Bolt Threads is a biomaterials company and a pioneer in versioning biology. The company has built one of the world’s most powerful protein production engines in the world to point it toward biomaterials for fashion, clothing, and general consumer use cases. Founded in 2009 by Dan Widmaier (CEO), David Breslauer (CSO), and Ethan Mirsky (VP of Operations) the company has set off to build an enduring textiles company - the last large company in the field to form was W.L. Gore & Associates in 1958 ($3B in revenue) that was based on the Gore-Tex invention.

Originally named Refactored Materials, Dan was in graduate school at UCSF studying spider silk under Chris Voigt along with Ethan who David reached out to for a source of silk protein for his own graduate work at UC Berkeley. Building a rapport through research, the trio experimented with the thought of a company. However, with so many failures to commercialize spider silk in the past, there had to be a strong answer to: why now? Through the decade, synthetic biology had made significant progress to bring engineering principles to biology and a few key drivers were and still are rapidly increasing in access and power - synthesis, fermentation, design.

With the assumption that the economics of producing recombinant spider silk in microbes at scale would increase rapidly, Bolt set off to reconfigure textile manufacturing. During the 20th century, advancements in chemistry to product synthetic fibers along with machinery/better automation massively shifted the economics of textiles. Natural fibers dominated the industry (i.e. cotton, wool, silk) and kept clothing relatively expensive. With the invention of rayon in 1910 and nylon in 1935 and beyond, ushered in a new era for using synthetic fibers, with better durability and lower costs, to produce everything from socks to underwear. Similarly, Bolt is positioned to potentially usher in a new era for renewable textiles. The three major drivers for textiles were:

Textile manufacturing

Iron founding

Steam power

Improvements in polymer chemistry led to the widespread use of synthetic fibers - where existing infrastructure was ported to a new material.

For biological materials, three analogous drivers are:

Fermentation especially at scale

Gene editing

Synthesis (longer and cheaper)

If Bolt and similar companies can accomplish commercial-scale production, these new materials once again will integrate into the current manufacturing processes and supply chains for textiles. With its current business model constrained both technically and by product margins, Bolt is setting off to focus on spider silk production for B2B use cases and have recently pointed its engine toward mycelium-based products to sell directly to consumers. This is mainly a consequence of the margin and large-scale demand of leather (mycelium is engineered to mimic the material) versus silk. This case study gives context on spider silk both around the technical aspects to produce it with synthetic biology and the business model. However, Bolt is focusing more on leather, for a few reasons mainly for technical feasibility and margins. Ultimately, Bolt provides quite a few lessons around synthetic biology platforms, what processes to invest in, what products are feasible, and the relationship between possible business models and technical bottlenecks (i.e. fermentation, synthesis, design).

Each major era in history was once named after a new materials - Iron Age, Stone Age, and so on. Maybe this era could be called the Steel Age or Carbon Fiber Age. With spider silk being many times stronger than steel and mycelium-derived leather reducing emissions significantly, Bolt and similar companies could potentially bring new materials for a new age - enabling inspiring products and great businesses.

Key findings

In synthetic biology, many companies are hoping to be saved by a Moore’s like law. However, Moore’s law is more economic-driven than technology. Growth in synthetic biology especially consumer products will be driven by demand with technology and scaling following.

As a result, the winners in the field will be those that pick and own specific markets. Bolt is working on finding the best fit for spider silk in a consumer and even medical setting. They are now doing the same for mycelium. Solugen has found a great fit in the oil market. Impossible has the same for beef. Building out infrastructure without demand is very risky.

The core barrier to use the power of synthetic biology to transform clothing, food, and beyond is scaling. Mainly around fermentation and downstream steps - so companies that build up moats themselves or through partners (i.e. Culture, ABI) will bring products to markets faster.

Bolt offers the promise to use biology to create more diverse types of consumer products. The company is a case study to monitor for the business model potential of versioning in general even for medicines (i.e. CAR 4.0, BMT 2.0). Just as Nike Jordan’s come out every year. New versions of iPhones are released annually. Software is easily versioned. Biology has the potential to bring this model, which imbues pricing power to more products - spider silk tie 3.0, mycelium-bag 7.9.

