Axial - Distributed Bio

Surveying great inventors and businesses

In series with surveying AbCellera, Distributed Bio is an equally great business. Given its mission and technology, Distributed is one of the most important life sciences companies right now. Axial seeks to partner with companies like this that are centered around great inventors and frugalness. Although the revenue for Distributed is a little harder to pin down (likely in the same range of AbCellera), the amazing part of Distributed is that they did not raise venture capital. The founders bootstrapped the company out of their apartment and created an incredible company. Not only is Distributed impacting the lives of patients with a wide set of medicines, the company has the strongest technical moat in the antibody discovery field.

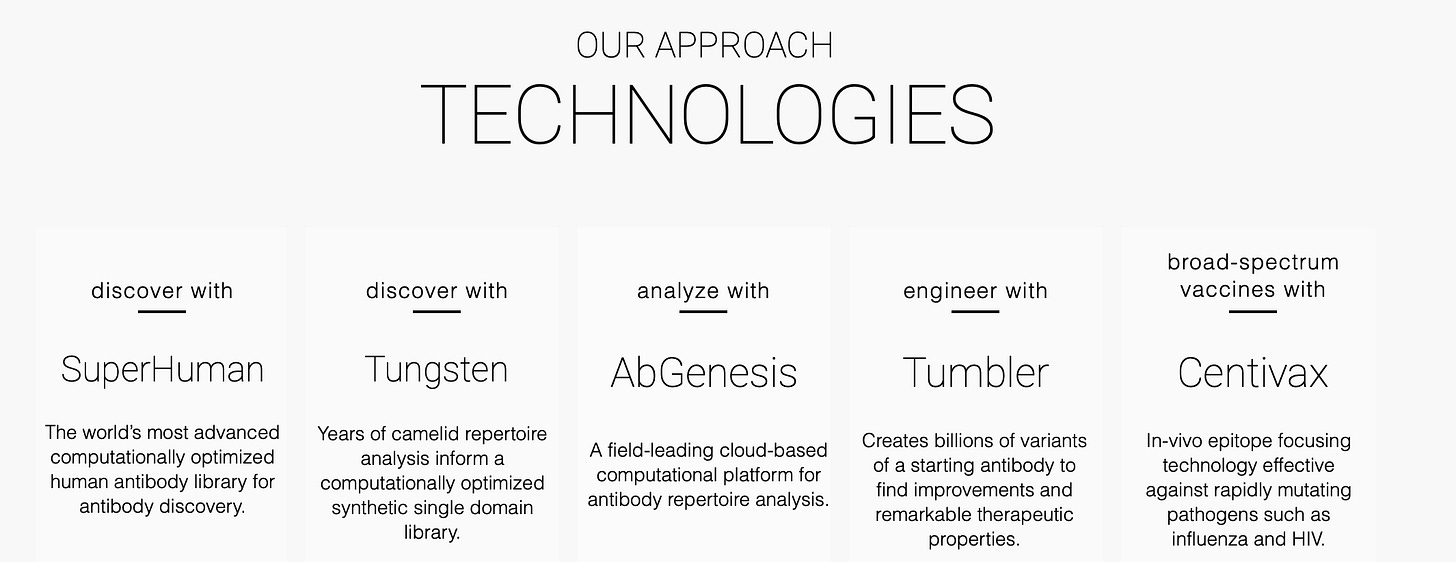

Distributed was founded by three individuals - Giles Days, Jacob Glanville, PhD (publishing machine), and Chris Smith. Whereas AbCellera was premised on a microfluidic technology, Distributed was formed around a computational engine. With a market measured in $100Bs and high clinical demand, the industry can support multiple large businesses. In particular, antibody discovery has 4 main features (market incentive, generic competition, clinical productivity, and new technologies) to enable unique transactions. Distributed not only is able to license out antibodies similar to AbCellera but has been able to license out its technology. Because Distributed is premised on computational immuno-engineering, the company has been able to create a truly unique business model that can go beyond antibodies into cell therapies and other modalities:

Source: Distributed Bio

Key findings

The most exciting life sciences platforms are those that connect the predictivity of one experiment to the next. This allows a company to benefit from technical compounding over time.

Software can enable updatable licenses in antibody discovery and maybe in drug development and life sciences in general. The ability to update a license, product, or subscription, gives a business a high level of pricing power.

The initial conditions (i.e. first 90 days) of a company often determine the type of culture and work environment created.

Software companies in drug development ought to pursue partnerships with CROs as part of their business development strategy.

