Axial: https://linktr.ee/axialxyz

Axial partners with great founders and inventors. We invest in early-stage life sciences companies such as Appia Bio, Seranova Bio, Delix Therapeutics, Simcha Therapeutics, among others often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Affinivax was acquired by GSK in 2022 for $2.1B. Founded in 2014 out of Boston Children’s Hospital, Affinivax develops vaccines without adjuvants. The company was acquired mainly for its 24-valent pneumococcal vaccine in late-stage trials to go heads up against Pfizer/Prevnar.

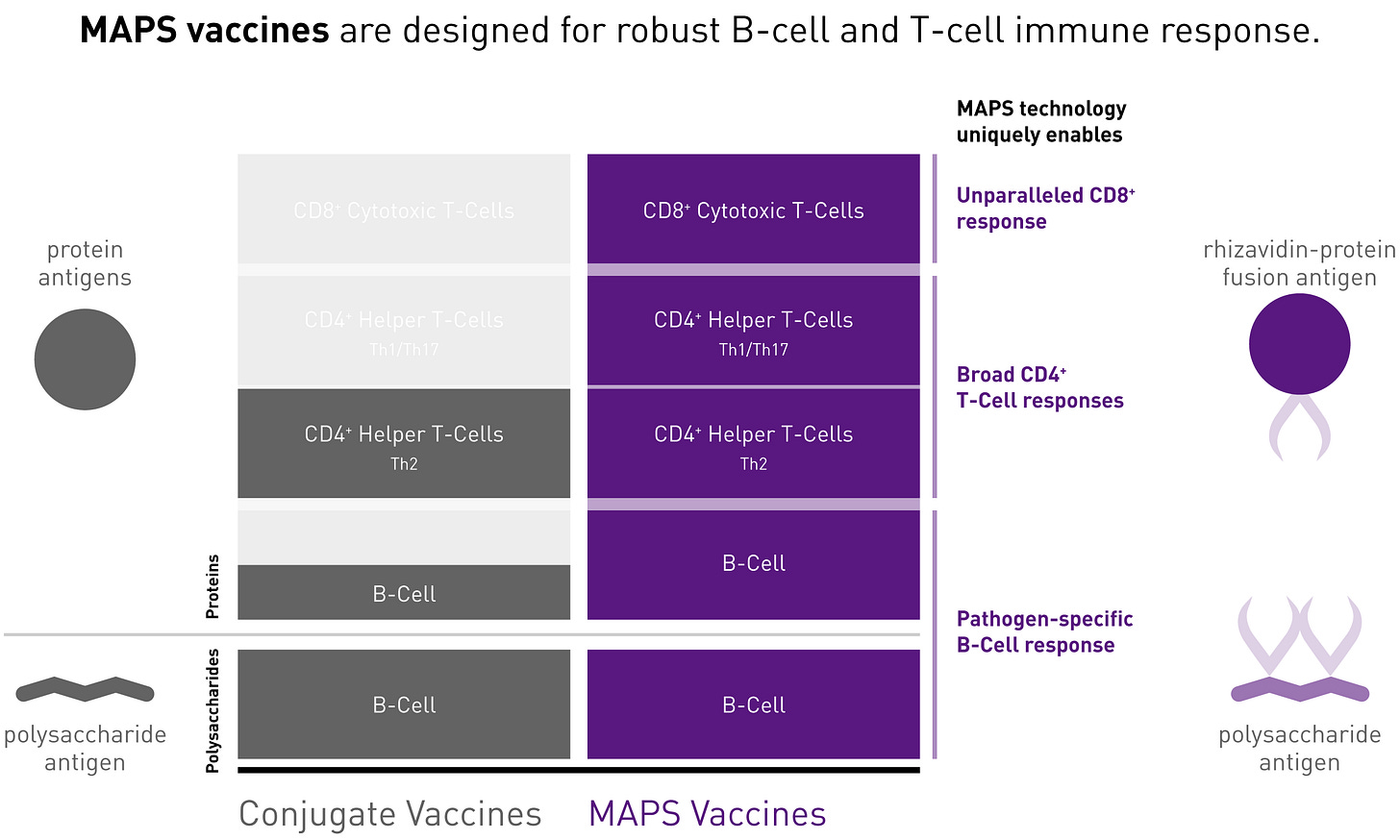

The company is built around its MAPS platform that uses non-covalent chemistry between biotin & rhizavidin to conjugate/present both polysaccharide & protein antigens to the host immune system to induce a B- and T-cell immune response. MAPS = Multiple Antigen Presenting System.

MAPS enables higher valency than conventional conjugation technologies. Affinivax’s focus is pneumococcal disease, the main cause of acute bacterial infections, leading to >150K annual hospitalizations in the US. Pfizer’s Prevnar has >$5B/year in PD, the bar is pretty high here.

Affinivax shows the value in vaccine development still exists. The initial focus is on preventing pneumococcal disease with a purview on other infectious diseases especially those acquired in a hospital https://www.gsk.com/en-gb/media/press-releases/gsk-completes-acquisition-of-affinivax-inc/