Technology

Simply, Bolt Threads has built out one of the world’s most powerful protein production engines. Spider silk is notoriously repetitive and difficult to express. So Bolt has engineered a system to make multiple variants of spider silk - it can probably point its engine toward other high-value proteins.

What’s nice about spider silk and all biological materials is that nature has already shown the it can be made. Now it’s on companies like Bolt to use engineering principles to figure out how to do manufacture at scale. Simply, if Bolt can commercialize spider silk it can do the same for other natural proteins.

Properties

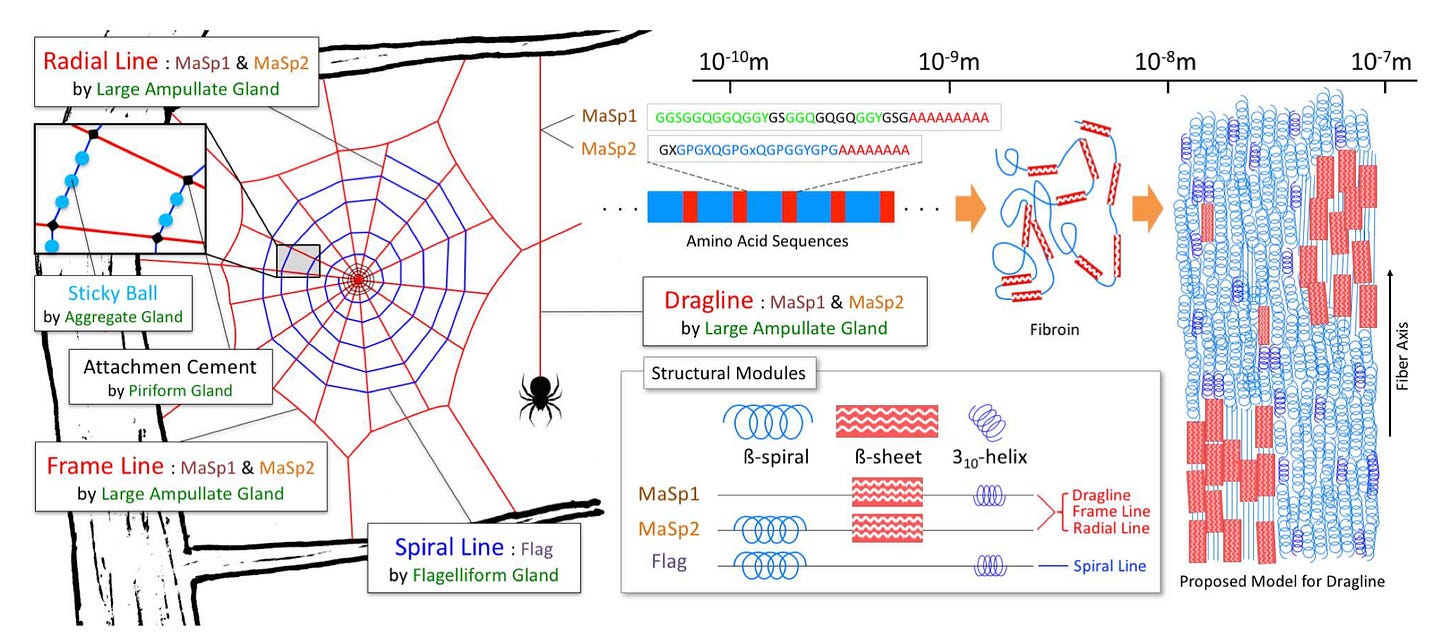

Spiders produce 7 main types of silk (individual spiders produce a smaller subset of these 7) each with their own unique properties:

Achniform gland - swathing silk

Cylindriform gland - egg sac silk

Ampullate glands (major and minor) - non-sticky dragline silk; silk from the minor ampullate gland is about half as strong as silk from the major gland

Pyriform gland - attaching threads

Flagelliform gland - core fibers of sticky silk

Aggregate gland - outer part of sticky silk (i.e. adhesives)

Each type of silk is composed of protein monomers (proteins in the 100s kDa scale) that are differentiated based on the composition of mainly alanine, proline, and glycine. These uniform structures are repetitive but create complex secondary and tertiary structures imbuing silks tenile and elastic properties - for example flagelliform silk is mostly composed of ß-spirals and helices (enabling high elasticity) whereas ampullate silk is composed of mainly ß-spirals and ß-sheets (enabling high rigidity). Finally, spiders can produce silk with varying percentages of each type. As a result, using microbes to produce synthetic silk is not only difficult due to expressing highly repetitive proteins but do so in certain percentages in line with nature.

