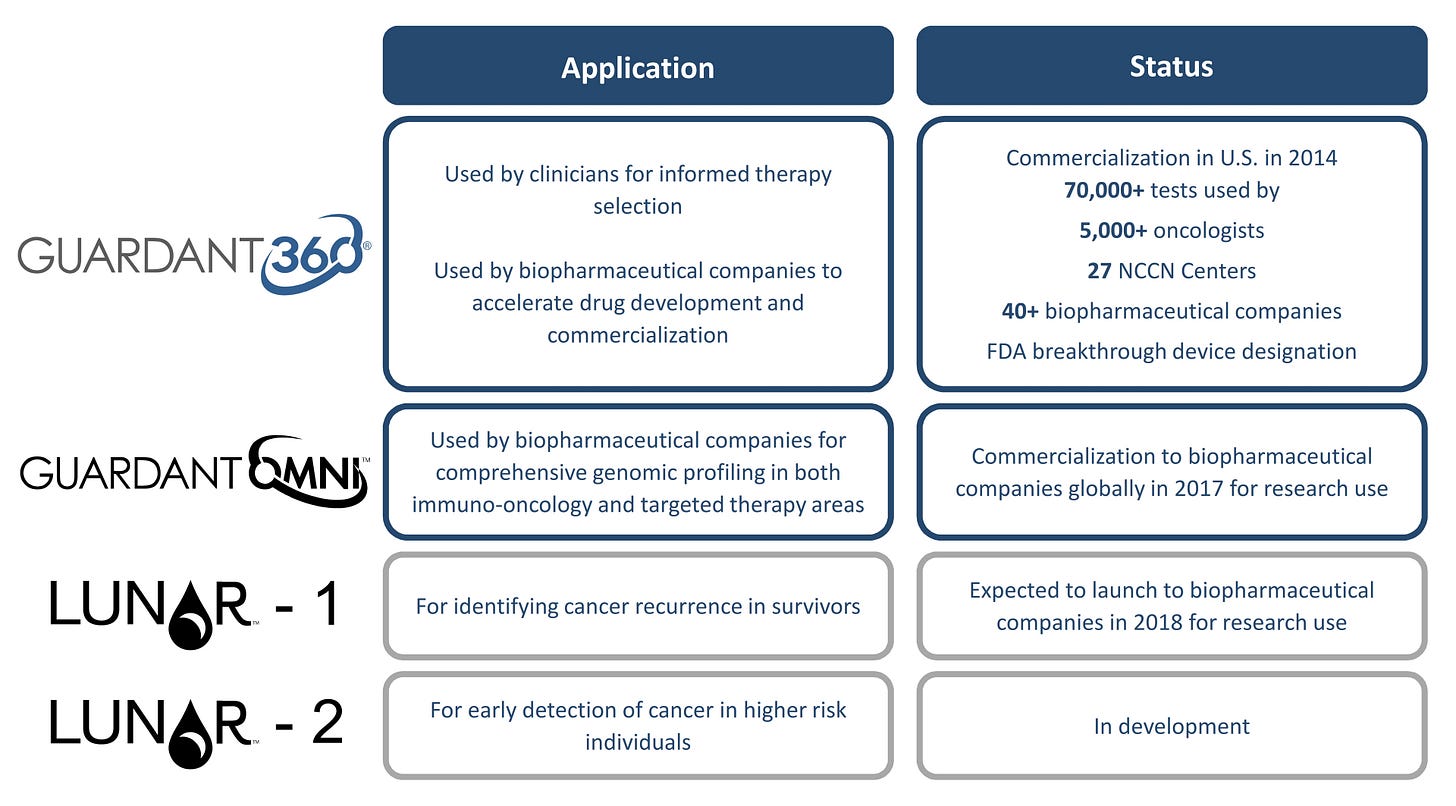

First Guardant built out an integrated sequencing platform (image below) to measure cfDNA at scale and generate useful data at the low detection rates of cancer cfDNA. Guardant’s first product is called Guardant360- initially focused on patients with advanced-stage solid tumors. The test measures 73 genes with a turnaround time of 7 days where tissue biopsy with around 2 weeks. The data showed a specificityof over 99% and a sensitivity of 85%, which changed a little bit in clinical use and later doing a retrospective studyto validate the product. The test has had success for solid tumors that are difficult to assess by tissue biopsy and when a previous test did not identify actionable mutations. A point to be made is that the test did not try to replace an existing test that drives revenue to a physician; instead it focused on solving a problem that tests were not currently addressing. As a result, since launching in 2014, Guardant360 has had over 100K tests ordered from over 6K oncologists and across over 50 clinical trials. Recently, the test has been able to show the ability to be a front-line test for non-small cell lung cancer (NSCLC). The NSCLC data was shown to be competitiveto conventional tests expanding the 360 tests into more indications.

Source: Guardant Health

The next product for Guardant was called GuardantOmni. The product is a 500 gene panel covering over 2 MBs focused on immuno-oncology (IO) and targeted therapy development with predictive value of over 97% for each of the 4 markersof importance (SNVs, indels, CNVs, and fusions). Guardant developed the test with both Mercks, Pfizer, AstraZeneca, and Bristol-Myers Squibb. The test focuses on measuring tumor mutational burden (TMB) in order to determine which patients will respond to a drug and which ones will not.

Where Guardant360 is focused on late-stage cancer and Omni is the companion test for drugs, the company has began the shift toward early-stage cancer, which they call Lunar. Launched in 2016, the Lunar product was split into 2 programs:

LUNAR-1 - tests for recurrence monitoring; focusing on colorectal cancer and NSCLC:

Source: Guardant Health

LUNAR-2 - tests for early detection; focusing on colorectal cancer:

Source: Guardant Health

The Lunar programs are only possibly due to the 360/Omni tests that validated the platform. However, new problems for Guardant emerge to detect early-stage cancer from a liquid biopsy. This is where the underlying sequencing process and machine learning (ML) ought to help. For the former, ensuring an accurate sequencing workflow to minimize biological noise is incredibly important. The latter, the Lunar tests are integrating genetic markers with epigenetic signatures to try to cancer cfDNA at the 0.01% concentration. There are a few other companies relying on machine learning to improve early detection, but most of them do not have the biobank Guardant has. For liquid biopsies and biology in general, machine learning has a hard time delivering real value due to biology’s high dimensionality. ML becomes powerful if the number of observations in a data set greatly exceeds the potential features. Biology has a lot of potential features setting the bar much higher to measure a lot of patients/events. Whereas language-recognition has millions of labeled objects and maybe a few thousand features. For Guardant, the number of patient samples are in the 10Ks right now and the number of biological features to measure, both genetic and epigenetic, are in the millions maybe billions. This could lead to overfitting from machine learning models for a liquid biopsy. Machine learning for biology has a lot of room to improve especially around data management (i.e. feature selection, regularization) and improving the models themselves.

With these 4 major products, Guardant is building an incredible moat with its biobank of patient samples. With 10Ks of samples, the company is in the powerful position to validate new targets where most can only do discovery and drive new medicines for cancer patients across all stages. Ultimately, the underlying technology platform and how Guardant has validated it over time allowed the business model to play out like it has.