Technology

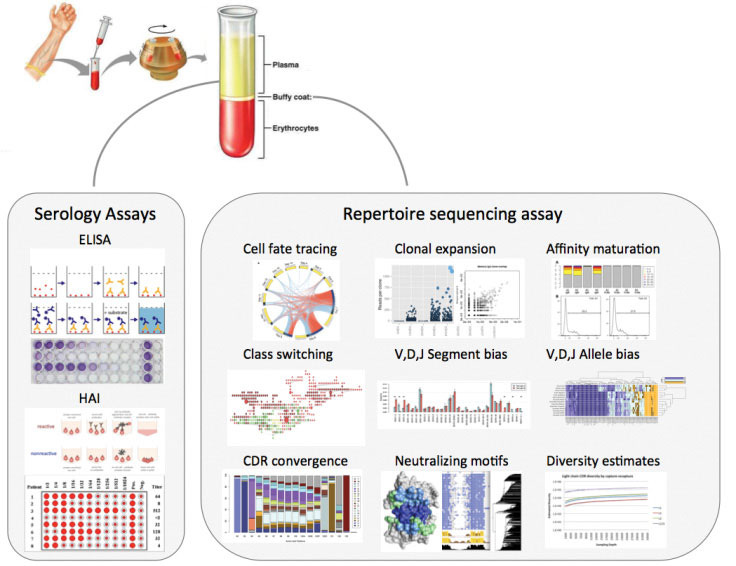

Distributed started off as a pure software company transitioning toward licensing now onto co-development and internal development. The first product was called AbGenesis, which allowed customers to analyze antibody repertoires within next-generation sequencing (NGS) data sets. The initial problem Distributed solved was around filtering antibodies from the data into functional groups based on affinity maturation and other features. Before the product, many of Distributed’s customers did not have the expertise to properly analyze their antibody libraries. Within a few years, the company was able to acquire over 30 customers. With this early revenue, Distributed started a lab and used their capabilities enabled by AbGenesis to create an antibody library. With this proprietary library called SuperHuman that now has well over 80 billion antibodies in it, Distributed has been able to structure really unique, updatable licenses. Initially, the combination of AbGenesis and SuperHuman created an increasingly powerful moat where the set of experiments (image below) improved over time with each run. This continuous improvementhas allowed the company to run away from the pack for identifying binders, measuring antigen responses, and increasing true library diversity:

Source: Distributed Bio

Distributed has been able to combine various computational methods into one pipeline and analyze experiments at scale. The SuperHuman library is optimized for sequence diversity and function (expression, immunogenicity, tolerance, specificity) through analysis of the thousands of human antibody repertoires Distributed is collecting and every past experiment involving antibodies. Each time Distributed does an experiment, the library gets a little better. Now the SuperHuman library is at a scale and diversity where the company is able to generate thousands of therapeutically relevant hits for each target a customers sends over. Over time, what’s exciting now is the target library Distributed is building up where they will be able to engineer antibodies in combination with engineering antigens (i.e. targets). With this technical basis, the company has set off to create universal vaccines (mainly through Centivax) and pursue hard-to-drug targets like GPCRs and ion channels.

Timing as well as value are incredibly important for any business or investment. Distributed’s path has been enabled by the increasing access to cloud computing (AWS), human immune repertoires (Illumina/NGS), and automation. With unprecedented amounts of information on the human immune system, Distributed created a platform at scale. This has allowed the company to garner unique economics and potentially move into TCRs, CARs, and cell circuits.

Business model

Beyond technology, Distributed is really one-of-a-kind due to the types of transactions it has been able to execute. The next few years are really exciting for the company as they scale up activity. Where companies like AbCellera have been able to close deals around R&D and antibody licensing, Distributed has the software to allow for deals centered around technology licensing potentially making their model more scalable (time will tell).

Once the SuperHuman platform was created, Distributed was able to generate therapeutically-relevant antibodies within days/weeks. Instead of licensing a single library or a certain class of molecular matter, Distributed customer’s get updates on their SuperHuman license. This puts Distributed in an awesome position to raise prices later on. This model of updatable licenses give customers and partners the ability to benefit from the entire platform (i.e. set of experiments) and Distributed the power to cross-sell and have a seemingly perpetual moat with SuperHuman.

Back to the origin of the company, once again it is truly incredibly how the founders built the business - starting virtual to a bench to a beautiful space in South San Francisco today. This initial condition built a great culture making Distributed one of the best places to work. Distributed is a very focused and mission-oriented organization; this is likely a consequence of building their company without venture funding. The company always needed to time the market properly and cultivate the intangibles (i.e. mission, mentorship) in order to grow. The parallels to Qualtrics with regards to origin story and company culture are very strong. Qualtrics was recently acquired by SAP for around $8B and I wouldn’t be surprised if a similar outcome happens for Distributed.

From studying Distributed’s business model, the most profound partnership is with Charles River Laboratories (CRL). Atomwise, another great company to profile in the future, has also completed a deal with CRL. Abe and the team are doing incredible work. In the fall of 2018, Distributed announced an exclusive partnership with CRL to offer their integrated end-to-end platform for therapeutic antibody discovery and development to CRL’s customers - https://www.businesswire.com/news/home/20181025005076/en/Charles-River-Distributed-Bio-Enter-Exclusive-Partnership CRL is the leading contract research organization (CRO) for pre-clinical work. CROs help their customers conduct many types of experiments from mouse models all the way to human clinical trials. Another way to view CROs is that they represent trust. CROs have longstanding relationships with almost every drug company and long track records; in short, they have aggregated the market. There are many enablers for unique business models, but one is the ability to acquire customers differently. As a result, Distributed’s partnership with CRL gives it an ability, not many other drug companies have, to distribute its software and library to customers at scale. So almost every drug company especially ones centered around software should pursue CROs in their business development strategy. It has created another moat around distribution for Distributed and CROs have the incentive to work with smaller companies in order to get access to new technologies and remain competitive.

Other deals Distributed has publicly announced are all around licensing the SuperHuman library:

LakePharma

Pandion Therapeutics

December 2017 - https://www.businesswire.com/news/home/20171212005057/en/Distributed-Bio-Pandion-Therapeutics-Announce-Multi-Target-Collaboration

Boehringer Ingelheim

December 2017 - https://www.distributedbio.com/single-post/2017/12/11/Distributed-Bio-and-Boehringer-Ingelheim-Announce-SuperHuman-Platform-Transfer

Pfizer

Kadmon

February 2018 - https://www.businesswire.com/news/home/20180228005067/en/Distributed-Bio-Announces-SuperHuman-Platform-Transfer-Kadmon

Ultimately, software has enabled Distributed to create unique distribution and the largest antibody library with well over 80 billion unique molecules (generating thousands of relevant hits per target). With these two moats, the company is scaling up its model and moving toward impacting the lives of more patients.