Source: aRxiv

Source: ScienceDirect

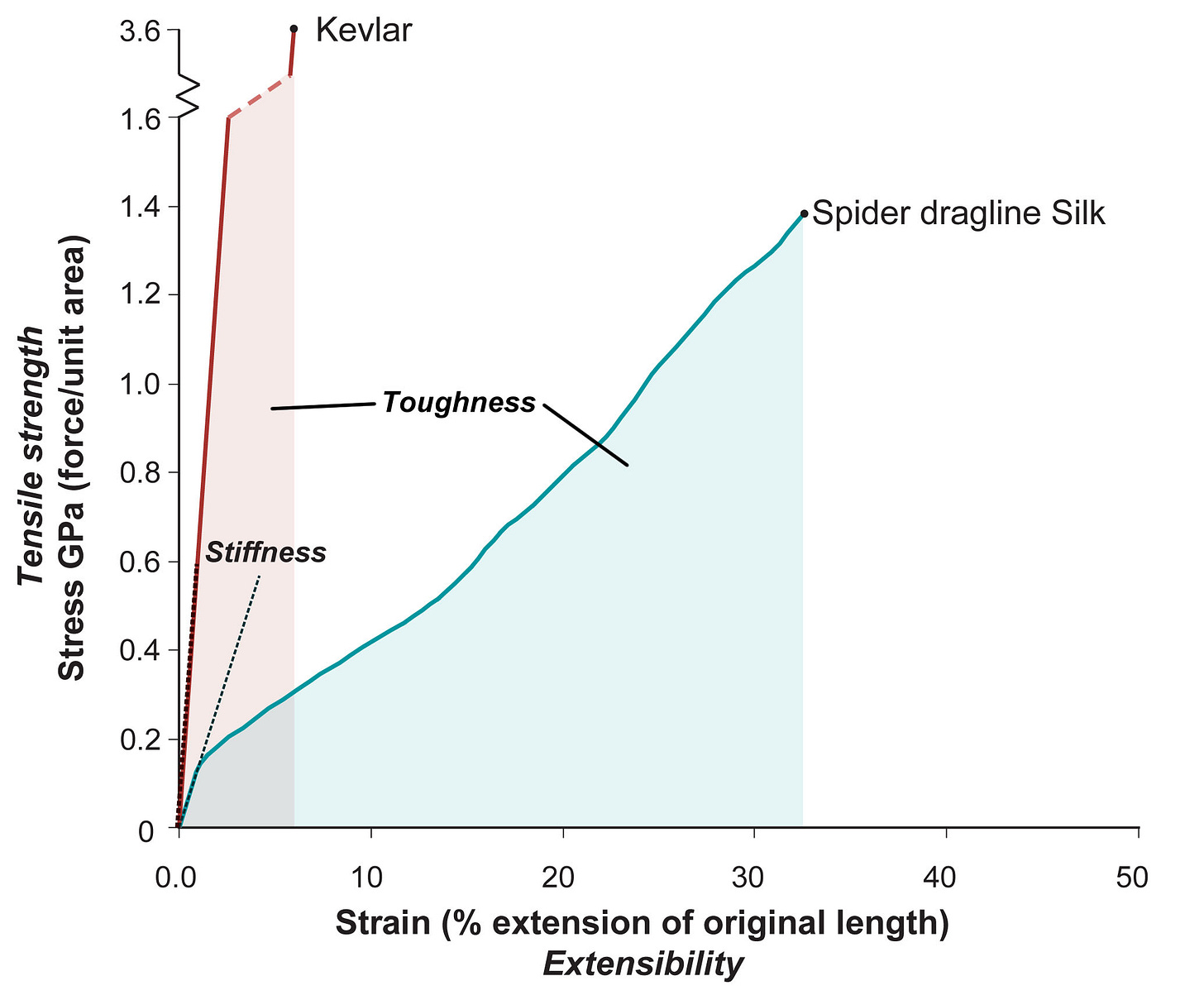

A few simple rules drive spider silks advantages over kevlar, one of the most resilient synthetic materials made:

Longer proteins provide higher tensile strength and elongation - spider silk proteins are longer than non-spider silk, enabling its unique properties, and have terminal regions that are non-repetitive that align the repeats of the spider silk protein to form 2D/3D structures

Spinning variation has a major effect of silk tensile strength and elasticity

Post-spin drawing (i.e. simply stretching after spinning material) spider silk increases ß-sheet content regardless of type

Repeated GPGXX sequence motif improve elongation properties

Higher poly-alanine content increases tensile strength

These rules have created a biological material with amazing features:

Kevlar - Strength of 4 x 10^9 N/m^2, energy to break 3 x 10^4 J/kg

Rubber - Strength of 1 x 10^6 N/m^2, ~120x higher elasticity than kevlar, energy to break 8 x 10^4 J/kg

Major ampullate silk - Strength of 4 x 10^9 N/m^2, ~7x higher elasticity than kevlar, energy to break 1 x 10^5 J/kg

Minor ampullate silk - Strength of 1 x 10^9 N/m^2, energy to break 3 x 10^4 J/kg

Flagelliform silk - Strength of 1 x 10^9 N/m^2, ~40x higher elasticity than kevlar, energy to break 1 x 10^5 J/kg

Manufacturing

Molecular biology has made significant advancements over the last few decades to make expression of recombinant spider silk possible; however, scaling up manufacturing is still an outstanding problem. Bolt’s platform is built up on a set of inventions, some public - WO2016149414A1, WO2017214618, WO2015042164A3, US20150293076 and some confidential, that enable microbe-derived production of spider silk and expression tuning. Out of the 7 types of spider silk, major ampullate probably is the most commercially viable one due to its relative rigidity and durability against physical and thermal forces.

Bolt Threads is currently facing a scaling problem with spider silk. High levels of demand would probably solve this problem (similar to Moore’s Law and transistors), but from a well to 1 kg it still takes millions of dollars. Bolt is in a interesting position where they have protein expression capabilities no one else has but generally there is not clarity on where spider silk would be in high demand. Expression an individual spider silk protein is relatively easy. Assembling them into a fiber is very hard - spiders use a combination of force and various gradients to extrude out a precise mixture of spider silk proteins. Bolt amazingly has figured this problem out better than anyone else but needs clarity on economic demand to drive investment into scaling especially when compared to analogous methods:

Bacteria - silk protein concentration of 100 mg/L in a 30K L fermentor, yield of 3 kg per fermentation run, in months

Alfalfa - 1% of soluble proteins, ~200 kg per acre per year, in ~5 years

Goats (engineered to express spider silk proteins in milk) - 15 g per L of goat milk with about 8 L per day, 18 kg per goat per year, in 1-2 years

In general, synthetic biology companies are facing a demand problem. What products can they make competitively? The companies that have clarity around this will make the right investments into scaling. For spider silk manufacturing is pretty because the proteins are very large (600 kDa) and repetitive. Some spider silk companies are producing proteins that are much smaller (~50 kDa), which makes manufacturing easier where the fiber loses a lot of its strength and flexibility. But marketing spider silk that maybe really isn’t is good marketing. We will see how the market responds to these products - jackets and all.

Biomanufacturing of spider silk is hampered by a few issues:

The repetitive nature and high GC content of spider silk proteins makes overproduction in microbes pretty hard

Difficult of spinning the spider silk proteins in solution into a fiber (Bolt is a leader here though)

During fermentation runs, purification steps can lead to massive yield losses and drive up costs (silk protein concentration can be as low as 10% and as high as ~80% and scales according to number of steps, which gets costly)

This leads to spider silk to have troubles competing on price with other textiles. Right now, Bolt and everyone in the field is facing this issue with scaling and product launches. Spider silk manufacturing will have to have costs of around $10 per kilogram (kg) to be competitive with other silk types on the market. This might not occur for decades even if fermentation and every downstream step has 100% yield. The various costs of spinning and even the molecular biology drives up costs. There are public statements of being able to achieve $100 per kg even $20, but this is at commercial scale no company has reached. For some versions, one kg of spider silk material costs millions still. As a result, spider silk probably won’t compete against other fibers (i.e. nylon, polyesters). But spider silk can create whole new markets. Figuring out which products to make is the trick. Bolt along with business partners are currently figuring this out.