Source: Guardant Health

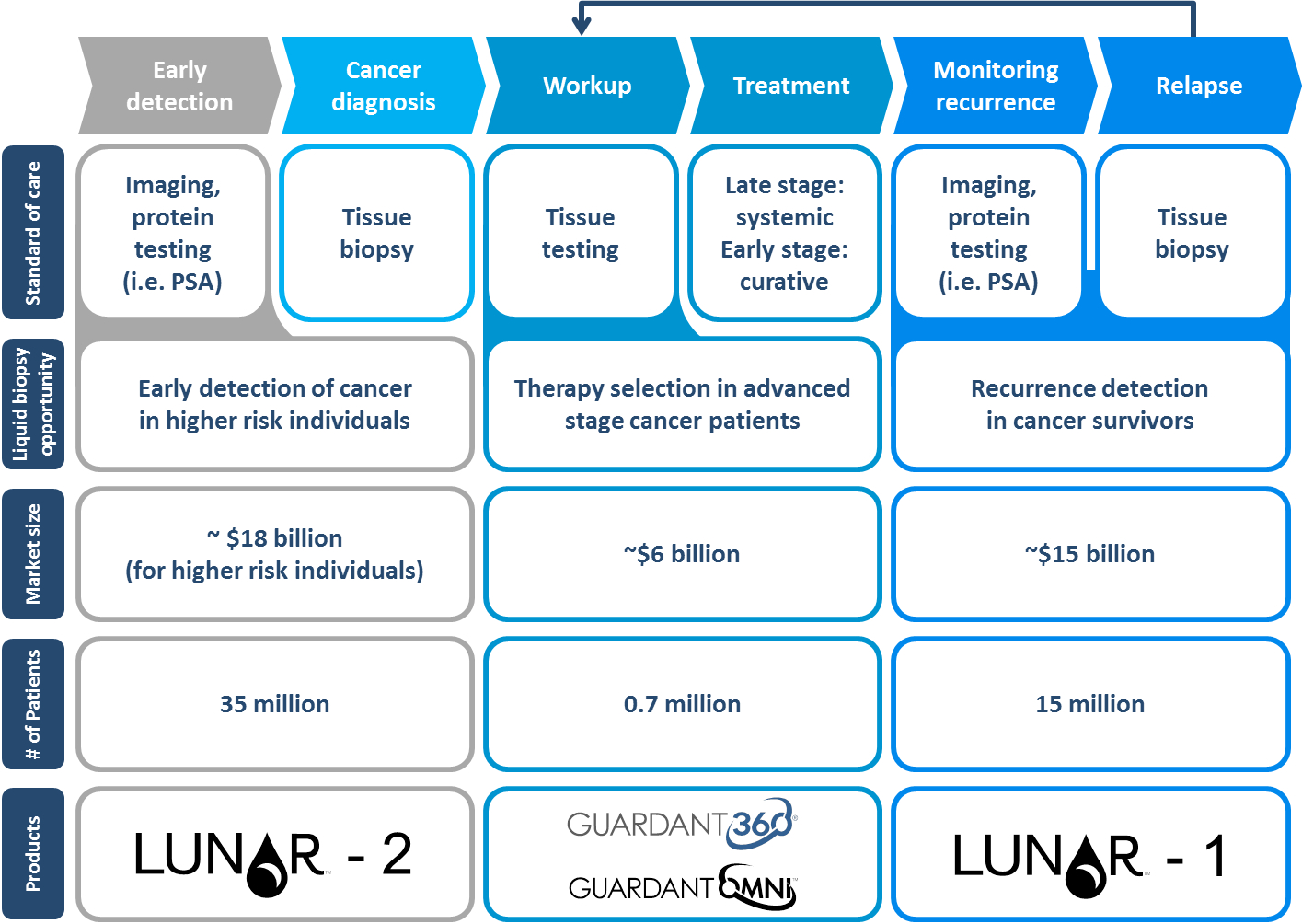

Market

Guardant’s 360, Omni, and Lunar products pursue markets worth $10Bs. Many diagnostic tests are focused on one indication in one setting limiting the opportunity. Guardant’s tests focus on measuring various genetic markers then connecting them to indications allow the 4 product lines to have broader applicability. When compared to tissue biopsy, Guardant’s tests can increase the number of patients who can get a test. However, despite the obvious advantages of liquid biopsies, the healthcare system has incentives to want to keep the expensive and risky tissue biopsies. Guardant avoided markets where incentives will not allow fast liquid biopsy tests (i.e. prostate cancer) focusing on indications where success can be achieved. This has allowed Guardant’s platform to be validated and be in the position to own more of the market as the broader incentives begin to shift toward value and outcomes. The image below from Guardant does the best job explaining the market opportunity in the context of physician workflow:

Source: Guardant Health

Source: Guardant Health

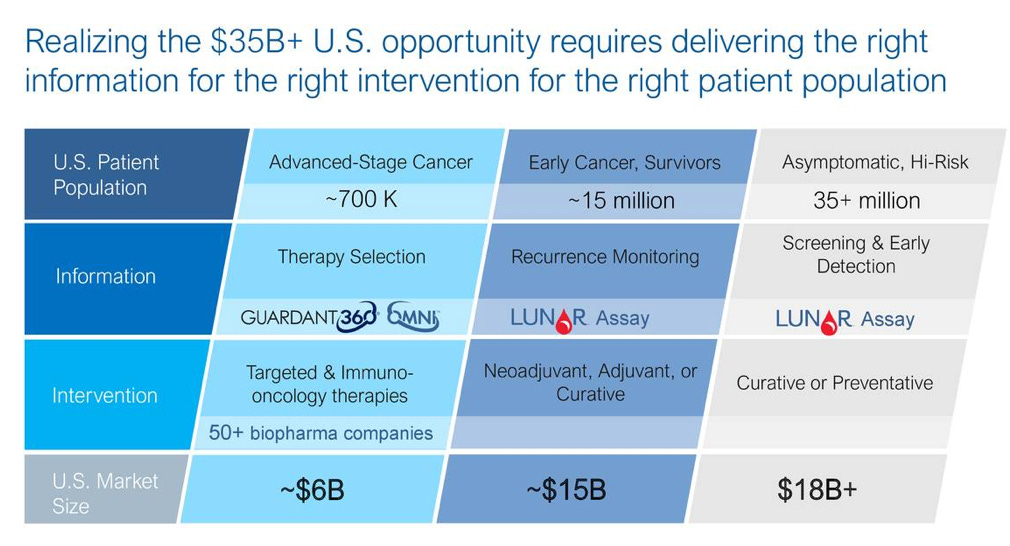

Over the next decade, the large opportunity for Guardant is moving toward therapy selection and development. The ability to profile the genomic state of a cancer patient and build out a data set of states at scale can enable Guardant to validate new targets. The opportunity to ultimately create medicines like cancer vaccines and IO drugs pursuing markets in the $100Bs. An example for Guardant would be using its 360 test for NSCLC and the Omni test to help make a better drug. There are many genetic variants driving NSCLC (SNVs, indels, CNVs, and fusions) that are FDA-approved as biomarkers. Guardant can help match patients with predictive variants to a biopharma partner’s own drug. Given that NSCLC has biomarker-driven use already embedded in it, Guardant can expeditiously validate a new combination of markers to drive either internal- or co-development of a new drug that beats out existing ones.

Business model

The initial business model to focus on late-stage solid tumors was the beachhead for something much larger. The core business generated $90.6M in revenue in 2018 compared to $49.8M a year earlier and is on track to earn over $148M for 2019. This growth is being supported by owning a market with a tractable problem expanding out in more difficult problems from 360 (late-stage) to Lunar (early-stage). Another key aspect of the Guardant business model that worked that others have executed on as well (i.e. PatientPing) is to slowly roll out their test to providers. Given liquid biopsies are an entire new workflow for clinicians, validating the 360/Omni profiles at ever large scale have lent Guardant a lot of credibility within the medical community and built up a powerful moat of goodwill many other diagnostic companies do not have:

Source: Guardant Health

By designing products that are used widely and can easily be integrated into physician workflows, Guardant has an improving set of information to help biopharma companies with their drug discovery and development programs. Once again Guardant has created a figure that conveys the opportunity much better than a few paragraphs can:

Source: Guardant Health