Right now, for manufacturing spider silk Bolt is the clear-cut leader with others behind (image below). Ultimately, Bolt’s ability to scale will be directly connected to the products the company makes. Spider silk for the sake of it won’t cut it. Creating different versions of the fibers to match likely a new need will need to emerge. Inspiration can come from Monsanto’s genetically versions seeds: engineered to be resistant to herbicides and insects where the company introduces a better seed every season informed by the aggregation of data on annual yields. By combining fermentation, gene synthesis, and design tools, Bolt is focused on generating many variants of spider silk proteins with unique properties and scale them up to compelling products. For everyone in spider silk, what consumer product is compelling enough to charge sometimes 10x higher prices on an equivalent product based on traditional textiles? For Bolt, business partners like Adidas and others will be essential to determine where demand really is. In the long run, Bolt’s spider silk capabilities will probably shift toward a business-to-business model given the high investment costs still needed and the lack of price parity for some time.

Source: ETC

Source: Bolt Threads

Mycelium

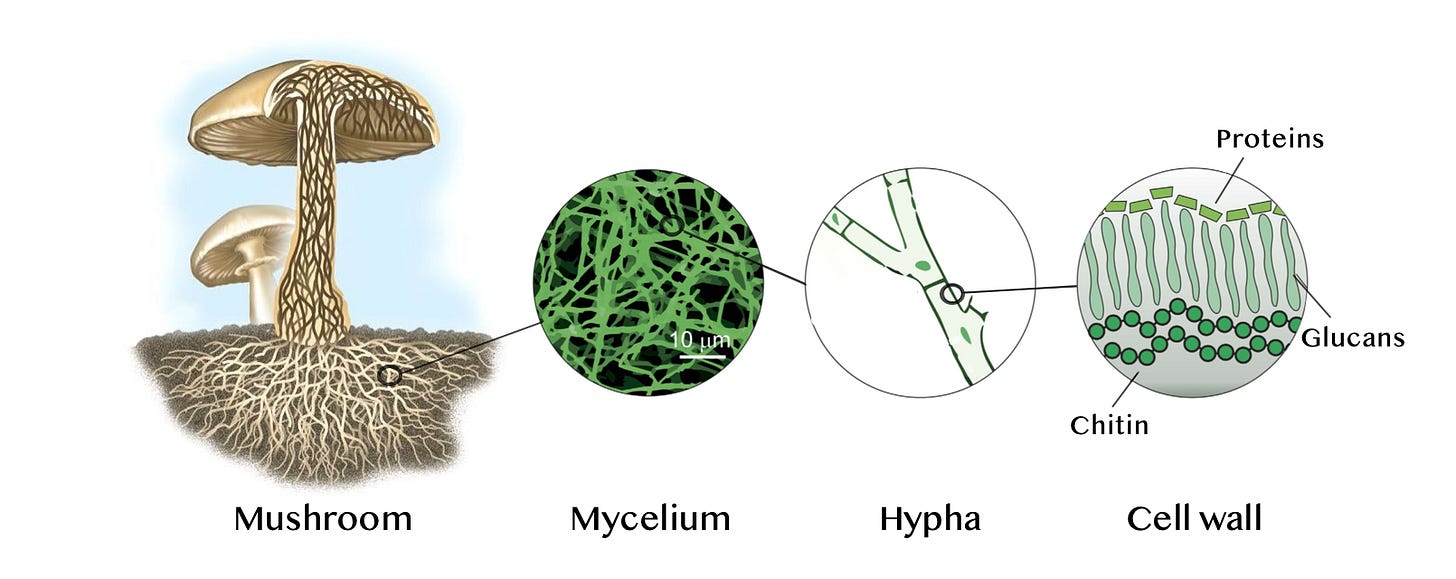

With uncertainties around which specific spider silk products will have pricing power, Bolt is adding mycelium-based leather (network of fungus) to its product portfolio. The general idea is that mycelium (two images below) production is a lot easier and cost competitive for traditionally high-margin leather products and large market size (total revenue base in the $10Bs versus billions for silk). In 2018, Bolt gained the exclusive license to Ecovative’s mycelium platform to produce a Bolt-branded driver bag (third image below). With other companies like MycoWorks in the field, Bolt is creating a new pipeline to work on launching a product at scale - mycelium is a little easier technically to scale up than spider silk, which makes it more probable for a business-to-consumer model for Bolt to work here.

Source: Nature (adapted)

Source: IJD

Source: Bolt Threads

Myecelium is the root structure of mushrooms and mainly composed of natural polymers (i.e. chitin, glucans, cellulose) to form a network of symbiotic fungi. The network interconnect with one another through branching fibers forming filaments called hyphae. Manufacturing is done via two major methods:

Forming a material by inducing mycelium to bind other substance

Growing liquid mycelium to use the pure concentrate to make materials (leads to more leather-like products)

With a common protocol of:

Prepping a substrate (i.e. nutrients, scaffolds) for mycelium where new properties can be easily introduced

Inoculating the substrate with mycelium where growth rates are determined by pH, temperature, various concentrations of gases/molecules

After a few weeks of growth, heating is used to stop the process

Usually a finishing is done on the mycelium product to make the end-product more usable

What’s advantageous for this process when compared to spider silk, going from a version of a product to one kilogram costs at least an order of magnitude less. Whereas for spider silk manufacturing, Bolt has a massive technical moat that other companies will find hard to reproduce, whereas for mycelium, Bolt will need to build up a moat not around manufacturing but for the various substrate types that lead to products. Creating unique mycelium substrates will lead to products with unique structural and mechanical properties for materials from leather to styrofoam.

Market

The synthetic biology market in general addresses markets from energy to healthcare comprising of trillions of dollars of production. However, accessing these various markets is not that easy despite the large size. Getting to cost parity, having the right incentives, and scaling will determine which companies can fulfill this promise.

For textiles, the industry is dependent on oil. Spider silk, mycelium-based leather, and other products give Bolt a unique advantage over synthetic fibers - the reduced environmental impact is incredibly important and in some cases can earn a premium even without large-scale incentives in place just yet. With billions of tons of waste produced each year from the textile industry and discarded oil-based textiles growing with population, the opportunity for Bolt is very large. Even beyond textiles, the opportunity to bring new biomaterials to drug delivery, wound management, regeneration, cosmetics, and other industries is very large. Right now Bolt, is focused on consumer use cases for its spider silk and mycelium lines.

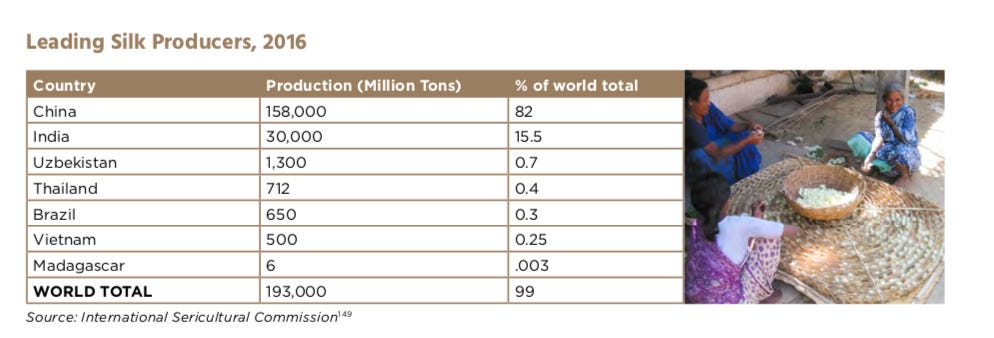

Silk and leather

Silk is a very small component of the overall textiles market, which is dominated by cotton (image below). With annual revenues in the billions silk is an interesting market. Leather is a lot more compelling with annual revenues in the tens of billions. Again, no wonder Bolt is moving quickly into the latter. However, like most opportunities for biomaterials, the most important piece is the reduce environmental impact. With the probability of rewards for positive environmental impact increasing, making these types of products will be important. The set is large but very difficult measure. This has made it easy for investors and companies to over-market the thesis and make non-rigorous decisions. For textiles, the negative impact can’t be ignored. With 20%-30% of all microplastic pollution and almost a quarter of all the world’s wastewater coming from the industry, new products need to solve this problem. Leather is just as bad. With around 2/3’s of leather coming from cows, the impact on water consumption, greenhouse gas emissions, and just general land occupation is very large. Globally, with a cow for every 4 humans, creating a new source of leather (about 30M cows are used annually in the industry) will help alleviate this issue. Hopefully, they get rewarded either by consumers or states. Bolt has a large opportunity in cosmetics with its silk products and they just recently launched a new business to pursue this. Spider silk has potential to help with drug delivery and medical devices particularly, coating catheters to prevent bacterial infections - a problem that leads to $100Ms of losses annually. Maybe Bolt’s spider silk to help with artificial tendons and ligaments - maybe Bolt helps Tom Brady play into his 60s. The opportunity in other consumer products beyond clothing is there - air bags, ropes, parachutes. This opportunity will only be realized if Bolt and similar companies get to multi-ton scale.

Business model

Versioning

Bolt has a great shot to use biology to create more diverse versions of fabrics. Using synthetic biology can create compelling product experiences, but for the business model, having easily updatable products creates substantial pricing power. Every year people line up to pay higher prices for Nike Jordans. Same for the iPhone. This type of phenomena extended to clothes and even medicines and other products can support outstanding businesses.

Bolt is built upon two main textiles: Microsilk (spider silk) and Mylo (mycelium). The difficult part of using biology to version is the cost to go from a proof-of-concept to materials at scale (at least a kg). Biology enables a new palette to vary fabric texture, stretch, biodegradability, and elasticity. The potential is probably much large than just the silk market. Synthetic fibers like nylon were originally marketed as silk replacements but ended up becoming much larger. If Bolt can scale up manufacturing, its products could follow a similar path.

A biomaterial launched that can inform Bolt’s process is DuPont’s Sorona product - a partly plant-based (about a third) material. During the hype of the last synthetic biology cycle, DuPont was expecting revenue of $1B by 2015, which has missed this mark significantly with DuPont working on selling off the division. Sorona is based on a compound called 1,3 propanediol (PDO) - DuPont partnered with Genencor to engineer a metabolic pathway in E. coli to produce a biocompatible version (Bio-PDO)and Tate & Lyle to scale up production. Sorona is composed of ~1/3 of Bio-PDO and the rest petroleum-based terephthalic acid. This product has been in commercial production for more than a decade being found in brands like Calvin Klein, L.L. Bean, The North Face, Timberland, and Izod. The value proposition is less energy use (10%-30%) and lower greenhouse emissions despite the lack of biodegradability. Despite launching the material at scale, the economic demand for Sorona-based products is not there. Maybe DuPont and its partners didn’t market well. Maybe customers really only care about cost parity right now. Sorona probably is not as environmentally friendly as advertised. Overall, Sorona serves as a warning for the entire synthetic biology field. Despite the promise of versioning, economic demand needs to exist for scale to emerge and new product versions to launch. If the first version is not used, why launch a second one? Ultimately, versioning is based on achieving large technical gains, but the business model needs large numbers of customers. If Bolt can identify where demand really exists, the company can transform textiles and the environment.

Economics

Roughly, products to make with synthetic biology can be guided by the operating margins on each one. No wonder making medicines is such a compelling business model for biology:

Tobacco - 40%

Software - 35%

Medicines - 25%

Alcohol - 23%

Soda - 20%

Specialty chemicals - 14%

Apparel - 10%

Commodity chemicals - 5%

Last cycle proved that producing commodities like petroleum with microbes is foolish. This cycle companies have gotten smarter, but similar mistakes are being made again due to the siren call of market size (for example, petroleum is worth trillions of biology is not useful for everything in that industry). Whereas Amyris wanted to own the entire process from the photons to the end-product, which earns operating margins similar to a commodity chemical manufacturer, Ginkgo was set up to design organisms and try to earn a software margin. However, the lack of large-scale demand has forced a recent shift in approach for the latter.

As Bolt is well-known for the potential of spider silk, it is useful to walk through the economics of producing the material with microbes. Mycelium is much more tractable with regards to economics with a lower barrier to entry. The ability to produce spider silk at scale would bode very well for other biomaterials given the difficulties in expression and purification:

Source: ETC

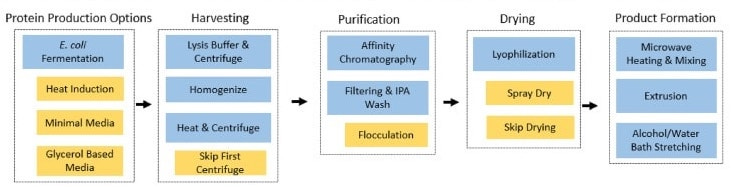

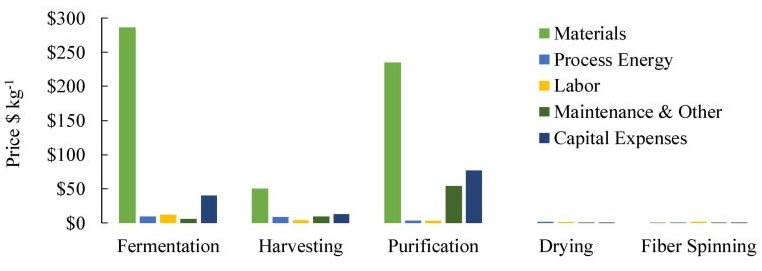

Using microbes to produce spider silk relies on multiple sets from design to product (first image below). Simple modeling would show that most of the costs are in materials with the bottlenecks around fermentation and purification (second image below). Overall, the problem is centered around maximizing spider silk protein expression. The costs are somewhat fixed at a certain scale of production (in the kilograms) but low expression leads to massive overhead in the input material required to get a kg of final product.

Source: DoE, Synberc

Source: DoE, Synberc

Economic modeling, albeit at scale with over 300 tons of production capacity, shows the most promising area to make spider silk production viable is protein expression. Getting to concentrations of ~20 grams per liter from 2-4 right now would be transformational. The challenge is, when compared to other recombinant proteins, is that spider silk proteins are relatively large inhibiting further improvements in expression levels. When compared to other methods like alfalfa and transgenic goats, microbes can be easily grown in large volumes (1Ks of liters). Without high expression levels, any product made with microbes won’t be viable. For spider silk, a few problems still need to be solved. To get to scale with spider silk, compelling products need to be developed. This is where Bolt will rely on partners to bring their expertise and networks.

Partnerships and products

Bolt’s model of building out a core biomanufacturing engine and point it toward various problems in textiles relies on partners and external companies to guide product design and for distribution. The business model has been focused on building products powered by Bolt Threads instead of branded by them. Although the sale of ties and other products at a small scale served to validate consumer demand for biological materials. So far, the company has had many partnerships with a few interesting ones publicly announced. This traction is still very early, and Bolt and the whole ecosystem have the problem of matching the underlying biology with consumer demand. Bolt and similar companies would be wise to send a biologist, fashion designer, and maybe a priest to a room to map out which markets biomaterials have an unfair competitive advantage:

Stella McCartney - using Bolt’s spider silk-cellulose blend for women’s clothing and recently introducing a sportsware line with Adidas based on Bolt’s microsilk product

Best Made Co. - acquired by Bolt Threads in 2017 to gain retail expertise and held an experiment to sell spider silk beanies

Ecovative - licensing the company’s core platform and integrating it to Bolt for mycelium-based products

Chester Wallace - making and still launching a driver bag made from mycelium

Eighteen B - cosmetic spin off to generate demand for Bolt’s B-silk product

Patagonia - had a collaboration with Patagonia still to be launched

Ultimately, Bolt Thread’s potential will play out of the next 5 years or so as the company launches more products and begins to scale. A shift toward mycelium will enable faster launches at higher margins but as various drivers for synthetic biology develop (fermentation, gene editing, synthesis) Bolt will be in the position to launched versioned biological products from spider silk and beyond.

Source: Bolt Threads

Source: Bolt Threads